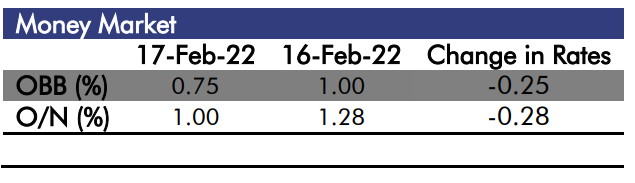

Money Market

System liquidity remained elevated today, as we saw no major outflows. Hence, the Open Buy Back (OBB) and Overnight (OVN) rates declined by 25bps and 28bps to 0.75% and 1.00%, respectively.

We expect interbank rates to rise sharply tomorrow, on the back of outflows from the FGN bond auction settlement and retail FX auction funding.

Treasury Bills Market

The treasury bills market was mostly quiet today, albeit with massive interests seen on the May-2022 maturity. Average benchmark yield declined by 10bps to 4.19%.

We expect the cherry-picking to persist, with the broad performance remaining tepid.

FGN Bond Market

The bond market was relatively bullish today, with interests skewed towards the short end of the curve. Average benchmark yield fell by 13bps to 11.28%.

We expect interests in short-dated bonds to persist, albeit on a less aggressive note.

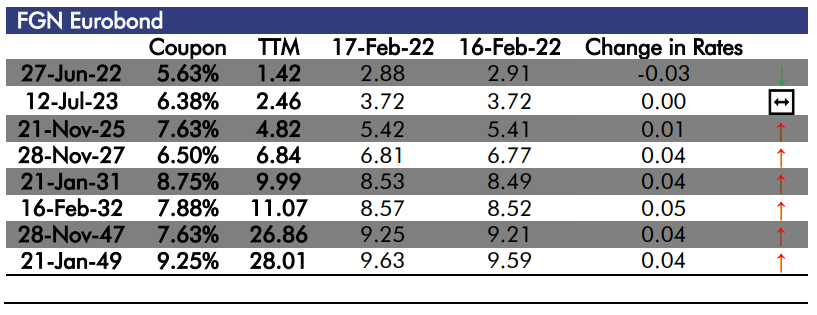

FGN Eurobond Market

The Eurobond market turned bearish today, with selloffs concentrated at the mid to long end of the curve.

Average benchmark yield advanced by 2bps to 6.85%.

We expect the selloff to persist, as the Ukraine-Russian crisis has left global sentiment frail.

Currency Market

The Naira depreciated against the US Dollar by 4bps to $1/₦416.67 at the Investors and Exporters FX Window.

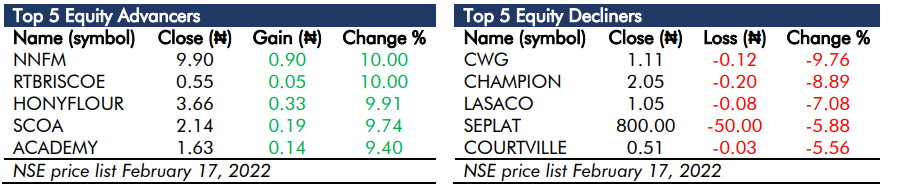

Equities Market

The equity market was flat today, as the benchmark All Share Index declined marginally by 1bp to 47,102.64 points, while Year to Date return and Market Capitalisation settled at 10.27% and ₦25.39 trillion, respectively. However, market breadth closed positive at 2.00x, as we recorded 32 advancers as against 16 decliners. While the overarching theme of the market was bullish, profit taking in large tickers like SEPLAT (-5.88%) and MTNN (-0.10%) pushed the overall market to the negative region.

Volume traded advanced by 12.41% to 357.74 million units, while value traded declined by 21.58% to ₦6,482.03 million. The most traded stocks by volume were GTCO (130.14 million units), UCAP (30.27 million units) and FIDELITYBK (26.50 million units), while GTCO (₦3.42 billion), MTNN (₦776.56 million) and SEPLAT (₦671.36 million) topped the value chart.

We expect to see an unaggressive bullish bias tomorrow.