The efficient functioning of capital markets in the West African Region demands a regular assessment of policies and programs to fit current realities and address the region’s peculiar challenges.

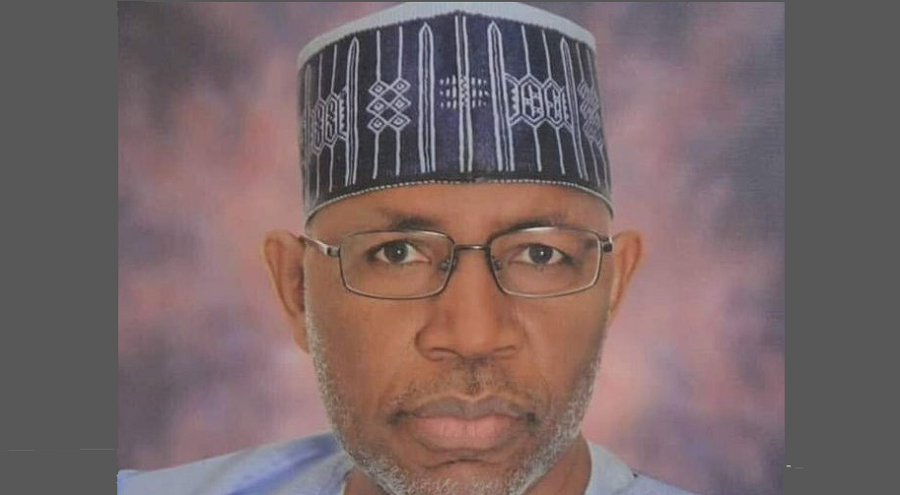

This was stated by the Director-General of the Securities and Exchange Commission, Mr. Lamido Yuguda at the West African Capital Markets Conference with the theme: “Deepening and Strengthening the Capital Markets Across West Africa through Effective Regulation” held in Accra, Ghana.

The conference was organised by the West Africa Securities Regulators Association, WASRA.

What the SEC DG is saying

The SEC DG who is also the WASRA Chairman said the need for regular assessment necessitated the revision of the WASRA/WACMIC (West African Capital Markets Integration Council) Road Map to reflect current developments and include specific initiatives that will further improve the successful implementation of integration and other efforts.

- He reiterated that against the backdrop of innovation and dynamism in the capital markets, there is a need for regulators to keep pace with this trend.

- Yuguda stated that the WACMC periodically presents members with an opportunity to explore the role that financial markets should play in supporting the growth of the real sector of the respective economies and indeed the sub-region in general.

- According to him, “We are not unaware that in some member states, capital markets activities are still in their nascent stage. In collaboration with ECOWAS, efforts are being made to encourage these jurisdictions to join WASRA. We intend to engage and partner with them to build capital markets that will support the growth and development of their respective countries while advancing our regional market integration efforts.

- “As the region continues to expand in market size and influence, it becomes increasingly more important to focus our attention on developing world-class markets by looking at innovative ways to address critical issues such as systemic risk, market integrity, investor protection, Fintechs and disruptive technologies. We must also be steadfast in our collective efforts to close the geographic distance between our markets through ways and means that facilitate regional integration.”

- Yuguda expressed delight at the high level of participation at the meeting emphasizing that the biennial Conference is geared toward promoting robust discussions on how to harness resources and effectively optimize collective efforts towards the integration of markets in the region.

- This he stated, will no doubt lead to the realization of a key outcome, namely, an increase in capital markets’ contribution to economic growth and development of the region.

- “You will recall that at our inaugural conference in Abidjan, Cote d’Ivoire, we resolved to continually strive to create an environment that facilitates cross-border securities transactions; strengthen investor protection; build capacity; be more innovative with our processes, among others.

- “To this end, we have made significant progress by adopting strategic initiatives aimed at boosting the economy, generating wealth, improving infrastructure development and growing trust and confidence as we strive for a deeper and more resilient capital market,” he added.