Crypto transactions at Africa’s biggest crypto market are stalling on the P2P level. The reason for this is Nigeria’s apex bank’s fierce battle against Crypto transactions through its financial ecosystem.

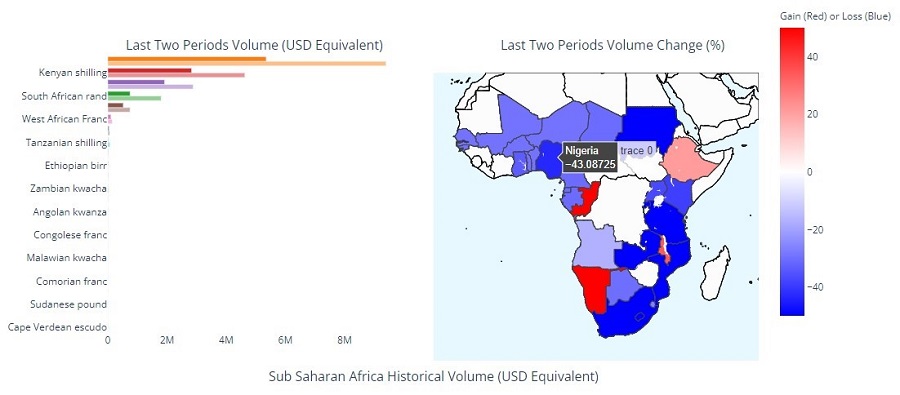

In the last week, Nigeria’s peer-to-peer transactions dropped by 43%. Nigerians posted weekly P2P volumes of about $9.4 million, followed by Kenyans and South Africans with nearly $2.8 million and $1.8 million respectively.

Peer to peer in BTC refers to an exchange of BTC between parties (such as individuals) without involving a central authority. Peer to peer exchange of Bitcoins between individuals and groups takes a decentralized approach but still, a growing number of Nigerians use their banks to settle in cash while carrying out their P2P trading.

P2P transactions are on the decline partly because the Central Bank of Nigeria recently ordered commercial banks to freeze the accounts of individuals trading crypto. The directive has once again reiterated its stance in a post-no-debit circular dated November 3rd 2021, issued by J.Y. Mamman, the Bank’s Director of Banking Supervision.

Banking regulators appear to be closing accounts of residents and companies that trade cryptocurrencies as part of a broader plan. Banks were previously forbidden by the central bank from servicing crypto exchanges earlier this year. Among the reasons given for the restriction were volatility, money laundering, and terrorism financing.

Banks enforce CBN clampdown on crypto transactions

According to a memo seen by Nairametrics, a tier-2 leading Nigerian bank has warned its employees not to assist cryptocurrency traders. Employees who wilfully conceal the existence of a crypto trading account will be punished, the bank said.

In the memo, the bank warned that all accounts found to be in violation of the CBN directive will be closed. To ensure full compliance with the CBN directive, all bank employees are now expected to monitor accounts, transactions, and customers.

Furthermore, the bank has created a list of 20 red flags that employees should watch out for so they can easily identify accounts that are used by cryptocurrency traders. Bank accounts receiving large numbers of daily inflows from numerous payees, and accounts that operate as bureaux de change without authorization by the CBN, are some of these red flags.

The bank would also red-flag accounts with large inflows and outflows over a period of time, as well as small companies with higher daily sales than what they should be.

Additionally, accounts that receive a large sum of money from multiple payees and make multiple payments to many individuals will also come under suspicion.

In my opinion, the reasons given by CBN for the crypto ban are flimsy, since it’s mostly the youths that trust and trade in crypto. The youths are probably the target of this ban, as a fallout from the endsars protest of 2020. Money laundering have long been associated with politicians, corrupt public officials and a few crooked business people and this group are not your typical crypto enthusiasts. With regard to terrorism, why haven’t the government gone after the alleged sponsors whose profiles had been allegedly released to the government if it’s so serious about fighting terrorism. The CBN should rather seek to ensure that people are only investing their own funds and not pooling funds or investments from the public. I believe that the crypto boom is just beginning especially with many global nvestment banks acknowledging it. But here, we have a government that is determined to cut off its nose just to spite its face .

Very well said brother, very well said.

This is exactly what was in my mind before reading this very very truth nothing but a truth comment of yours.Why are they still not reveal those behind this banditry ACT. Mr CBN Gov, should know taking such action is going to preach mind think of another negative activities. .This your comment is worth sharing.

Well said bro thanks a millions

Does anyone know what’s the definition of crypto in the Nigeria law. Thanks

This insult on we South Nigerian Youth Was Created Indirectly By Promoting BUHARI against Jonathan. BUHARI a open racist and jiahdist is what some Youths in the south who can not think like a Proper Human is what those Youths were clamoring for then even right th on Twitter the Terrorists Promoter President have now taken away from them!!!

But can this Fulani President win this war against we SW, SS and SE Youths because it is we Youths in those 3 regions that spearheaded “END-SARS” which the Northern Nigeria Rulers Hates Us For Sooooo So Much.

If this rubbish do not stop, this will totally end Nigeria turn by turn!!!

Good one

If the CBN like they should freeze all the youth bank account,we will find a way out of their nose and continue taking our future in our hands..

It is so glaring that those in this system are clueless as many of them are now suffering from old age but they refuse to admit that..

Can the CBN tell me what Important things the e-Naira project is meant for the youth?..

The brain behind that project shown that they don’t have the love of the citizens at heart but to enslave them with their subterfuge ideas..May God preserve us all to see the best the youth will come forth with sooner or later..By Gods grace we will never relent..

Yes bro

Don’t we know that there great positives significant effect of this crypto in our economy today? The youth unemployment search has reduce, the rate of crime has equally been minimized as a result of crypto. With what am feeling, is like we like seeing people’s tear and also regular protest against Government.

Why not look for means to check mate anomalies in this newly global economy that is providing daily manners to citizens alover the globe instead of putting a ban to it? It will be a minus to this administration if after banning this world growing digital currency and it been lifted by the next administration. CBN please think twice because Nigeria is in serious economic hardship, so banning this may cause more.

With a due respect CBN are not serious .

Crypto currency also known as digital currency is where money is heading to …instead to adjust and adopt and join the train u are doing otherwise.

You should be better informed bcos that is where we are heading to jet age.

You don’t have to be backwards Everytime.

Nonsense .I think CBN are jeleous of crypto investors. I Know there are true scammers in crypto but the way CBN is taking it , will affect innocent account holders.crypto

But first of all let CBN close all accounts that have billions of naira in there account. They are all criminals. No one should own billions in this economics hardship when some doesn’t have work or food to eat

The new naira speed wallet should also closed because it’s an attribute of crypto

Crypto is not Evil, every human being should have access to financial tools, like crypto that allow for greater economic independence.

Crypto as prove to be useful in all ramifications of live, for example a project call Story Token which is a platform that helps individuals in needs by just uploading a 60s video of what they need and the community fund it.

Furthermore, there are good crypto project out there that are in to help the people. Government should not fear for it but rather look for ways to benefit from.

Thanks.

God bless you.

Mtsw This Cbn governor doesn’t know what he is doing because there is alot of people that don’t even know what is crypto and they have millions in their accounts, some they perform transactions from various accounts in a day. Hmm I you don’t help the youths they will find the way out and If they find their way. Anything cnhpn

They want the youths to be slaves forever. God forbide

Nigeria has no law on cryptocurrencies and digital ‘assets’.

The CBN is just arrogating powers to itself, no thanks to our weak laws and institutions.