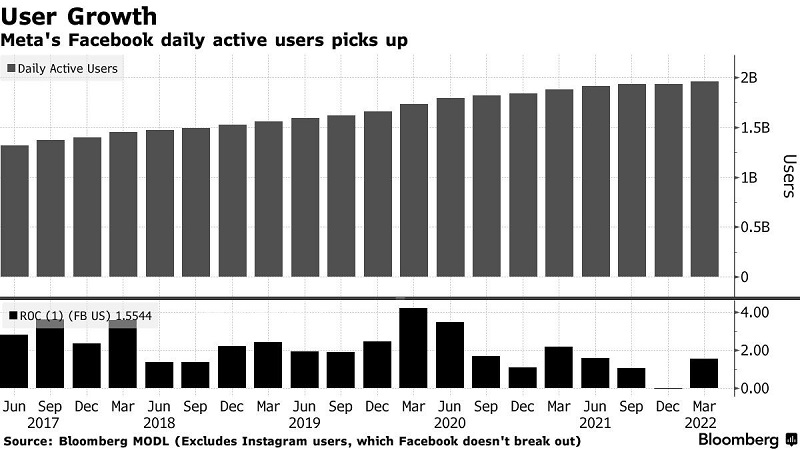

For the first time since its unimpressive fourth-quarter earnings report sent the stock down by 26% in February, Meta investors have a lot to smile about. From 1.93 billion to 1.96 billion, daily active users bounced back from the fourth quarter decline.

Even with Wednesday’s after-hours rally, the stock is still down for the year. Nearly half of the shares’ value had been lost by the close of 2022.

However, if the stock continues to climb on Thursday and ends up more than 19.1%, it would mark the stock’s second-best day ever and its biggest gain since July 2013.

Key highlights

- Facebook exceeded revenue expectations per user as well as earnings expectations. However, nearly all other key metrics missed, including monthly active users.

- Facebook’s revenues grew by 7% in the first quarter since it became a public company, marking the company’s first growth in the single digits in the past ten years. Analysts had predicted 7.8% growth.

- Refinitiv analysts expected Facebook’s revenue to be between $28 billion and $30 billion for the second quarter.

- According to the company, the guidance reflects continued trends from the first quarter, including soft revenue growth associated with the war in Ukraine.

- In October, Facebook changed its name to Meta to demonstrate CEO, Mark Zuckerberg’s desire to move the company towards a virtual world where people can work, play, and study.

- 97.5% of Facebook’s revenue came from its apps, including its core app, Instagram, and WhatsApp. Lastly, $695 million came from Reality Labs, the company’s attempt to create products in the metaverse.

On Wednesday’s earnings call, Sheryl Sandberg, chief operating officer at Facebook, told analysts the company has so far “closed a good part of the underreporting gap and shared that with advertisers,” but it will take more time to close the rest.

“While these times are challenging, we believe that over the long run, we have a strong competitive edge when you consider the options advertisers have to advertise both offline and online,” Sandberg added.