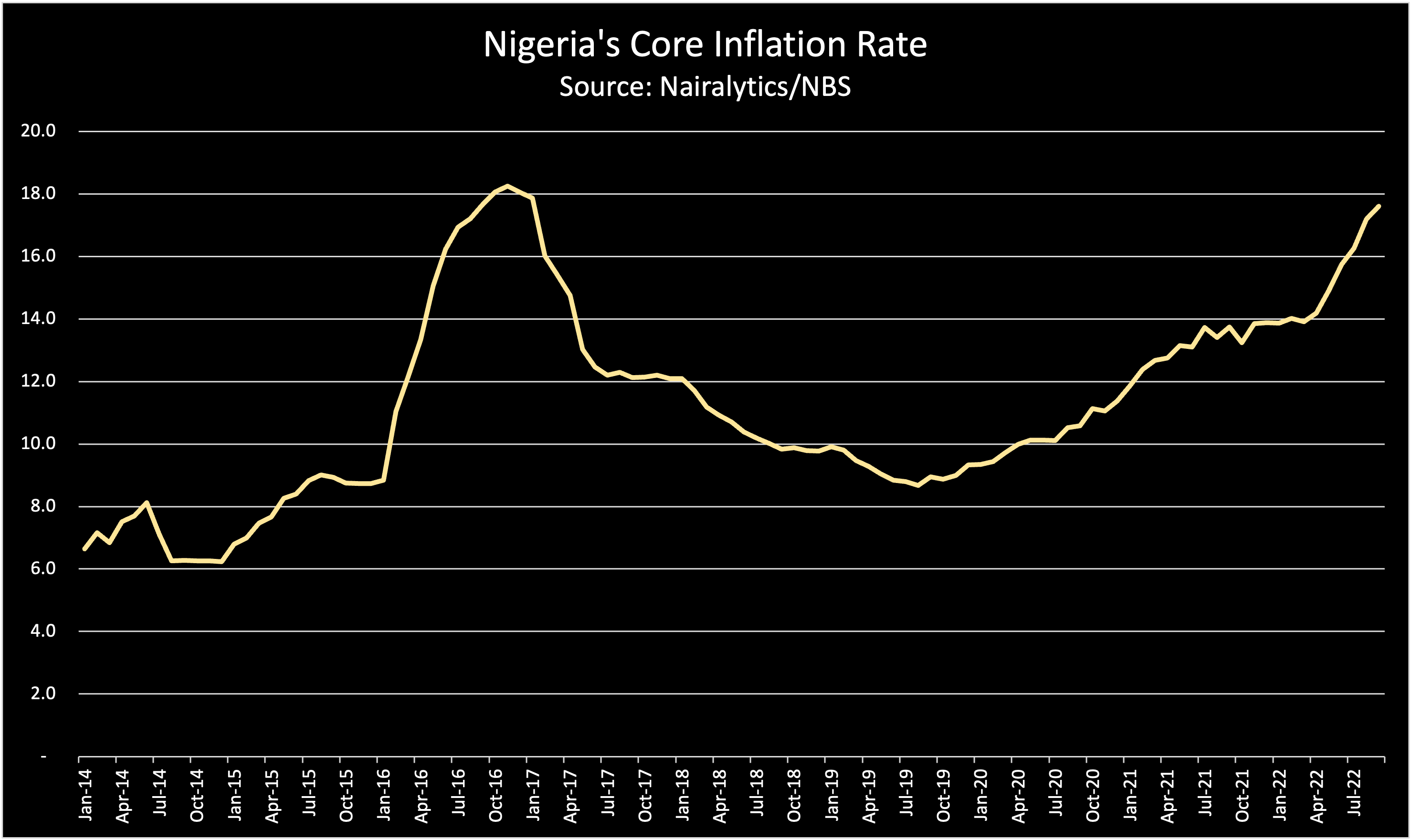

Nigeria’s consumer price index (less farm produce) or core inflation rose by 17.6% for the month of September 2022, the highest in 5 years.

Core inflation is a more stable measure of the inflation rate that strips out the volatile food inflation rate. It is largely seen as a better reflection of the rise of goods and services without volatile factors such as food.

On a month-on-month basis, core inflation rose by 1.58% year on year repeating the same figure reported a month earlier. Core inflation has heated up month on month since April when diesel prices rose to over N700 per litre. It rose to a record high of 1.87% month on month in May.

According to the bureau of statistics, Nigeria’s broader consumer price index (inflation rate) rose by 20.77% the fastest in 17 years. The more volatile food inflation rose by 23.34% to levels not seen since the base of 2009.

Nigeria has been experiencing galloping inflation in recent months largely due to several factors such as a depreciating exchange rate, an increase in money supply in the country, insecurity, rising energy prices, logistics issues, and imported inflation.

January 2014 to October 2022.

Major drivers of core inflation

At 17.6% Nigeria’s core inflation rate is now 210 basis points higher than the monetary policy rate of 15.5% which the apex bank announced about a month ago.

- The rising core inflation rate indicates prices of goods and services other than food have been affected by supply and demand factors that have been a drag since the pandemic.

- A cursory view of the data reveals essential items such as footwear and clothing rose by 17.8% well above the core inflation average rate.

- Transportation costs rose the highest recording an 18.7% hike year on year reflecting the higher cost of energy that transporters have passed on to commuters.

- Education also recorded over a 16.4% increase in inflation rate year on year as parents endured higher costs of school fees for the first term of the 2022/2023 school sessions.

Impact of core inflation

The implication of rising core inflation reverberates more than the headline inflation rate as the market considers core inflation as a broader view of just how quickly purchasing power is being eroded in the economy.

- The central bank in its last monetary policy communique identified the hike in energy prices (diesel), such as the hike in electricity tariff, as well as the perennial scarcity of Premium Motor Spirit (PMS) as major drivers of core inflation.

- This among others triggered its decision to raise monetary policy rates to 15.5%. With core inflation still rising, it is likely that the central bank will consider another rate hike when it meets on November 21 and 22, for the last time this year.

- Banks are also likely to raise interest rates higher in order to combat the rising core inflation.

- Foreign investors might also demand a higher return on investing in Nigeria at least to match the higher inflationary trend even though most investors prefer to cite the long-run broader inflation rate of 12%.

- Finally, Nigeria’s exchange rate crisis could worsen due to rising core inflation.