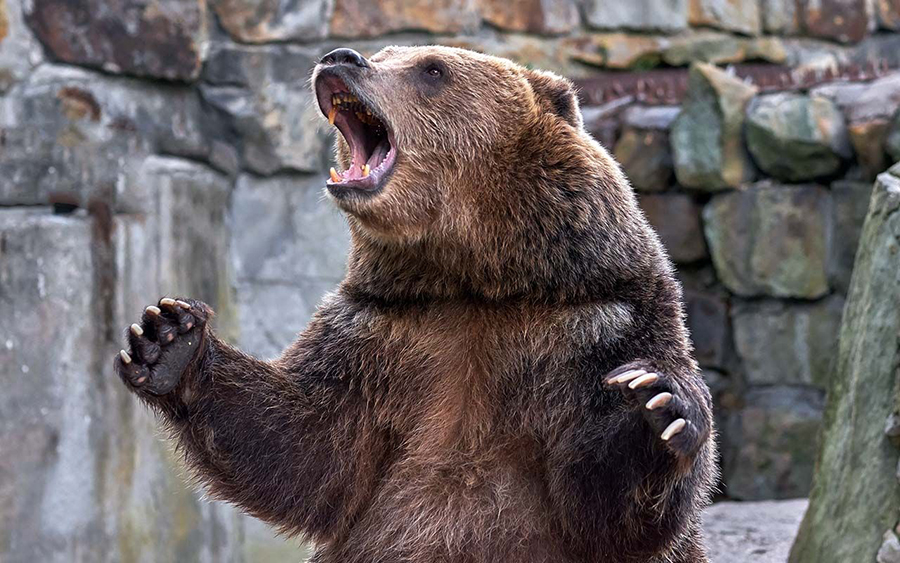

The Nigerian Stock Exchange (NSE) market ended Tuesday’s trading session on a bearish note and posted a loss. The All-Share Index decreased by -0.57% to close at 39,267.11 index points as against the +0.71% profit recorded on Monday.

The NSE market value currently stands at N20.55 trillion. Its Year-to-Date (YTD) returns currently stand at -2.49%.

The market breadth closed slightly negative as LIVESTOCK led 22 Gainers, and REGALINS topped 13 Losers, showing bearish momentum.

Top gainers

- LIVESTOCK up 9.66% to close at N1.93

- CORNERST up 9.09% to close at N0.60

- COURTVILLE up 9.09% to close at N0.24

- NPFMCRFBK up 8.33% to close at N1.95

- ROYALEX up 7.69% to close at N0.28

Top losers

- REGALINS down 9.09% to close at N0.30

- PRESTIGE down 8.89% to close at N0.41

- DAARCOMM down 8.00% to close at N0.23

- ETI down 4.72% to close at N5.05

- SOVRENINS down 4.17% to close at N0.23

Outlook

Nigerian Stocks started the second trading session of the week on a bearish note. Trading turnover on Tuesday’s trading session was boosted by UBN, GUARANTY, and COURTVILLE.

Nairametrics, however, advises cautious buying in this era of growing uncertainties.