The Nigerian Electricity Regulatory Commission (NERC) has commenced the process of reviewing the Meter Asset Provider Regulations 2018 to end the seemingly perennial challenges with estimated billing in Nigeria.

This was disclosed by NERC via it’s Twitter handle on Wednesday.

It tweeted, “@nercng is in the process of reviewing the Meter Asset Provider Regulations 2018. The link below is for the consultation for comments from stakeholders and members of the public.”

READ: Electricity: FG approves one year waiver of import levy on meters

@nercng is in the process of reviewing the Meter Asset Provider Regulations 2018. The link below is for the consultation for comments from stakeholders and members of the public. @MobilePunch @THISDAYLIVE @daily_trust @ProfOsinbajo @GuardianNigeria https://t.co/uHTeUa4dvS

— NERC Nigeria (@NERCNG) February 24, 2021

READ: NERC says electricity consumers will be refunded for meter payment

What you should know

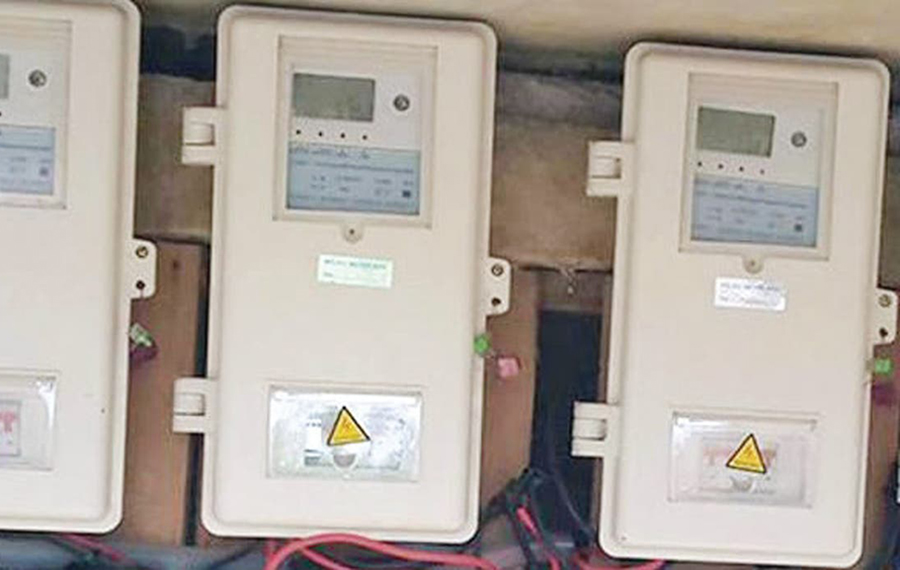

- In December 2017, in its bid to end the seemingly perennial challenges with estimated billing in Nigeria, NERC released the Draft Meter Asset Provider Regulations 2017 (“Draft Regulations”).

- Thereafter, following extensive consideration of comments from and reactions to the Draft Regulations, as received from relevant stakeholders, the Board of NERC eventually approved the updated Draft Regulations.

- Consequently, on March 8, 2018, the Meter Asset Provider Regulations 2018 (“MAP Regulations”) was finally issued under the common seal of NERC and became effective as the governing framework for the metering of electricity consumption in the NESI.

THE METER FOR INSTALLATION FOR THE CUSTOMERS SHOULD NOT COME PRE LOADED.

THESE METERS SHOULD BE PRISTINE.

DO NOT RIPE YOUR CUSTOMERS APART TRYING TO RECOVER YOUR LOSSES.

Chika you are very correct. I support your view. May NERC listing to the cry of electricity Consumers and make all Disco do the right think.

Map should be independent. Answerable to Nerc not to DISCO

MAP should be 100 percent independent and NERC should be in charge to avoid undue influence of Disco. Disco like estimation and lack capacity to provide essential device like transformer not to talk of meter.let people free from Disco

Nerc should understand that discos don’t want people metered.even if free meter map should be there for express metering for those who can afford it. Nerc always have good ideas but don’t monitor the process. NERC have never recorded any achievement since their inception. Unlike NCC That at is doing well.Line was sold at #35,000 in those days.NERC bark without biting