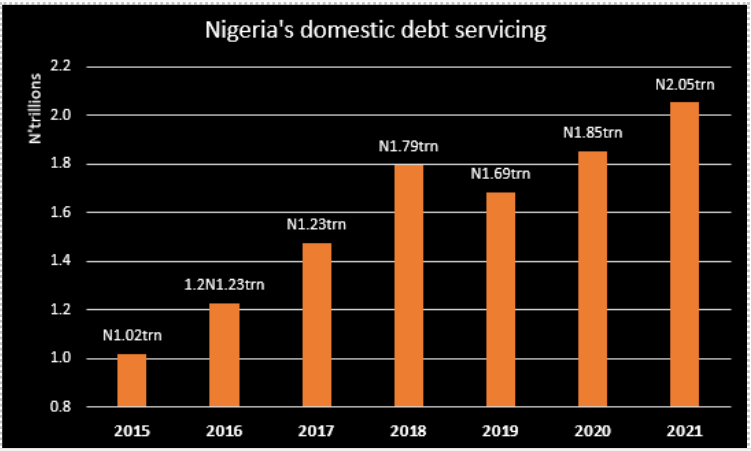

Nigeria spent a sum of N2.05 trillion to service its domestic debts in the year 2021, representing an increase of 10.8% compared to the N1.85 trillion incurred in the previous year.

This is according to the report on Nigeria’s debt service, released by the Debt Management Office (DMO).

A further look at the data showed that a sum of N1.66 trillion was paid as interest on federal government bonds, which accounted for 80.8% of the total amount incurred on domestic debt service. It is also worth noting that the amount spent on servicing domestic debts in 2021 is the highest on record.

Meanwhile, Nigeria’s domestic debt profile rose by N3.49 trillion in the review period to N23.7 trillion as of December 2021 from N20.21 trillion recorded in the previous year. Domestic debt accounted for 59.9% of Nigeria’s total debt profile, while external debt represents 41.1% of the total.

Read: CBN says heavy debt servicing is taking a toll on fiscal resources

The rise in the country’s debt profile is attributed to the N5.6 trillion budget deficit for the review year by the federal government. Recall that the federal government signed a budget of N13.59 trillion for 2021, which needed a sum of N5.6 trillion to fund the budget deficit.

The budget deficit for the year informed the need for a N2.34 trillion new loans each from both domestic and foreign sources, N709.69 billion multilateral/bilateral loan drawdowns and N205.15 billion privatization proceeds.

A cursory look at the breakdown of Nigeria’s domestic debt service, a sum of N81.81 billion was incurred as charges for Nigerian treasury bills, accounting for 4% of the total amount. In the same vein, a sum of N219.41 billion was paid back as part of the principal for promissory notes, while N25 billion was paid for treasury bonds.

Read: Nigeria’s domestic debt service gulps N2.1 trillion in 2021

Revenue problem still persists

While Nigeria continues to spend a huge sum on servicing both domestic and foreign debts, while accumulating new loans, its revenue bucket is shrinking further, largely due to the decline and underperformance of its oil revenue.

- A glance at the Medium-Term Expenditure Framework and Fiscal Strategy Paper (MTEF & FSP), by the federal ministry of finance, budget, and national planning, Nigeria generated net oil and gas revenue of N876.54 billion between January and May 2021, which is 49.5% lower than the prorated figure of N1.74 trillion for the same period.

- The underperformance of the Nigerian oil revenue bucket has been largely due to its inability to improve production quota, which was reduced by the OPEC+ in 2020 due to the covid-19 pandemic in order to drive crude prices up. A move that drove the prices up to around $80 per barrel.

- However, since the cartel decided to increase production, Nigeria has found it difficult to meet its own quota, despite significant surge in the price of crude oil.

- Meanwhile, its non-oil revenue surpassed its target by 7.2%, recording a net non-oil earning of N1.97 trillion over the prorated N1.78 trillion between January and May 2021.

Read: Nigeria in a limbo: Borrowing to service Debt

FG continues to obtain new loans

The federal government of Nigeria continue to obtain new loans from both local and foreign sources, despite growing debt profile and servicing cost. However, this is necessary given the level of Nigeria’s annual revenue, which has been marred by the decline in crude oil earnings amongst other factors, such as subsidy payments.

- Likewise, Nigerians have been trooping to subscribe to the FGN savings bond issuance, with the issuance being oversubscribed in three consecutive months in 2022 (January to March).

- Specifically, the Debt Management Office auctioned a bond issuance of N150 billion in two tranches in March 2022, which was oversubscribed by a whopping N448.42 billion.

- The rally for government-issued securities is not surprising despite the low-interest rate environment, considering the level of volatility in other markets in the local economy. Government securities are also seen as a secured instrument, with capital and returns sure to be paid by the government.