When Satoshi Nagamato published the first whitepaper on bitcoin on October 31, 2008, he titled it “Bitcoin: A peer-to-peer electronic cash system.” As novel as bitcoin seemed then, he had already envisioned the coin being accepted as a payments system. A decade and some change later, more than 32% of small businesses in the US accept bitcoin as payment. Customers can now pay for goods ranging from Dominos pizza to Microsoft games and even until recently Tesla cars with their bitcoin. This and more is a huge indicator to the vast benefits of integrating bitcoin as a payment medium in your business.

Take the story of an electronics retailer who once reported selling over $300,000 worth of merchandise to hundreds of customers globally by accepting bitcoin along with other crypto currencies as payment.

In Nigeria, business owners daily experience detrimental levels of challenges ranging from transaction fees when receiving payments, network fluctuation and bank downtime, countless cases of fund reversal, fake alerts, high third party commissions, inability to sell globally and more because of limited payments processors especially with Paypal and others blacklisting Nigerian businesses due to perceived reputations of fraud. This creates a demand for payment processors which accept bitcoin and remit naira to Nigerian businesses like CashOut.

Cashout is known for helping business owners solve their problems by accepting bitcoin payments and remitting the naira equivalent to business owners.

All kinds of businesses from brick and mortar to e-commerce models even event hosts, organisers and the likes simply do not need to limit themselves to receiving payments in fiat currencies as they can attract attendees and customers from across the globe when they receive payments for shows, events, goods and other services in their kiosk wallet.

Cashout also goes a step further to ensure that these merchants are able to cash out their naira immediately and protect themselves from fraudulent chargebacks and reversals.

3 Steps on How to integrate CashOut in your business

Sign up and verify your account

By clicking their website, you can easily sign up with your email address and then verify your email address to start. Your cashout account gets verified in minutes upon completing your KYC and uploading a valid ID.

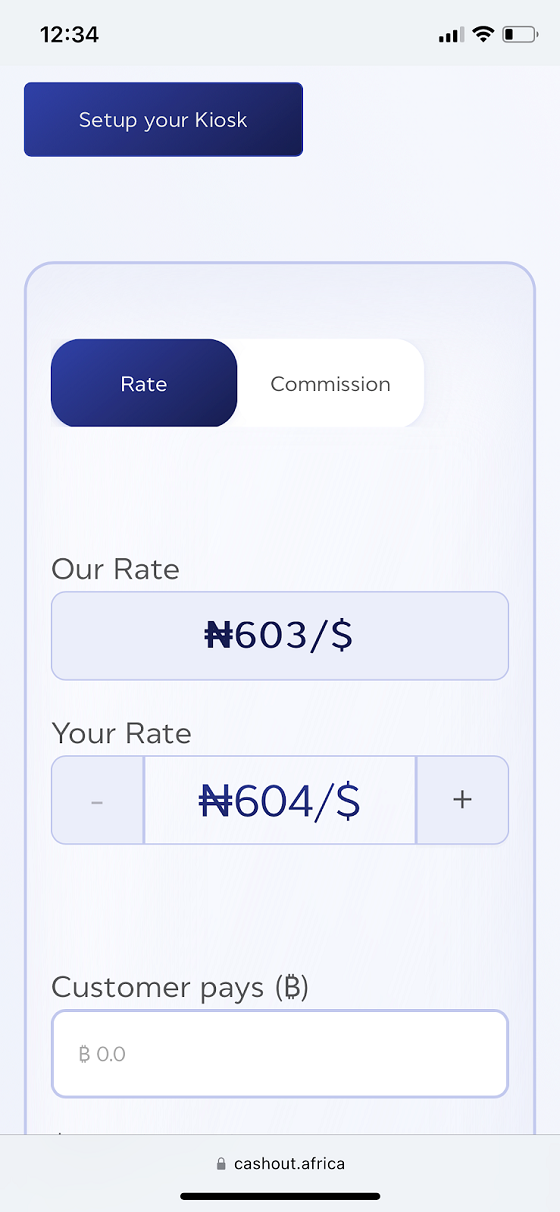

Set up your kiosk: personalising your own kiosk name and rate sets you on a path to receiving profits and commissions on every transaction.

Copy and distribute your link: using your correct kiosk link, share and receive instant funds in your business or personal account.

How to sign up on Cashout

1. Visit cashout.africa and click on “get started”

2. Input your email address and choose a strong password. Read on how to choose a strong password here.

3. You will receive a link in your email telling you to verify your account. Click on it.

4. Go back to cashout.africa and log in.

5. Choose a kiosk name that resonateswith your brand.

6. Decide on a flexible rate for all your transactions.

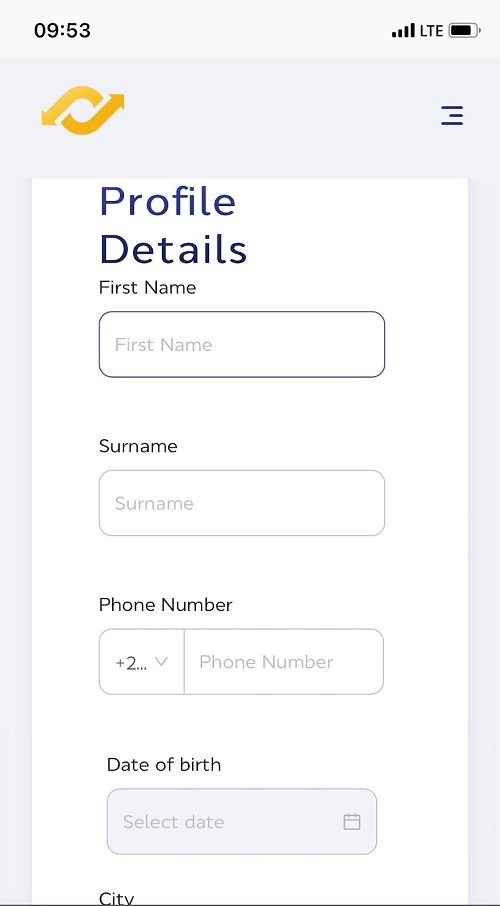

7. Complete your KYC.

a. Using your phone’s camera, take a selfie.

b. Fill in your first name, surname, and phone number.

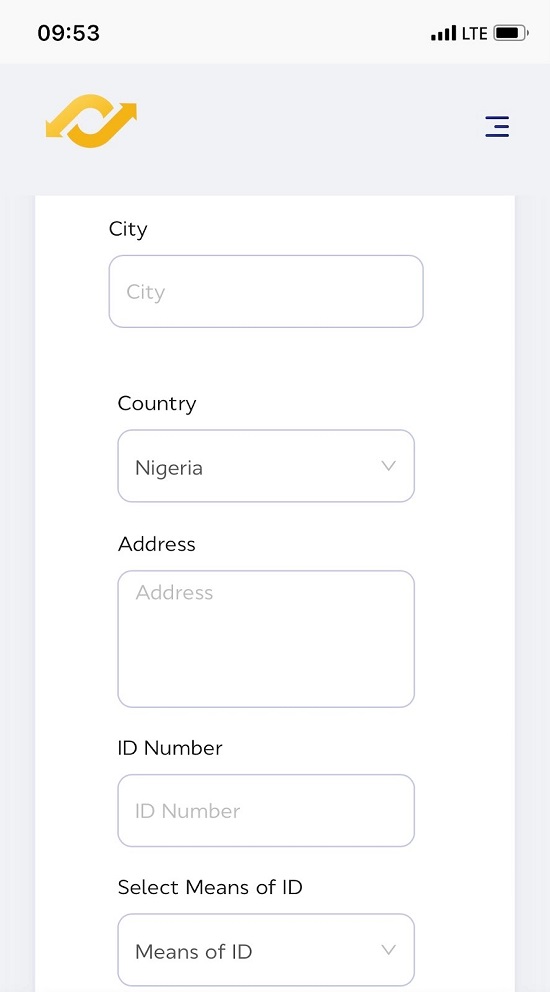

c. Next, you put your date of birth, city and address.

d. You will be required to upload a valid means of ID (Drivers licence, International passport or NIN.

8. Enable 2-factor authentication to help secure your transaction. You can read on how to enable 2FA here.

9. Copy your link and share references.