Leading credit-led digital bank, FairMoney Microfinance Bank, is out to help Nigerians achieve their goals faster with the introduction of its new product, FairLock. FairLock is FairMoney’s new fixed-term deposit product that enables customers securely lock funds and earn high interest returns on their funds. With up to 18% per annum and savings tenure from 7 days to 2 years, FairLock boasts of having the best interest rates in the market, with a wide range of savings tenure options to go with. According to the digital bank, this will not only help the customers stay on track to achieve goals, but will instill savings discipline in them.

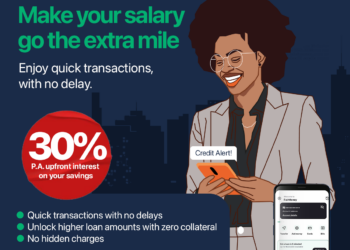

To reward early adopters of FairLock and also stay true to the promise of helping its customers achieve their goals faster, FairMoney has further introduced the FairLock #IDonLockUp Promo. This is a first of its kind deal that gives customers access to the highest interest rates the market has ever seen. The #IDonLockUp promo which kicked off on the 1st of November 2022 automatically doubles the original interest rate for some FairLock tenures. This will see rates go from up to 18% to up to a whopping 26%. Customers who participate in this promo also stand a huge chance to win valuable gift items.

“We all have goals and everyone’s goal is valid, no matter the size or time it takes to achieve it. Therefore, to help our customers reach their goals faster, while enjoying high interest rates and multiple saving tenures, we birthed FairLock. It is safe, secure and easy to use” said Nengi Akinola, Head Marketing and Branding at FairMoney.

“To incentivize early users of Fairlock, we are going further to introduce a first of its kind promo, a generous offer that doubles the original interest rates on some FairLock tenures. I dare say this is the highest the market has ever seen for the product category. In addition to these benefits, we are also rewarding customers who jump on this promo with a lot of freebies such as Motor bikes, Generators, Microwaves, Smartphones and other valuable gift items.”

“We urge Nigerians to take advantage of this product and promo as they plan their goals for the end of the year and coming year. Whatever your goals are, be it saving for a wedding, personal or career development, business capital, travel or event school, with FairLock you can create a lock plan to help you stay focused on your goals and then enjoy the reward that comes with the highest interest rates ever.” Nengi added”.

To try this product and enjoy the benefits, download the FairMoney app here and follow these steps; Log in to the FairMoney App, Click on “Access savings”, select FairLock from the drop-down options, click “Start saving” then Input the amount you want to save then select your preferred savings tenure. Name your plan and authorize the transaction to start.

FairMoney Microfinance Bank is a leading Neo bank that offers lending, banking and investment services to everyday people. Established in 2017, FairMoney MFB is committed to driving financial inclusion and supporting emerging economies. Currently serving the Nigerian and Indian markets with an operational office in Paris, France, FairMoney has recorded exponential growth; over 10 million app downloads on Google Play Store, 5 million+ users and over 3 million bank accounts opened. FairMoney processes over 10,000 loans daily and has successfully disbursed over N200 billion in loans. In July 2021, the bank raised $42 Million in its Series B funding.

Watch the FairLock video commercial below.