The thirteen Nigerian banks listed on the Nigeria Exchange posted N501.13 billion as profit after tax in the first six months of 2021, outpacing the N443.17 billion recorded in the corresponding period of 2021 by 13.1%.

This is according to an analysis by Nairalytics – the research arm of Nairametrics, from the review of the financial statements of the thirteen banks. The banks grew their bottom line in the period under review despite economic headwinds crippling business profits as a result of high operating costs.

Recall that some banks were forced to reduce working hours in the second quarter of the year, in a bid to manage the rising operating costs after the price of diesel hit record highs spiraling into an upsurge in the prices of most goods and services in the country.

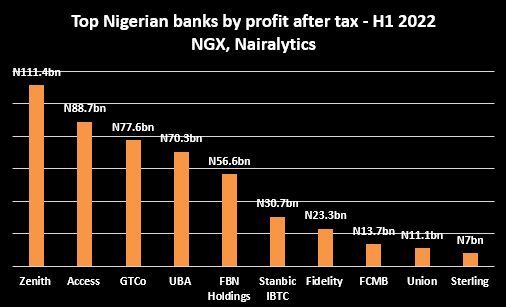

Specifically, Zenith Bank, Access, and GT Bank recorded the highest post-tax profit in the review period, while FCMB and Wema Bank recorded the highest year-on-year profit growth. It is worth noting that the top five banks in terms of profit after tax during the period are the tier-one banks, typically referred to as the FUGAZ.

Recommended Reading: Top largest banks in Nigeria in 2022

Below is a list of the top banks with the highest profit after tax in H1 2022.

#5: First Bank – N56.6 billion

First Bank posted a profit after tax of N56.6 billion in H1 2022, accounting for 11% of the total profit of the listed banks. In contrast to the previous comparable period, its net profit surged by 48.6% from N38.09 billion recorded in H1 2021.

First Bank also recorded a 47.3% growth in its net interest income to N152.91 billion as well as a marginal improvement of 1.7% in its net fees and commissions income. Meanwhile, personnel expenses gulped N55.31 billion, an increase of 7.9% year-on-year, while operating expenses jumped by 32.7% to N116.78 billion.

#4: UBA – N70.33 billion

United Bank for Africa (UBA) recorded a post-tax profit of N70.33 billion in the first half of the year, a 16.1% increase compared to N60.58 billion posted in the corresponding period of 2021. UBA accounted for 14% of the total profit aggregate by the thirteen banks.

Notably, UBA recorded a 19.9% growth in its net interest income to N177.46 billion while fees and commission income improved by 30.9% to N59.92 billion in the same period. Meanwhile, personnel expenses surged by 22.7% to N52.29 billion, while other operating expenses increased by 22.6% to N96.57 billion.

Tax expenses on the other hand declined marginally by 1.2% to N15.42 billion in the first six months of the year.

#3: Guaranty Trust Holding – N77.58 billion

GT Bank recorded a profit after tax of N77.58 billion between January and June 2022, representing 15% of the aggregate net profit posted by the thirteen banks. GT Bank however saw a 2.3% decline in its bottom line from N79.42 billion recorded in the corresponding period of 2021.

The decline in the company’s bottom could be attributed to increases in operating and tax expenses. In the period under review, GT Bank spent a sum of N63.57 billion on operating expenses, 17% higher than the N54.34 billion incurred in the corresponding period of 2021.

The increase in its expense line dwarfed the 15.1% growth recorded in its total revenue, while personnel expenses increased by 7.6% year-on-year to N18.54 billion. Meanwhile, tax expenses surged by 88.3% to M25.69 billion in the review period.

#2: Access Bank – N88.74 billion

The largest bank by asset value in Nigeria is a distant second on the list with a profit after tax of N88.74 billion, which accounted for 18% of the total profit posted by the banks under consideration. The newly restructured company recorded a marginal 2.1% growth in its net profit compared to N86.94 billion recorded in the corresponding period of 2021.

Access Bank grew its gross earnings by 31.4% year-on-year to N591.8 billion, however, the surge in its operating expenses affected the growth of the bank’s profit. Notably, personnel expenses increased by 33.9% to N58.27 billion while other operating expenses surged by 40.2% year-on-year to N176.71 billion.

It is worth noting that tax expenses declined by 14.3% to N9.05 billion in the period under review.

#1: Zenith Bank – N111.41 billion

Zenith Bank posted a net profit of N111.41 billion in the first half of the year, accounting for 22% of the total N501.13 billion generated by the thirteen banks. Compared to the corresponding period of 2021, its profit grew by 5% from N106.12 billion recorded in H1 2021.

A look at the company’s financial statement shows a 17.1% growth in its gross earnings to N404.76 billion in the period under review. However, its operating expenses surged by 26.8% year-on-year to N123.78 billion, while personnel expenses increased by 5.7% to N39.74 billion.

Meanwhile, tax expenses gulped a sum of N18.59 billion, which is 69.9% higher than the N10.94 billion spent in the corresponding period of last year. Despite the increase in its expenses, the increase in its fees and commission line of the business and trading gains helped keep the bottom line elevated.

Others on the list include

- Stanbic IBTC – N30.67 billion

- Fidelity Bank – N23.31 billion

- FCMB – N13.66 billion

- Union Bank – N11.07 billion

- Sterling Bank – N8.01 billion

These profits are the results of cheating and manipulating customers. We need to understand current issues in banking. We thank CBN for stating that the minimum interest rate on savings should be 30 percent of MPR. Meanwhile, How many banks commenced the implementation of the minimum savings rate in August as directed?

How many banks started in August and reversed same during the month

How many banks are adhering to this minimum

Banks find multiple ways to cheat customers. It is a sin to save money in the bank. It is no lie that savings no longer equal investment

CBN itself is not making it easy for bank savers. For instance, the apex bank has withdrawn from its website the circular on the minimum interest rate in savings account. Why must this be withdrawn. Fund owners get 4 2percent while lending rate is in excess of 30 percent. Why will PAT not spike? Indeed bank customers are in for hard times

You just spoke truth to power Adeola. The system is design to favour the rich and punish the poor, afterall the current CBN Governor is from Zenith Bank who themselves don’t pay interest on Savings Accounts. Why call it a Savings Account! Abi I lie.

@Adeola Akin…LOL! Which country has interest rates on savings at 30%? Only PONZI SCHEMES will offer you such interest rates. SMH

What the CBN’s August 2022 circular actually mandated was a minimum rate of 30% OF THE MPR RATE. Given that the MPR in August was 12.5%, the minimum interest rate on savings accounts was therefore pegged at 4.2%!

Meanwhile, I chuckle at the typical Nigerian AWOOF mentality that banks are “cheating” them for charging fees on services provided (eg, that 24/7 ATM machine is powered by generators with diesel at about N700 per liter).

I do not think.Adeola ever mentioned 30 percent saving rate..what I read in the comment was as specified by CBN – minimum savings rate should be 30percent of MPR. This makes the minimum savings interest rate now at 4.65percent, up from 4.2percent in September Though not stated, thereafter, it can be graduated from the minimum. The minimum lending rate of most commercial banks is hovering around 30percent per annum if not more. For microfinance bank, it is even higher. No bank is your friend. They are wired to milk you and derive maximum profit. The gap between the savings rate of 4.65percent and the lending rate of 30percent is the net interest income, which feeds into their operating cost and profits.

Nigerian Banks are the classic definition of a Mushroom.

Making billions in Profits in a dead economy.

Factories are shutting down, People can not even get loans from the banks to do business.

Yet they somehow manage to declare billions…yeye dey smell!

Show me a banker, then I will show you a criminal in Suit.

Banks ril fraudulently continue to make huge profits from our hard earned money. True zenith bank doesn’t pay any interest on savings, First bank charges you even on internal transfers. CBN will not do anything to stop this cheating because the Governor is from that industry that cheaters 🙄.