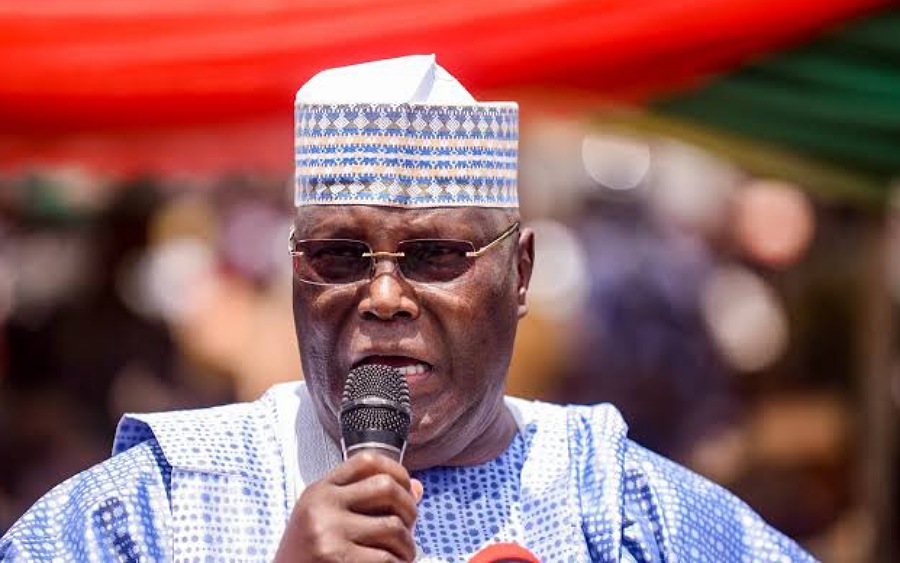

Atiku Abubakar, the presidential candidate for the Peoples Democratic Party, has stated that within the first 100 days in office, he will unveil an Economic Stimulus Fund with an initial investment capacity of approximately US$10 billion.

He said this is to support private sector investments in infrastructure and to prioritize support to agriculture, manufacturing and the MSMEs.

Atiku disclosed this in a social media statement on Tuesday evening.

What Atiku is saying

He said for Nigeria to grow the economy, exports require a coherent and investor-friendly foreign exchange policy that improves the global competitiveness of domestic enterprises.

“Larger volume of non-oil exports will earn more foreign exchange for Nigeria, improve our foreign reserves, and help in stabilizing the Naira. All of these will contribute to growth in GDP,” Atiku said.

He stated that the first thing he will do is “restore investor confidence in the economy so that they can take risks and invest capital, especially in the non-oil sector. This we can achieve by being more consistent and coherent in our economic policies (policy flip-flops sends investors away).

“Secondly, within the first 100 days in office, we shall unveil an Economic Stimulus Fund with an initial investment capacity of approximately US$10 billion.

“This is to support private sector investments in infrastructure and to prioritize support to agriculture, manufacturing and the MSMEs across all the economic sectors, as they offer the greatest opportunities for achieving inclusive growth.”

He added that In the agricultural sector, he will elevate irrigation to a top policy priority and support both smallholder and commercial farmers to cultivate at least 10% of the potentially irrigable land-(currently, only 2% is under cultivation).

Also, by fighting insecurity. Investment is a coward animal and fears conflicts and insecurity.

Secondly, within the first 100 days in office, we shall unveil an Economic Stimulus Fund with an initial investment capacity of approximately US$10 billion.

— Atiku Abubakar (@atiku) July 26, 2022

What you should know

- Recall Nairametrics reported earlier that the former Vice President stated that his administration will launch a $20 billion consortium of private sector institutions to establish an Infrastructure Debt Fund (IDF) to primarily mobilise domestic and international private resources for the financing and delivery of large infrastructure projects.

- Atiku said the IDF will have an initial investment capacity of approximately US$20 billion and also cause the creation of an Infrastructure Development Credit Guarantee Agency to complement the operation of the IDF by de-risking investments in infrastructure to build investor confidence in taking risks and investing capital.

Sounds more like what I was hearing from French presidential aspirants during the last presidential election in France. This strategy may be justifiable in an accountable and developed economy which has multitudes of high quality export products to ensure pay back of such stimulus funds as soon as the economy picks up. However, in a corrupt and wasteful economy like ours, such stimulus would likely not achieve the desired results for obvious reasons and end up compounding our debt situation and economic woes. Rather, I expect Mr. Atiku as well as his fellow aspirants to seek for solutions that are tailor-made for the peculiar economic and other challenges that have been holding this country down for decades now.

Thoughtful but accountability is the major thing we must tackle to achieve economical growth not just investments.

That thing is good