Few hours after the listing of its Series 1 bond worth N41.2 billion on the FMDQ Exchange, Fidelity Bank Plc has printed its highest gain for the week, just as its market capitalization gained about N1.74 billion in a single trading session on Friday.

This is according to data from the Nigerian Stock Exchange (NSE), seen by Nairametrics.

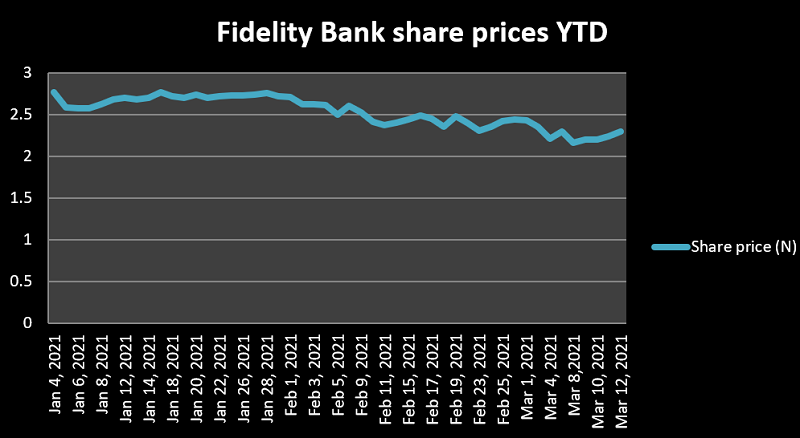

The gain came on the back of increase recorded in the share price of the second-tier bank from N2.24 to N2.30 as at close of business on Friday, representing an increase of 2.68% within the aforementioned period. The share price is the highest posted by the bank for the week ended 12th of March, 2021.

Recall that Nairametrics had earlier reported the successful listing of Fidelity Bank Plc Series 1 Fixed Rate Subordinated Unsecured Bond worth N41.21 billion. In lieu of this, investors cashed in on the news to trade 4.73 million units of the bank’s shares as against 3.12 million units traded a day earlier, representing an increase of about 51.6%.

The surge might be an indication of strong investors’ confidence in the outlook and potentials of the Bank, especially as it coincides with the listing of the bank’s bond- a reflection of the Bank’s ability to generate enough capital that will be used to fund key projects.

The summary of the movement in the share prices of Fidelity Bank is depicted by the diagram below;

Fidelity Bank share prices since 4th of January, 2021

Fidelity Bank share prices since 4th of January, 2021

What you should know:

- Fidelity Bank had earlier released its FY 2020 results which showed a Profit before tax of N30.21 billion.

- It is also pertinent to note that the bank has recorded a year-to-date decline of 8.73% from N