The dairy sector is a fast-moving consumer goods (FMCG) sector that engages in the production of milk and products related to milk as part of its operations. The market has been growing; for instance, Nigeria produced 524,733 tonnes of milk in 2020, up from 220,000 tonnes in 1971. It increases annually on average at a rate of 1.94%.

Milk is one of the most important sources of food nutrients for Nigerians, and as Africa’s most populous potential of the dairy industry, the country imports at least 60% of the dairy products it consumes, with the remaining country with approximately 200 million people, Nigeria represents a larger market for dairy products. Despite the 40% produced locally.

The industry’s value chain comprises of cattle breeding, which produces more than 90% of the country’s total annual milk production. These cattle are raised in low-input, low-yielding pastoral systems and traded in informal value chains. Out of Nigeria’s 5 million cattle used for this purpose, there are exotic and improved dairy cattle raised specifically for milk and other uses, and they are: Holstein Friesian, Brown Swiss, and Jersey breeds.

One of the players in dairy food production in Nigeria is Royal FrieslandCampina N.V., a multinational Dutch dairy cooperative headquartered in Amersfoort, the Netherlands. It was founded in 1871 with currently about 23,783 employees worldwide, and with a presence in 36 countries and with products selling in more than 100 countries under various brand names including Nigeria. In Nigeria, the company is known for its Peak milk brand.

The business has undergone numerous mergers and acquisitions. The most recent was in 2007 when Campina and Friesland Foods merged to form the business that goes by its current name. Campina and Friesland Foods declared they were looking into the possibility of merging on December 19, 2007. Under the condition that certain cheese and dairy drink divisions were sold off, the EU approved the merger of the two cooperatives.

Its other subsidiaries are:

- Alaska Milk Corporation (Philippines)

- FrieslandCampina Engro Pakistan (Pakistan)

- Dutch Lady Milk Industries Berhad (Malaysia)

Milk, baby and infant food, dairy drinks, yoghurts, desserts, cheese, butter, cream, milk powder, and dairy ingredients are among the products offered by FrieslandCampina. Its main brands are Friesche Vlag or Frisian Flag in its Indonesian market, Chocomel, Fristi, Friso, Dutch Lady, Milner, Campina, Landliebe, Optimel, Mona and “Mix’it”.

About FrieslandCampina WAMCO Nigeria Plc

FrieslandCampina WAMCO Nigeria Plc is a subsidiary of the Dutch company Royal FrieslandCampina and was incorporated in Nigeria under the Companies and Allied Matters Act (Cap. C20) laws of the Federation of Nigeria 2004, as a Public Limited Liability company. Its manufacturing site is in Ogba Industrial Estate, Ikeja, Lagos, and has been providing dairy products in Nigeria for over 60 years under the brands Peak, Three Crowns, Coast, NUNU, and Olympia milk.

Through the construction of a dairy farm in Vom, Plateau State, the company developed its first backward integration strategy in the early 1980s. Since then, it has integrated all lessons learned and developed into the more sustainable Dairy Development model, which was introduced in 2010.

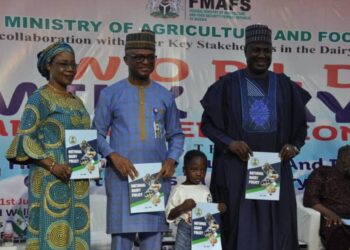

Working with pastoralists, smallholder dairy farmers, and commercial farms is part of the Dairy Development activities, which are supported by a number of partners, including IFDC-2SCALE, Bles Dairies, Wageningen University, the Federal Ministry of Agriculture and Rural Development (FMARD), and the Central Bank of Nigeria. The program’s goal is to make dairy farming more impactful to the next generation of farmers, making the industry more sustainable.

FrieslandCampina WAMCO’s Dairy Development currently operates in Oyo, Osun, Ogun, Kwara, and Niger states with products such as Coast, Nunu, Peak, Coast, and Olympic milk.

STAKEHOLDERS

- Hein Schumacher (CEO)

Hein Schumacher is the current CEO, who became the Chief Financial Officer of FrieslandCampina on January 1, 2015. Prior to this, he held financial and general management positions at Heinz in the Netherlands, the United States of America, the United Kingdom, and China. He succeeded Roelof Joosten, who had served as CEO of from 2004 until June 1, 2015.

- Ben Langat– Managing Director, Sub Saharan Africa Cluster

Ben Langat, the managing director in Nigeria, in charge of Sub-Saharan Africa and reports to Roel van Neerbos, COO of Consumer Products Europe, Middle East, and Africa. His appointment became official on March 13, 2017. Langat oversaw significant business transformation, a route to market strategy, increasing volumes, and expanding market share while serving as the managing director of Nigerian Bottling Company Limited, Coca-Cola, and Hellenic Bottling Company from June 2015 to June 2016. He has worked for Unilever in Kenya, Malawi, and Ghana over the course of his more than 24 years in the industry.

Ben Langat is an accountant by profession with a degree in Commerce from the University of Nairobi, Kenya, and an alumnus of the Harvard Business School, Boston, having completed the Advanced Management Programme. He has done several professional courses, including the Excel Leadership Programme from IMD, Lausanne.

Board members in Nigeria include:

- Jacobs Moyo Ajekigbe, Chairman

- Benard Cheruiyot Langat, Managing Director

- Roel Van Neerbos, Non-Executive Director

- Oyinkan Ade-Ajayi, Non-Executive Director

- Isaac Adefemi Agoye, Non-Executive Director

- Mustafa Bello, FNSE Independent Non-Executive Director

- Peter Eshikena, Non-Executive Director

- Oreoluwa Famurewa, Executive Director

- Marc Galjaar, Executive Director

- Robert Steetskamp, Non-Executive Director

Ben Langat’s achievements at FrieslandCampina WAMCO Nigeria Plc

According to Ben Langat, “I knew I wanted to make the world a better place, through nutrition, sustainable practices and agriculture…the real barometer for success is the adoption of its nutrition agenda. If every single Nigerian has a portion of dairy nutrition in what they consume daily, then, as an organization, we will have succeeded.”

Under his leadership;

- The company had a revenue growth of 35% for the year ended December 31, 2021

- As a result, turnover increased from N199.5 billion in 2020, to N268.4 billion in 2021

- Operating profit increased by 13% from N19.4 billion in 2020, to N22 billion in 2021

- Business strategies were strengthened and investments were scaled up in brands and optimized physical availability

- Route-to-market (RTM) distribution strategy was expanded which sustained its leadership position and delivered significant top-line growth.

- Likewise, the sustainable Dairy Development received a boost through significant initiatives including collaboration on the Value4Dairy Consortium. Dairy Development Program (DDP) involves 3,500 dairy farmers in Oyo State, of which 950 are women.

- Investments were made in a new mobile yoghurt factory to scale up fresh milk processing with expansion to new states in Nigeria.

- Backward integration was been strengthened and product diversification strategies were implemented

- Since his appointment in 2017, the local contribution to one of its main products, Peak evaporated milk, has increased from 2% to 10%.

Regulators

Commercial Dairy Ranchers Association of Nigeria (CODARAN) and the National Agency for Food Drug and Administration Control (NAFDAC), among others, regulate the company. CODARAN is the national apex body and collective voice for indigenous commercial dairy producers, ranch operators, and small, medium, and large-scale dairy farmers. NAFDAC, on the other hand, is in charge of overseeing all milk and dairy products manufactured, imported, exported, advertised, sold, distributed, or used in Nigeria.

Performance

The company declared a revenue growth of 35% for the year ended December 31, 2021, across its segments which are individual, food service professionals and industrial customers.

Being a listed company, the board of directors proposed a total dividend of N5.83 per share, comprising of an interim dividend of N1.10 per share which was paid in 2021, and a final cash dividend of N4.23 per share which was approved by the shareholders at the AGM, in addition to a bonus share to be issued to existing shareholders on a one-for-one basis.

The company’s headquarters reported revenue of €11.14 million, and a profit of €172 million as at 2021 in its full-year financial report. (Its full-year 2022 report is yet to be released). In its Nigeria operations, revenue was N82.3 billion and profit before tax stood at N4.9 billion as at Mar 31, 2022.

Consumer Perception

The company is perceived to be a pioneer and established company producing a household milk brand, consumed by many Nigerians.

Competition

Promasidor’s Cowbell milk, which introduced powdered milk in smaller sachets in 1993, was the first to challenge Peak’s dominance. This provided ordinary Nigerians with access to branded milk. Peak milk had no choice but to follow suit.

Other major competitors for the average Nigerian consumer, is such Nunu from PZ, and Blue Boat marketed by Ranona, Jago, owned by Sosaco Nigeria, Coast, Miksi and Loya.