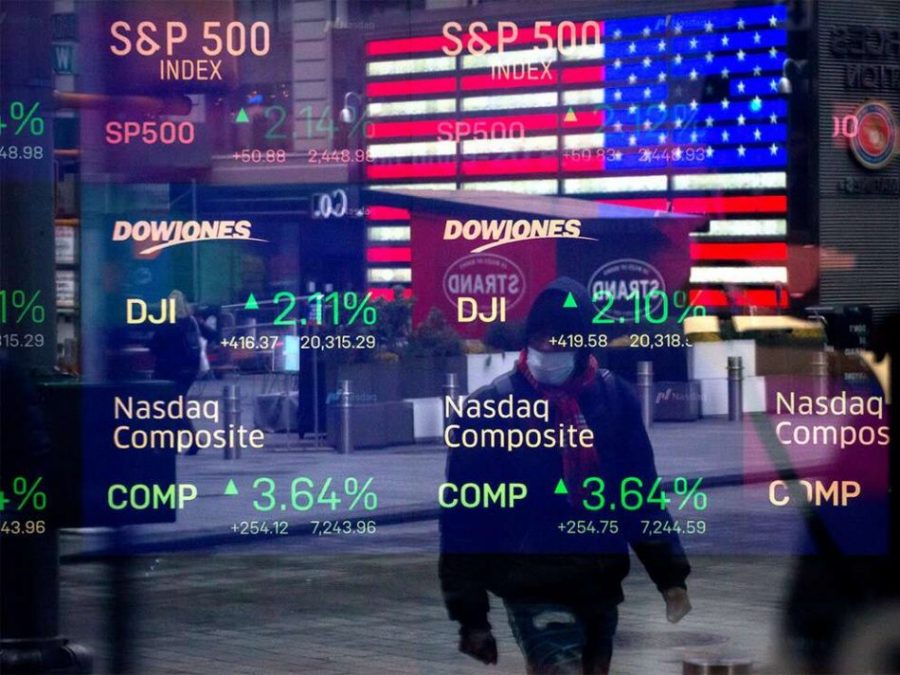

The Dow Jones Industrial Average dropped 282 points on Tuesday, while the S&P 500 also suffered significant losses. The Nasdaq was the worst performer on the downside, losing almost 130 points.

Disappointing economic statistics from China released on Monday heightened fears of a worldwide downturn. On Tuesday, blue-chip stocks fell for a second day, with the iShares Semiconductor ETF down 1.9% and Nvidia down almost 2.5%. Tesla and Boeing, both strongly reliant on China as a growing market, saw their stock prices fall.

Technology stocks, on the other hand, have been trending lower. Google parent Alphabet, Amazon, Apple, and Facebook all finished the day in the red.

Quick market analysis

The Nasdaq fell 0.9% at the closing, the S&P 500 index dropped 0.7%, snapping a five-day winning streak. The Dow Jones industrials ended the day with a 0.8% loss. The Russell 2000 index, which fell 1.2%, was the worst performer on the negative. On the Nasdaq and the NYSE, volume was more significant than at the closing on Monday.

Shares are also underachieving in the Dow encompassed Boeing (BA), Dow Inc. (DOW), and Caterpillar (CAT), down 3%, 1.6%, and 2%, respectively.

The continuing geopolitical turmoil in Afghanistan shook markets. In addition, the market was harmed by a lower-than-expected figure for July retail sales. According to the Census Bureau, retail sales decreased 1.1 % in June, owing primarily to a reduction in auto sales.

Meanwhile, after decreasing seven basis points on Friday and four basis points on Monday, the 10-year Treasury yield remained essentially steady at 1.25%.

Following reports that the National Highway Safety Administration had started a formal inquiry into Tesla’s Autopilot technology, Tesla shares dropped more than 4% on Monday. Since early 2018, the agency claims it has documented 11 incidents in which a Tesla car operating on Autopilot or Traffic-Aware Cruise Control collided with vehicles with flashing lights, flares, an illuminated arrow board, or cones warning of dangers.