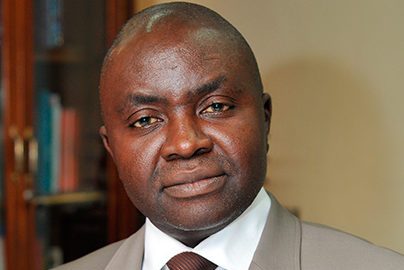

Dr. Muda Yusuf, the Founder/CEO, of the Centre for the Promotion of Private Enterprise, (CPPE) has said that Nigeria’s macroeconomic management framework has continued to pose serious challenges to investors in the economy.

He said this on Saturday in a statement titled “CPPE COMMENTS ON NIGERIAN ECONOMY AT 62”

According to Dr. Yusuf, the situation has been further compounded by the shocks and disruptions inflicted by the Russian invasion of Ukraine and the lingering effects of the covid-19 pandemic.

What Dr. Yusuf is saying

He further said “The fragile macroeconomic conditions remain a major cause for concern. The troubling macroeconomic situation has manifested in the following ways in recent years: weak and depreciating currency, high inflationary pressure, high and rising debt profile, exchange rate volatility, liquidity crisis in the foreign exchange market, increasing fiscal deficit, growing debt service burden, and the acceleration of money supply following the rising CBN financing of the deficit.

He noted that there are profound concerns around investment climate issues.

He stated that high infrastructure deficit, cargo clearing challenges, which have continued to worsen, high transactions cost at the ports, weak productivity in the real sector largely as a result of infrastructure conditions, regulatory challenges and policy inconsistency are contributory factors to poor economic performance.

“Persistent importation of petroleum products had continued to put pressure on foreign reserves and weaken the capacity of the CBN to support the forex market. Petroleum refineries have remained non-performing over the years.

“The fiscal position of the federal government and the states are very weak, characterized by high fiscal deficit, high and increasing debt profile and the associated debt service burden is a cause for concern.

“The state of insecurity continues to take its toll on the economy, especially on agricultural output and fueling food inflation. It is also impacting the confidence of investors. The spate of oil theft and the associated leakages of government revenue are very troubling. Billions of dollars have been lost to this apparent failure of security effectiveness in the oil-producing areas.

Speaking on the way forward, he said, “There is a need for urgent steps to be taken to ensure a better macroeconomic management framework to stabilize the exchange rate, eradicate the challenge of illiquidity in the foreign exchange market, and stem the current depreciation of the naira.

He said It is imperative to have urgent reforms in the foreign exchange market with a greater focus on supply-side strategy.

According to Dr. Yusuf “There is a need to review the current disproportionate emphasis on demand management of the foreign exchange market. Most sectors are experiencing serious disruptions and dislocations because of the current foreign exchange policy regime.”

He highlighted some ways forward

- Strengthen strategies to attract private sector capital to complement government financing of infrastructure.

- Reduce the level of debt financing, especially the reliance on commercial debt to fund government operations. Public debt, currently at N42.8 trillion is already at an unsustainable threshold.

- Steps should be taken to attract foreign exchange through a strategy of ensuring new investment opportunities to stimulate foreign capital inflows into the economy. We should be seeking more equity capital than debt capital.

- There’s to review the country’s trade policy to support investment growth and investment sustainability. Tax policy must support investment and not become a disincentive to investment.

- The security situation, which has continued to deteriorate needs to be urgently addressed in order to mitigate the effects on investors’ confidence. There should be greater emphasis on quality intelligence in the war against terrorism.

- The oil and gas sector reform, which is now being anchored on the Petroleum Industry Act [PIA] should be accelerated in order to ensure the unlocking of the enormous value in the oil and gas sector, particularly the gas sector.

- There should be an immediate cessation of the impunity that has characterized the stealing of crude oil and the attacks on oil installations.

- Institutional reforms are necessary to ensure that the regulatory institutions have a better disposition to support the growth of investment and focus less on the generation of revenue.

- The international trade process needs to be reformed to prioritize trade facilitation. The current obsession with revenue generation is hurting the international trade processes and impacting adversely domestic and foreign investment. Therefore, the orientation of the Nigeria Customs Service, Nigerian Ports Authority, the shipping companies, the terminal operators, and the security agencies at the ports need to change in favor of an investment-friendly international trade process.