The United States Federal Reserve says it would keep raising interest rates until there is clear evidence inflation is steadily falling despite growth concerns.

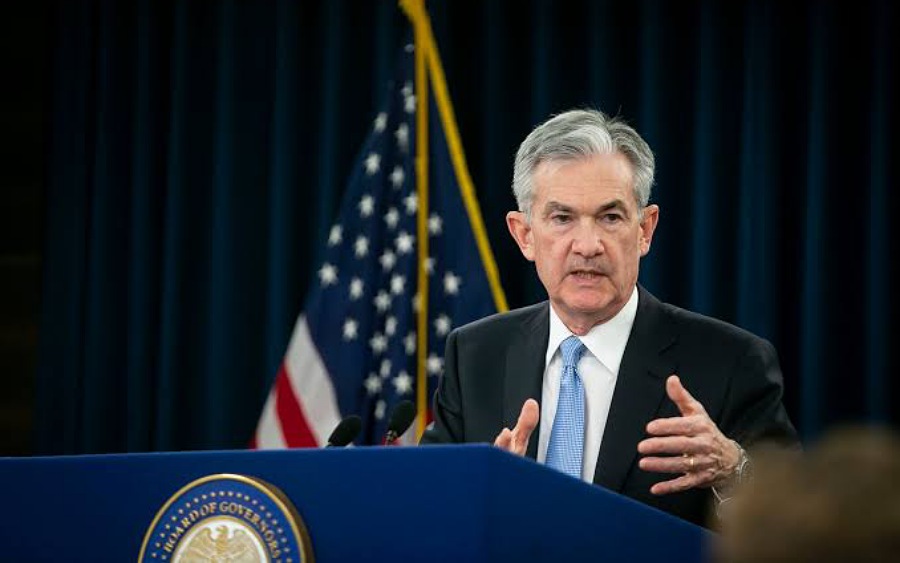

During the roughly 35-minute interview, the Fed chair, Jerome Powell repeatedly emphasized the need to curb the fastest inflation in decades, calling price stability “the bedrock of the economy” and acknowledging that some pain in achieving this — including a slight rise in the unemployment rate — was a cost worth paying in order to achieve it.

Powell and his colleagues on the Federal Open Market Committee voted earlier this month to raise their benchmark rate by a half-percentage point, and the chair signalled to reporters at the time that similar hikes would be on the table at their next two meetings in June and July. He reiterated that guidance and stressed that short-term inflation developments will be crucial.

What Powell is saying

Increases in the Federal Reserve’s benchmark short-term rate often result in higher borrowing rates for consumers and businesses, including mortgages, auto loans, and credit cards. Despite economic concerns, the Fed maintains its hawkish posture.

- “What we need to see is inflation coming down in a clear and convincing way,” Powell said in remarks to a Wall Street Journal conference. “And we’re going to keep pushing until we see that.”

- The Fed chair, who was confirmed by the Senate last week to a second four-year term, suggested that if price hikes do not decrease, the Fed may consider hiking rates even faster.

- “What we need to see,” Powell said, “is clear and convincing evidence that inflation pressures are abating and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively. If we do see that, then we can consider moving to a slower pace.”

- And he said the Fed “wouldn’t hesitate” to push its benchmark rate to a point that would slow the economy if needed. While it is unclear what level that might be, Fed officials peg it at about 2.5% to 3%, roughly triple its current setting.

- Powell’s remarks follow other statements he has made that have indicated the Fed is implementing a series of rate hikes that could amount to the fastest tightening of credit in more than 30 years.

- When asked if the Fed’s rate hikes could disrupt financial markets, without necessarily bringing down inflation, Powell responded, “I don’t see that happening.”

The yield on the two-year Treasury note has climbed consistently since the beginning of the year, which Powell cited as evidence that Wall Street expects the Fed to continue restricting lending. Such expectations should serve to cool the economy by slowing borrowing and spending.