Flour Mills Nigeria Plc has announced its first quarter 2022 results for the period ended 30 June 2022, revealing a 45% increase in revenue to N339.6 billion from N233.7 billion in 2021, with performance across all segments (Food, Agro-Allied Sugar, and Support Segments). This was supported by volume growth and a favourable mix despite the challenging macro environment.

The interim results which were released to the Nigerian Exchange Group (NGX) indicated that operating expenses increased by 52% to N14.7 billion, versus the prior period of 2021 which stood at N9.7billion.

The revenue was enhanced majorly on the back of Food and Agro-Allied segments following inflationary pressure.

At the analysts’ conference, the company said the Food segment contributed N213.166 billion from N146.925 billion, accounting for 45% while Agro-Allied segment accounted for a 37% growth to N65.652 billion from N47.688 billion in 2021.

What the company is saying

- The company increased its penetration into new and rural markets e.g, growth of breakfast cereals in the Eastern states, Abuja, and the implementation of innovative marketing strategies to serve the rural markets.

- It also noted that it continued to focus on investments enroute to consumer redistribution resulting in 8,000 new outlets in Q1 2022 and launched new SKUs in the starch and fertilizer business segments, and commenced operation of fertilizer blending plant in Kaduna with a 90 tonnes per hour capacity. Gross profit reached N33.2 billion in Q1’22, up from N25.7 billion in Q1 2021.

- It noted that Honeywell Flour Mills Plc’s (HFMP) acquisition was completed in May 2022 and the transitional process resulted in an N-1.1billion deficit for HFMP and N0.4billion one-off transactional cost for FMN. Earnings before tax growth net of transitional costs and would have been 15% compared to the previous year.

- The Group said it is very comfortable with the Honeywell investment, and the long-term projections are very positive after having managed the operations since the middle of May adding that it remained committed to maintaining growth and sustaining profitability by increasing local content with further backward integration investments.

- On operational review, the group said it consistently maintains a good operating performance (despite increase in input prices) in the food segment and continued solid performance in the Agro-allied segment following continuous penetration into new and rural markets. Investment enroute to customer redistribution and improved customer interface engagement resulted in N7.3 billion Profit Before Tax, up by 1% on an absolute basis and 15% on an operational basis when excluding the transitional costs.

- “Our sugar segment saw a 64% revenue with stabilized trading environments and strong demand for brown sugar which is locally produced at our farm in Sunti. Our animal feeds business attained 21% revenue growth, driven by investments in logistics infrastructure and farmer training extension services across the country,” it said.

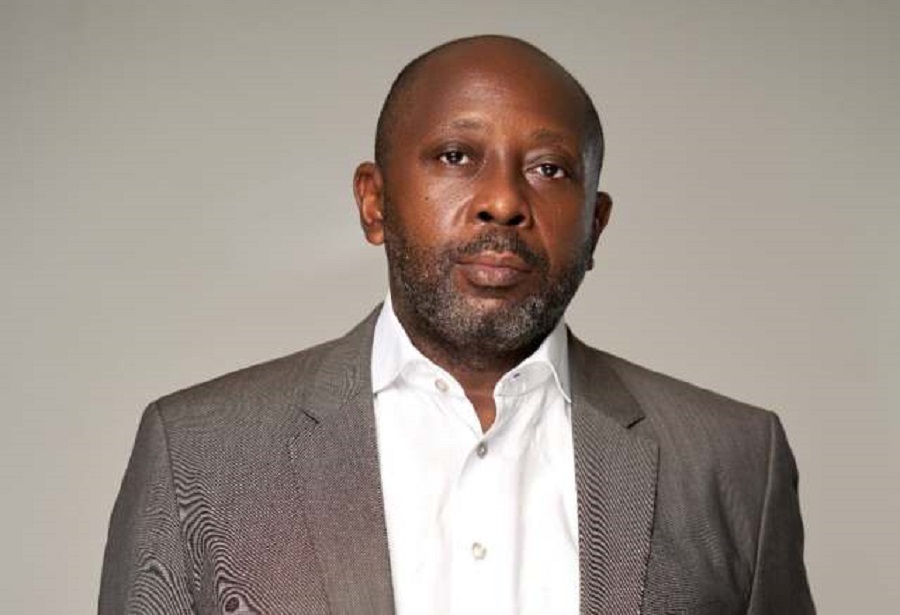

- Commenting on the result, Omoboyede Olusanya, the Group Managing Director, said: “Despite the challenging socio-economic environment, we continue to deliver strong business performance with resilience and operational excellence. Our increased operational efficiency with accelerated plans for our supply chain optimization, content localization, and cost optimization across our business segments has helped to cushion the sharp rise in the cost of raw materials. We would always be committed to our purpose of Feeding the Nation, Everyday through our offerings of quality products and services.”

- The Group is dedicated to achieving sector strategic growth opportunities, both organic and inorganic with keen determination as we continue to create value for our shareholders.”

With daily Increasese in the uniit prices of all there product we dont expect in growth of Flour Mill Profits.

Colliding with distributors and wholesales to exploit Nigerians

@Adefolarin, feel free to go open your own flour milling business, and that way you can give away your products for free if you want to. Cheers.

This is really funny but I got your point.