This might be it!

Finally, a financial app that considers the lifestyle of regular people, the harsh economic situation in the country, and everyday financial challenges that influence how people borrow, save or invest.

Can we pique your interest?

Let’s start with savings. Some of us have been saving from when we were kids and it was cool to have a piggy bank. Beyond piggy banks and other traditional ways of saving like Esusu, it has become common to save with banks and almost everyone has a savings account. Some even have up to three. But what value do you get from those savings accounts or the Esusu contribution? How much interest do you earn from them in a month?. Probably nothing. In most cases, you even pay more on annoying charges. The good news is that savings has evolved. It’s no longer enough to just keep money anywhere and call it savings. Financial apps like Branch, PiggyVest and Kuda have shown that your savings can be an investment which allows you to earn actual interest, no matter how small. People hardly have enough money to meet their financial needs and this clearly influences the service features on the majority of these financial apps.

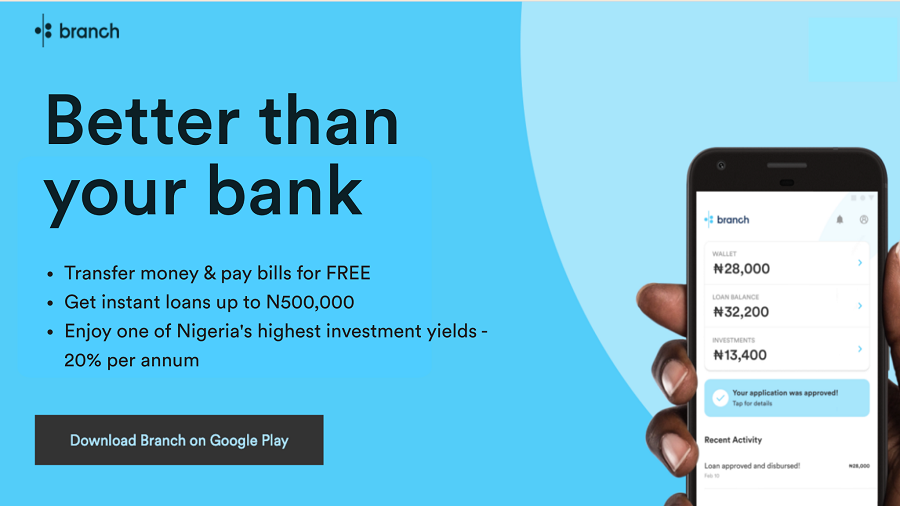

However, they all differ in the interest they offer on their platforms. If you’re familiar with all the top ones, a quick research will show you that while several savings and investment apps offer sumptuous interest rates with up to 15% per annum being the highest, Branch sets the pace with 20% interest rate per annum. Branch is also the only financial app so far that offers flexible withdrawals, which means your money doesn’t have to be locked for any minimum duration. Afterall, we save for rainy days, don’t we? So if the rainy day comes you should have access to your money.

All the things your bank won’t do.

Here are a few more things that sets Branch apart from both your regular banking and other financial apps.

At your beck and call, for a cost: Trust your bank to be on top of their game when they send you notifications but obviously at a cost. Branch has no such thing as SMS alert fees.

Pay, to pay bills: Every month, you pay all sorts of bills like DSTV and PHCN on your regular financial apps and banking apps. But of course, it always comes at a cost – N100 here, N50 there. Some banks even say this cost is negligible, but everyone knows if you stack up enough N100 notes, you’ll eventually have enough to do something that is not negligible. Again, with Branch, this service is free!

Transfer fees: How many transfers have you made in the last month alone? How many did you make last year? If you add up all the charges you pay for making transfers in a month, you can at least buy airtime or data with it. If you add up all the cost for a year, who knows what you can buy with it. The point is, in the end, all these costs and charges add up to something. So if you can make unlimited transfers for free, why would you rather pay for it?

Anybody home? – Customer service with most banks would leave a sour taste in your mouth. They will put you on hold. They will tell you the problem can’t be solved remotely and you should go to a branch near you. When you get to the bank branch, you’ll be in a queue, then you’ll fill forms. Finally, they’ll tell you to go wait at home and that it will be done in a few days. That doesn’t happen with Branch. Branch customer service team is available 24/7 and all problems are resolved in-app.

Bonus programs: Most financial apps have some form of bonus program but none of them is like Branch. Branch has a second-generation referral system that makes referrals a win-win for all parties. Whereas other financial apps pay one-time bonuses for referrals, Branch pays you N500 when friends you refer pay up their first loan. The friends you invited also earn N500. In addition, you earn N50 for every deposit of N300 and above. How cool is that?

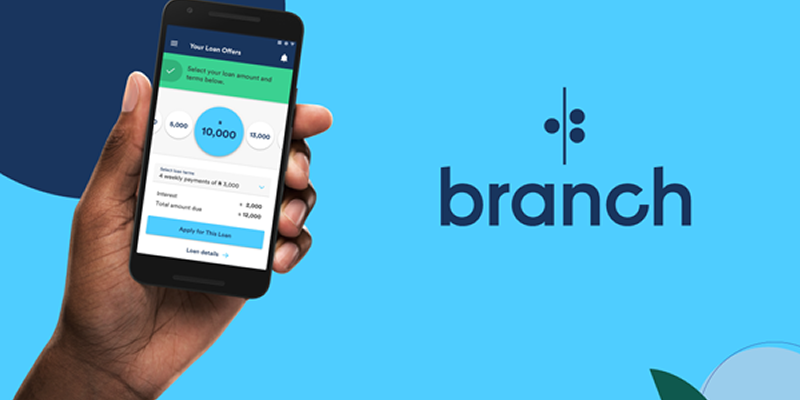

The money part: Branch gives you up to N500,000 in loans within seconds of applying on the app. No collateral or paperwork required. Start with small loan amounts and get higher amounts the more you repay.

Clearly, Branch offers you more flexibility and a lot more profit than other financial apps. So if you’ve been suffering from poor financial services, it’s time to make a switch and Branch in. Branch can be downloaded on the Google Play Store

They are not ready for iPhone users