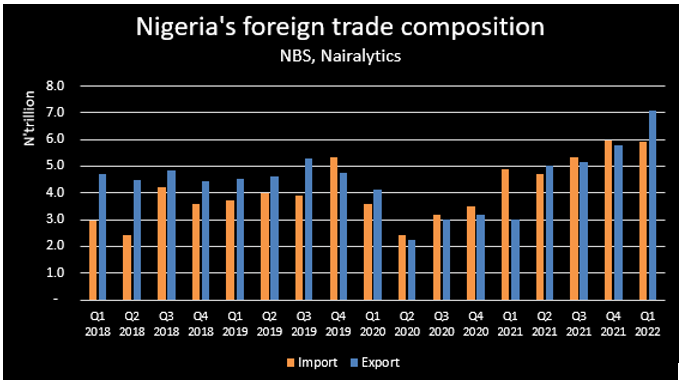

Nigeria’s foreign trade rose to N13 trillion in the first quarter of 2022, increasing by 11.1% from N11.7 trillion recorded in the previous quarter and 65.4% higher than the N7.86 trillion recorded in Q1 2021.

This is contained in the recently released foreign trade report for Q1 2022, by the National Bureau of Statistics (NBS).

According to the report, the improvement in Nigeria’s merchandise trade was due to increases in crude oil export receipts in the quarter under review. Specifically, Nigeria’s crude oil earnings rose by 31.66% quarter-on-quarter to N5.62 trillion in Q1 2022.

Consequently, total export earnings improved by 23.13% from N5.77 trillion recorded in Q4 2021 to N7.1 trillion in Q1 2022, as against a 0.67% decline in import bill to N5.9 trillion in the same quarter. This resulted in a N1.19 trillion positive trade balance, the first since Q2 2021.

Highlight

- Total imports in Q1 2022 stood at N5.9 trillion, decreasing by 0.67% when compared to Q4 2021 (N5.94 trillion), but 21.04% higher when compared to the value recorded in the corresponding quarter of 2021 (N4.88 trillion).

- Nigeria’s Export income in Q1 2022 stood at N7.1 trillion, which represents 23.1% and 137.9% increases compared to N5.77 trillion and N2.98 trillion recorded in Q1 and Q4 2021 respectively.

- Re-Exports in the first quarter of 2022 which stood at N115.8 billion decreased when compared to the same quarter of 2021 (N123.46 billion) and in Q4 2021 (N284.54 billion) by 6.2% and 59.3% respectively.

- In terms of Imports, in the first quarter of 2022, China, The Netherlands, Belgium, India and the United States were the top five countries of origin of imports to Nigeria.

- The values of imports from the top five countries amounted to N3.44 trillion representing a share of 58.34% of the total value of imports.

- On the other hand, the top five export destinations in the first quarter of 2022 were India with a share of 16.57%, followed by Spain with 9.54%, The Netherlands with 9.30%, Indonesia and the United States with 6.68% and 5.25% respectively.

Crude export lifts Nigeria’s trade balance

- The price of crude oil in the global market recorded significant rally in first quarter of the year after the president of Russia, Vladimir Putin ordered the invasion of his troops on Ukraine in February. Crude prices surged as high as $127 in March 2022.

- Although Nigeria’s crude oil production has recorded recurrent decline, the significant rise in the price of crude oil was able to elevate its earnings from crude export.

- Notably, crude oil earnings jumped by 175% year-on-year to N5.62 trillion from N2.04 trillion recorded in Q1 2021.

- Crude oil export earnings also accounted for 79.16% of the total export earnings recorded in the quarter under review. Hence, Nigeria’s trade moved to a favourable balance in Q1 2022, with N1.12 trillion foreign trade surplus. This is the highest quarter trade surplus recorded by Nigeria since Q3 2019.

Why this matters

In a time, when Nigeria is in dire need of forex earnings, Nigeria will look to increase this performance in the following quarters, in order to compensate for the N1.9 trillion trade deficit recorded in the previous year.

this is very impressive bop surplus. but note this china came first among the five importing countries, but china is not among the top five nigeria export destination, this needed an urgent attention.

Hello, please next time you make an analysis, please US dollar abeg.