The word Ponzi is now synonymous with fraud, especially financial fraud. Its important investors do very basic scoring of financial offers they receive or are considering.

What is a Ponzi Scheme? A Ponzi scheme is a fraudulent investment scheme that offers high interest but pays this interest by taking the deposits of new investors to pay the earlier investors. A Ponzi scheme is a game of numbers for the perpetrators; if there are more new investors, the scheme continues. A Ponzi scheme is very similar to a pyramid scheme; a pyramid scheme involves recruiting new “investors”. A Ponzi scheme is always illegal, and it consists of selling a product or service.

How can you spot a Ponzi scheme? It is complex; Ponzi schemes being fraudulent, always seek to mimic what is legal to confuse and deceive investors. Take Charles Ponzi, from whom the name Ponzi Scheme comes. Charles had a rather formal name for his scheme; he called it the Securities and Exchange Company or SEC. s. So let’s talk about two critical red flags that you should look out for.

- Incomplete registration

- Custodian

- Outlandish promises of investment return

Incomplete Registration

If the company Registration is incomplete or absent, it’s a red flag. All organisations that do business with the public have to hold a valid and up to date registration. This requirement is essential for any company offering financial products or services. Simply having Corporate Affairs Commission registration (CAC) registration is insufficient. I will list the two financial activities and the regulatory body empowered to register or license them to simplify this.

The company seeks to accept deposits and make loans: Central Bank of Nigeria (CBN)

The company seeks to offer or solicit investment products to the public: Securities and Exchange Commission (SEC).

If a company offers public investment products, that organisation MUST be SEC registered. Keep in mind that a company cannot also seek to raise funds from the public to fund its private business. The investor must ask two questions from any entity offering investment products.

- Is the entity providing the investment service duly registered by SEC?

- Is the investment scheme authorised by the SEC?

- Who is the fund custodian?

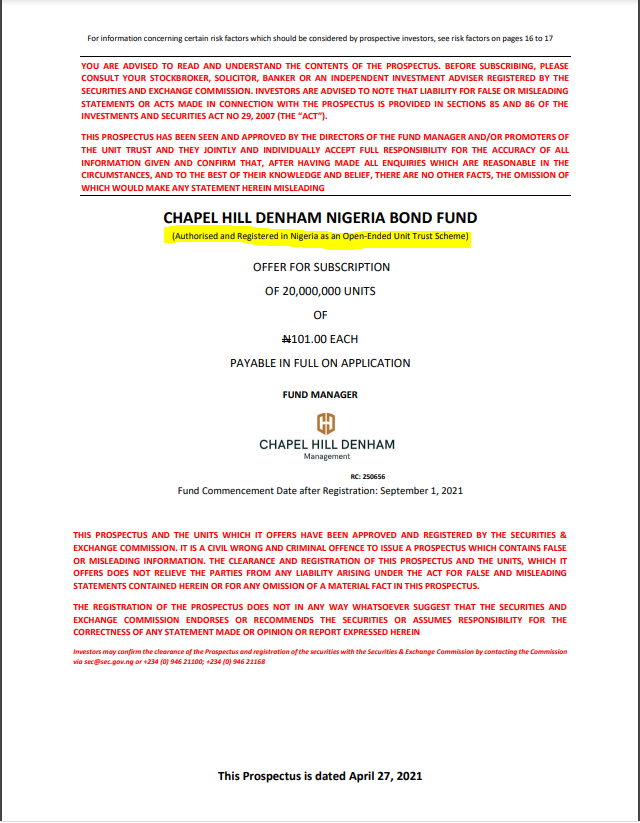

For example, please look at this prospectus by the Chapel Hill Denham on their Bond fund in figure 1; they disclose that their bond fund is authorised and registered in Nigeria by SEC.

DO NOT INVEST WITH ANY ORGANISATION THAT IS NOT REGISTERED BY SEC.

Figure 1.

SEC registration does not confer sainthood or business longevity, but it helps weed the unregistered from your contemplation.

This is a link to verify if any organisation is SEC registered. https://sec.gov.ng/cmos/

What about crowdfunding?

SEC defines crowdfunding as raising funds from the public through an online portal in exchange for shares, debt or other investment instruments. According to SEC, ONLY MSMEs who are incorporated in Nigeria for a minimum of two years or less if they have a strong technical partner can raise funds via a crowdfunding portal. So ask the company for their CAC Certificate and verify they have been in business for two years. Also note, Co.

Cooperatives as well?

Keep in mind that Cooperatives, including multipurpose cooperatives, Agricultural and Consumer cooperatives, are licensed at the State level by the Governor via the Director of Cooperatives.

Custodian Relationship

SEC rules now mandate that all collective schemes, including funds held by registered fund & portfolio managers, including discretionary and nondiscretionary mandates, maintain a custodial relationship. Again, don’t invest with any manager without a custodian. This means the fund managers cannot retain custody of clients’ funds but must maintain them with a custodian. See Figure 2

Figure 2.

Outlandish promises of return

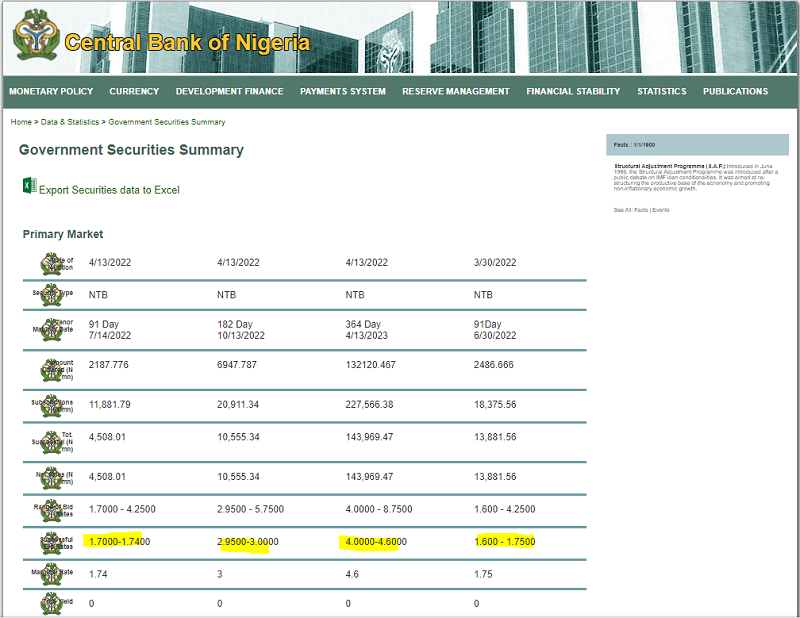

Ponzi schemes can only survive if they get new investors. To ensure new funds keep rolling in, Ponzi schemes offer very high and outrageous rates of return. The question I hear you asking is, what rates are high? The answer is to benchmark the rates you receive to the Nigerian risk-free rate. Below in figure 3 is the Government Securities summary report from the Central Bank of Nigeria.

Figure 3.

From figure 3, the Federal Government of Nigeria’s securities, the safest in Nigeria, offer the lowest risk, with yields from 1% to 3% per annum for short term borrowing. This means every borrower in Nigeria will have to offer rates higher than 1-3% per annum to borrow, but how much? 20%? 20% per month? MBA Forex, the currency trading Ponzi scheme, offered 20% every three months or 1,200% a year; this is too high and suspicious. Any lender will pay higher rates to keep funds from leaving or attracting funds at any cost, which is a red flag.

Watch for interest quoted per month; that’s unusual. That must trigger questions if the interest quoted exceeds ten basis points from the FGN rate. You should ask and get answers to these questions.

- Why does the firm need money this bad?

- How are redemptions handled?

- Are there any guarantees?

Ask questions, get answers in writing.

Make sure you never invest in “silence”, do your research, ask around, and read reviews online. The most significant investment scam in the world was perpetuated by Bernie Maddoff, who had a registered and SEC approved investment company; the only giveaway was that he was paying a fixed return whilst investing in a variable return asset class.

Please trust but verify.