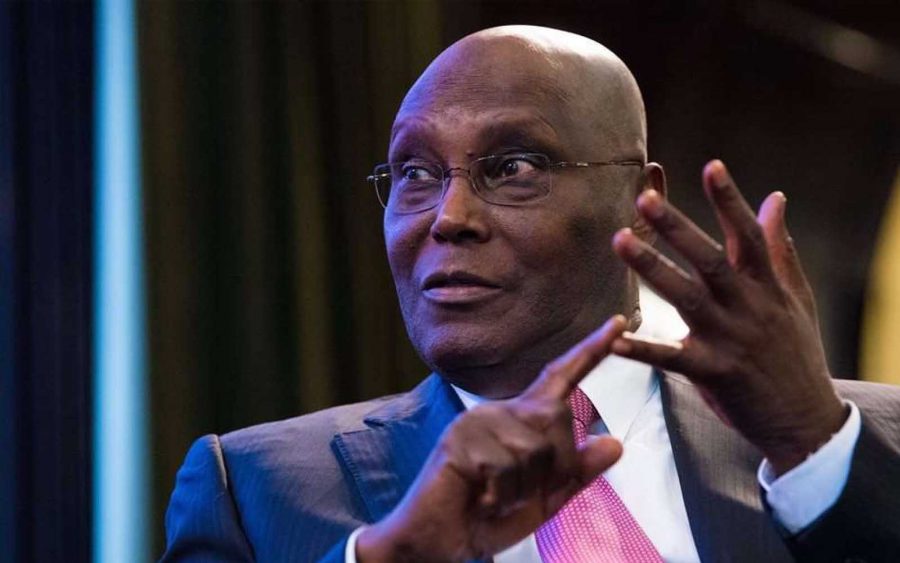

Former Vice President, Atiku Abubakar has warned that the rising insecurity in Nigeria is a result of rising youth unemployment. He urged Nigeria to tackle out-of-school children cases, pay a monthly stipend to poorer families, incorporate youths who are above school age into a massive public works programmes and others.

Atiku disclosed this in a social media statement on Sunday titled “World’s Highest Unemployment Rate: Time To Help This Government Help Nigeria.”

Atiku revealed that the recent Bloomberg report which projected Nigeria to have the highest unemployment rate on Earth is a cause of concern, citing that stakeholders warned that abandoning the people-centred leadership and free trade and deregulatory policies of the Obasanjo years would trigger unemployment.

“What this government must realise is that the unprecedented insecurity Nigeria is facing is the result of youth unemployment,” he said.

READ: Insecurity: Nigeria needs to increase military spending – Senator Ali Ndume

What Atiku advised:

- Idleness is the worst feature of unemployment because it channels the energy of our youth away from production, and towards destruction, and that is why Nigeria is now the third most terrorised nation on Earth.

- Drastically bring down youth unemployment, every family in Nigeria with at least one school-age child, and earning less than $800 per annum should receive a monthly stipend of 5000 Naira via their BVN and NIN on the condition that they verifiably keep their children in school.

- If we can get the 13.5 million out of school Nigerian children into school, we will turn the corner in one generation. If we do not do this, then the floodgates of unemployment will be further opened next year.

Atiku also urged that Nigeria is better off privatising its refineries and the NNPC through the LNG model in which the FG owns 49% equity and the private sector 51%.

“This will not only free the government of needless spendings but also clean up the infrastructure mess in the petroleum downstream sector,” he said.

READ: #EndSARS: I strongly condemn any disproportionate use of force on protesters – Atiku

He urged that the fastest way to bring down a world record unemployment rate is via incentivised education, citing that increased education has been scientifically linked with lower rates of crime and insecurity, along with lower infant and maternal mortality, and a higher lifetime income.

“In a situation where we are simultaneously the world headquarters for extreme poverty, the world capital for out-of-school children, and the nation with the highest unemployment rate on Earth, there is a very real and present danger that we might slip into the failed states index,” he warned.

What you should know

Nigeria’s unemployment rate as of the end of 2020 rose to 33.3% from 27.1% recorded as of Q2 2020, indicating that about 23,187,389 (23.2 million) Nigerians remain unemployed.

- A total of 30.57 million individuals were fully employed as at Q4 2020, i.e., work 40 hours and above weekly, while 15.9 million of Nigeria’s population work between 20 and 39 hours.

- Also, 11.03 million individuals work between 1 and 19 hours (unemployed) while 12.16 million were without work in the period under review.