Nigeria’s economy recovered from its economic recession in Q4 2020 following two consecutive quarters of negative movement in the country’s GDP. However, the economy still struggled to reach pre-pandemic levels in 2021 on the back of galloping inflationary pressure, rising unemployment rate, surging debt profile amongst others.

The year 2021 can be regarded as a tough economic year for the African giant given the less than desired macro numbers printed in the review year. Although, it is worth noting that Nigeria recovered from its economic downturn faster than anticipated, posting 0.11% real growth in Q4 2020, to overturn negative numbers recorded in Q2 and Q3 2020.

As we embark on the new year, Nairametrics recounts the factors that paint 2021 as an economic failure for the country.

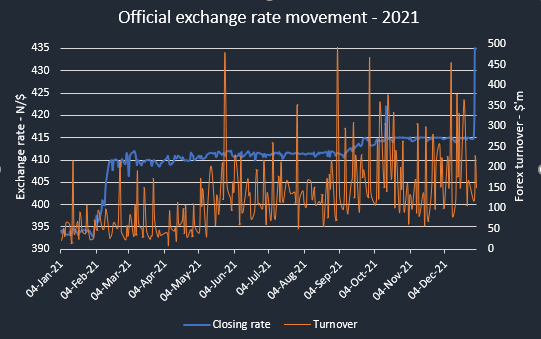

Continuing exchange rate quagmire

Nigeria’s official exchange rate depreciated by 6.03% in 2021, closing at N435/$1 on the last day of the year, despite averaging at N410.3/$1 for the year. Naira faces the risk of a further devaluation after it depreciated by 4.82% on the 30th December 2021, likely repeating the events that played out in the previous year.

The official exchange rate on the last trading day of 2020, depreciated by 4.12% to close at N410.25/$1, which indeed indicated the rate for the year. This implies that the official rate could be on its way to the region of N435 to a dollar.

On the flip side, the parallel market also recorded significant depreciation as the naira closed at N565/$1 for the year, representing a fall of 22.8% against the US dollar. The continuous volatility at the black market further widened the market differential to N140.74 from just N49.75 in the previous year.

The Central Bank of Nigeria continues to intervene in the Investors & Exporters window to ensure the stability of the local currency, with over $32 billion traded in the year. However, the pressure from negative trade balance, decline in diaspora remittances, dwindling capital inflow, drop in crude export amongst others, is persistently mounting pressure on the exchange rate.

FG revenue problem

In time past, Nigeria’s problems have been attributed to low revenue rather than over-spending. This issue is still not looking green owing to the underperformance of the federal government’s oil revenue purse.

As of May 2021, FGN’s retained revenue was N1.84 trillion, which was 33.3% lower than the prorated figure of N2.77 trillion. This was largely due to the performance of the oil revenue as of the review period.

Notably, oil revenue was estimated at N423 billion, representing just 50.5% performance rate compared to the prorated figure of N837.9 billion. On the other hand, non-oil revenue only marginally fell below the prorated target with CIT and VAT surpassing targets by 2.4% and 24.7% respectively.

Nigeria’s oil revenue is still likely to suffer from shortages, with the country unable to meet the OPEC+ production quota and petrol subsidy still gulping a significant amount of our scarce income.

Unemployment rate at 33%

In March 2021, the National Bureau of Statistics (NBS), released the labour force report for Q4 2020, which spelt more woes for the country with unemployment rate estimated at 33.3%, indicating that at least 23 million Nigerians were without jobs.

Unemployment has been a topical issue in the Nigerian economy, however, at 33.3%, it represents the highest rate on record. As if the surging rate is not enough, the nation’s labour force population reduced by over 10 million to 69.7 million as of Q4 2020.

In the same vein, the number of full-time employed citizens dropped by 14% from 35.6 million recorded as of Q2 2020 to 30.6 million people as of the end of the year. The surging rate reflects how much Nigerians are losing their jobs and many more people falling out of the labour force bracket.

Recall that during the covid-19 lockdown in 2020, several businesses were forced to halt their operations during the period, which led to some of these firms downsizing, while some workers were forced to accept pay-cut to hold on to their jobs. The situation is also reflected in the Q4 2020 labour report, as Nigerian businesses were yet to recover from the lockdown as of the time of releasing the report.

GDP

The Nigerian economy grew by 0.51%, 5.01%, and 4.03% in Q1, Q2, and Q3 2021 respectively, indicating a recovery from the two consecutive contractions recorded in the previous year. The significant growth recorded in the year under review was however due to favourable base period.

The GDP is compared to the corresponding quarter in the previous year, and we could recall that Nigeria’s real GDP dipped by 6.1% in the second quarter of 2020, which birthed the 5.01% growth in Q2 2021, while a 3.62% contraction in Q3 2020 resulted in a 4.03% growth in Q3 2021.

Meanwhile, the growth was attributed to the performance of the non-oil sector, with the telecommunications and trade sector of the economy printing stellar performances.

Galloping inflation rate

Nigeria’s galloping inflationary pressure from 2020 extended into 2021, with headline inflation surging to 18.17% in March 2021, representing the highest monthly inflation rate since January 2017 when the CPI increased by 18.72%.

The uptick in the inflation rate was attributed to the surge in transport costs, medical services, as well as continuous disruption in the food supply chain. Despite significant intervention by the federal government through the Central Bank of Nigeria to the agricultural sector, there is still a huge food supply gap in the country.

Notably, food inflation crossed the 20% threshold in the year, hitting a high of 22.95% in March 2021, while core inflation in the same period stood at 12.74%. It is, however, worth noting that the inflation rate has witnessed significant moderations in the year, largely due to baseline effects.

The latest CPI report by the NBS for November 2021 saw headline inflation trickled down to 15.4%, the lowest recorded yet in the year 2021

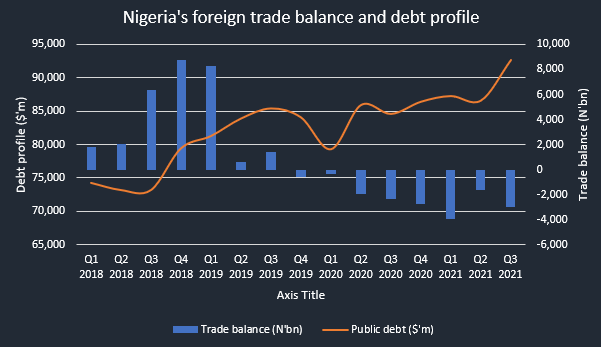

Increased debt profile (N38 trillion)

Nigeria’s public debt profile as of Q3 2021 surged to N38 trillion from N35.47 trillion recorded in the preceding quarter (Q2 2021). The debt profile of Nigeria continues to witness significant increase both from domestic and foreign sources.

For example, Nigeria’s external debts rose to $37.96 billion in Q3 2021 from $33.47 billion, which was recorded in the previous quarter, an increase largely due to the $4 billion Eurobond secured by the federal government from the international debt market.

In the same manner, domestic debts also reached $54.67 billion in the same period, increasing by 3% from $53.1 billion recorded in Q3 2021. A further analysis of the debt report by the Debt Management Office (DMO), indicates that Nigeria has acquired at least $6.23 billion new loans so far in the year as of Q3 2021.

While debt profile has witnessed significant increase in the review period, debt service cost has also gulped a significant portion of the country’s scarce income. According to the data tracked by Nairametrics Research, Nigeria has paid N1.74 trillion and $1.82 billion as domestic and external debt service costs respectively between January and September 2021.

Continuous negative trade balance

Foreign trade deficit is an undesirable outcome in any economy and Nigeria has recorded huge trade deficits in recent time, spanning through from Q4 2019 to Q3 2021. Trade deficit, otherwise known as negative trade balance, occurs when a country’s import value surpasses their export income.

Nigeria’s foreign trade balance worsened in 2021, triggered by a significant surge in import bill, especially in the third quarter of the year. According to data from the NBS, Nigeria’s import bill skyrocketed by 51.1% year-on-year to N8.15 trillion in Q3 2021, representing the highest on record.

In as much as import is increasing, it would have been ideal if the export value is also increasing in the same fashion, unfortunately, Nigeria’s export income is below commendable levels, as the country is still unable to meet oil production quota, which is the highest source of export earnings.

The implication of the continuous trade deficit is that it has also affected the country’s balance of payment account, hereby causing more pressure on the exchange rate. Notably, the official exchange rate at the Investors and Exporters (I&E) window depreciated by 6.03% to close the year at N435/$1 while a 22.8% depreciation was recorded at the parallel market to close at N565/$1.

Living on borrowed reserves

Nigeria’s foreign reserve gained $5.15 billion in 2021 to close at $40.52 billion as of 30th December 2021 compared to $35.37 billion recorded as of the end of the previous year. The boost can be attributed to the $4 billion Eurobond, which was secured by the federal government in September 2021.

Since, the reserve level surpassed $41.8 billion in October, it has continued downwards, thereby losing $1.3 billion in two months. The increase in the country’s reserve could also be attributed to the $3.35 billion IMF facility under the Special Drawing Rights (SDRs).

Despite Nigeria currently boasting of an external reserve in excess of $40 billion, the fact remains that it was funded by more borrowings, which at some point in the future would be paid back, and with interest.

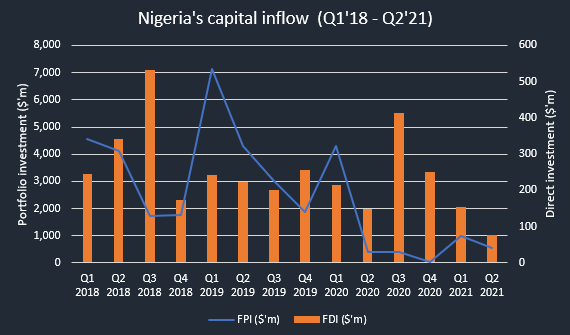

Declining foreign investment

Another source of forex inflow for Nigeria apart from the exportation of crude substance is attracting foreign investments, especially through FDIs (Foreign Direct Investment). Nigeria was faced with a huge capital inflow problem in 2021, attributed to the downturn in most areas of the economy.

According to data from the National Bureau, FDIs and FPIs (Foreignremained low in the first and second quarter of 2021, following abysmal numbers recorded in 2020 during the pandemic. Nigeria recorded foreign portfolio investments of $551 million and direct investments at $77.97 million, both significantly lower compared to pre-pandemic levels.

It is hoped that Nigeria will be able to attract significant inflows in form of investments in the new year following the kick-off of the Petroleum Industry Act (PIA), and recovery from the pandemic effect in 2020.

Stock market underperformance

The Nigerian stock market posted a 6.07% gain in the review year, failing to consolidate on the stellar performance printed in the previous year (50% gain). A 6.07% rate of returns in the stock market, is significantly below the country’s inflation rate, which is still comfortably in the double-digit region.

The stock market, which houses most of the major corporations in the country, recorded a performance of two halves during the year, with a bearish first half, which was later overturned in the second half.

It is worth noting, that the stock market is a good medium to attract foreign portfolio investors, which could, in turn, be of great advantage to the nation’s liquidity. Unfortunately, the local bourse was unable to capitalise on its previous year’s success.

Covid-19

A summary of the events that unfolded in 2021 will be incomplete without talking about the continuous spread of the covid-19 disease, which hit its fourth wave in December 2021. A total of 154,774 new cases of the disease were recorded in 2021, which is more than double the 87,567 cases recorded in the previous year.

Similarly, total number of deaths skyrocketed by over 100% to 3,031 compared to 1,289 cases recorded as of the end of 2020. The turn of events has moved the number of patients currently treating covid-19 in the country to a record 25,014 people.

Bottomline

The year 2021, was quite eventful with ups and downs, which we hope would be better in the new year. The monetary policy voted to hold rates throughout the year in a bid to ensure economic growth, the federal government also increased the budget earmarked for the year in a bid to spur growth.

The Central Bank incentivised the withdrawal of dollar from official channels, also it discontinued the sales of forex to BDC operators in the country. It will be interesting to see how some of these monetary and fiscal policies will reflect on the macro numbers in 2022.