The Nigerian Stock Exchange (NSE) has grown to become one of the largest stock exchanges in Africa, with about 168 listed companies and a market capitalization in excess of N20 trillion in recent times.

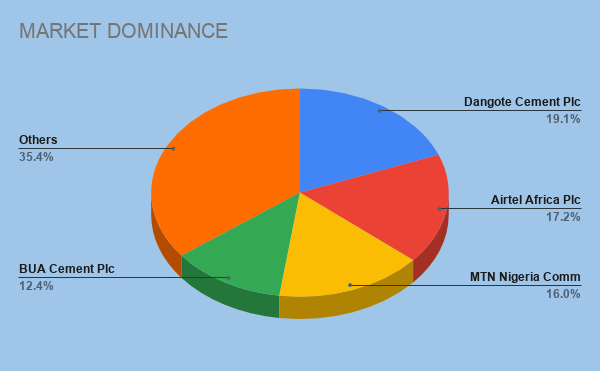

Despite being home to 168 listed companies, the total equity capitalization “market capitalization” of the NSE is dominated by four giants companies – Dangote Cement, Airtel, MTN Nigeria, and BUA Cement – which jointly accounts for about two-thirds of the total market value of the Nigerian bourse.

Data tracked on the NSE website revealed that these big four companies, as of the close of trading activities on NSE yesterday, 10th March 2020, have a combined market capitalization of about N13.17 trillion, which represents 64.7% of the total equity capitalization of the NSE.

READ: Four FMCG companies lost 15.2 billion in value in a single day

This indicates that the “fantastic four” companies are huge to the point of impacting the performance of NSE at any point in time, noting that a 10% change in the share price of any one of these companies will see NSE’s All-share-index increase/decrease by 1.25% or more (all else being the same).

In the same vein, the absence of Dangote Cement, Airtel, MTN Nigeria, and BUA Cement on NSE, noting that they jointly account for 64.7% of the total equity value, would see the market capitalization of the local bourse drop down to a meagre N7.2 trillion.

Hence, it is fair and logical to assert that the growth recorded in 2020 – the year NSE stormed the world to post a one year return of +50.3% as the best performing exchange in the world – was largely driven by the growth in the share price of these companies.

READ: Sell-off of shares by investors extend Flourmillers loss on NSE to N25 billion

Source: NSE, Nairalytics (As of 9th March 2021)

Dangote Cement Plc (DANGCEM)

Dangote Cement Plc is the largest listed company on NSE with a market capitalization of nearly N3.89 trillion, representing a total 19.07% contribution to the market capitalization of NSE.

The market capitalization of the leading cement manufacturer has increased from around N2 trillion in April 2020 to N3.89 trillion in recent time, adding approximately N1.89 trillion to the total equity capitalization of the local bourse in less than a year.

The cement giant’s revenue in the first nine months of 2020 rose 12% Y-o-Y to N761.4 billion, despite a challenging operating environment in the year 2020.

READ: Why Nigerian stocks are getting pummeled

The Group volumes for the nine months were up 6.6% and Group EBITDA (Earnings Before Interest Depreciation and amortization) was up 17.1%, at a 46.6% margin, at the back of a strong appetite for real estate investment and the recovery of infrastructure spending.

Dangote Cement maintains the status of the leading cement producer in Africa, with a pan-African installed capacity of 48.6 million MTA across Africa, the company has a national installed capacity of 32.5 million MTA in Nigeria.

The company maintains operational footprint in Cameroon (1.5Mta clinker grinding), Congo (1.5Mta), Ghana (1.5Mta import), Ethiopia (2.5Mta), Senegal (1.5Mta), Sierra Leone (0.5Mta import), South Africa (2.8Mta), Tanzania (3.0Mta), Zambia (1.5Mta).

READ: Best performing Nigerian stocks in 66 days

Airtel Africa Plc (AIRTELAFRI)

Airtel Africa is the largest telecommunications company on NSE, and the second most capitalized company on NSE with a market capitalization of N3.50 trillion, representing a total 17.16% contribution to the market capitalization of NSE.

The leading provider of telecommunications who recently gapped MTN to become the largest tech company listed on the exchange has seen it’s market capitalization surge by N300 billion this year alone.

The tech giant’s revenue at the end of Q3’21 grew by 13.8% Y-o-Y to $2.87 billion, driven by the growth across Airtel’s operating regions during the period, with revenue in Nigeria, East Africa, and Francophone Africa up by 21.6%, 23.4%, and 8.0% respectively.

However, an 11.3% increase in depreciation and amortization expenses coupled with a 41.4% increase in net finance costs pressured the group’s profit after tax down to $261 million, 21.1% lower than 2019 figures. ($331 million).

During this period, Airtel’s Customer base across all regions was up by 11.0% to 118.9 million, as it gained an additional 2.5 million customers in Q3’21.

MTN Nigeria Communications Plc (MTNN)

MTN Nigeria is Nigeria’s largest provider of communications services, connecting over 75 million people in various communities across the country, and maintaining leadership status since its launch in 2001.

The company’s market capitalization at the close of the market on the 9th of March 2021, stood at N3.26trillion, making it the third-largest company on NSE, with a total market capitalization contribution of 15.99%.

MTN service revenue at the end of 2020 surged by 14.7% to N1.3 trillion, making the telecommunication giant the first company to generate more than a trillion-naira revenue in an accounting period.

Its impressive performance for the year was driven by the growth in voice and data revenue, spiked by the increase in the demand for mobile connectivity, with its 4G internet coverage during the year increasing to 60.1% of the population from 43.8% in 2019.

During this period MTN’s mobile subscribers and active data users increased by 12.2 million and 7.4 million to 76.5 million and 32.6 million respectively.

BUA Cement Plc (BUACEMENT)

BUA Cement Plc, a cement manufacturing company incorporated on May 30th, 2014 remains one of the fastest-growing companies in the country today.

BUA is the fourth-largest listed company on NSE with a market capitalization in excess of N2.53 trillion, representing a total 12.43% contribution to the market capitalization of NSE.

The cement tiger who is Nigeria’s second-largest cement company announced revenues of N209 billion in its unaudited 2020 Full Year results, this represents an increase of 19% from the corresponding period in 2019.

The company’s impressive performance in 2020 was driven by the resurgence of real estate investment and the recovery of infrastructure spending, this led to a 13% increase in sales volumes, up by about 600,000 tons to 5,100,232 tons in 2020.

In the same period, operating profits increased to N82.5billion whilst PAT rose to N70.5billion from N60.6billion in the corresponding year.

According to the information contained in BUA’s recent earnings statement, the company is expected to consolidate on its position as one of Nigeria’s most profitable companies, with the commissioning of new 3 million Metric Tonnes Sokoto Cement Plant this year.

This move, and the addition of 3 new lines of 9 million metric tonnes total capacity in Adamawa, Edo, and Sokoto States by 2023, are expected to expand BUA Cement’s total installed capacity to 20million metric tonnes per annum by 2023.

Keep me updated

Am interested

my name is muhammed adamu ali from gombe state gombe L.GA Dear sir , ineed help from my business farming is we have a two plans fist we have a fish farming an fish goods

A GOOD PROGRAM BUT POORLY IMPLEMENTED.

Most people who registered under the CBN-NIRSAL AGSMEIS Loan scheme and were trained by CBN accredited institutes who submitted their business plans since last year are yet to hear from NIRSAL. This is one program that would have turned the economic fortune of Nigeria around. So let CBN arise to their responsibility thank you

Am really interested and be part of the beneficiary

I wish to Apply for payment of Nirsal micro finance loan