AFEX Commodities Exchange Limited (AFEX), a private commodities exchange company, has announced the first Warehouse Receipt Backed Commercial Paper in Africa. The paper has tech-enabled operations and a 24-hour fast cash turnaround for borrowers.

This was disclosed by AFEX in a statement issued and seen by Nairametrics on Thursday.

The $50 million Agri-SMEs fund is expected to bridge the funding gap between lenders and borrowers in the Nigerian agricultural sector with a commodity-backed instrument – for the first time.

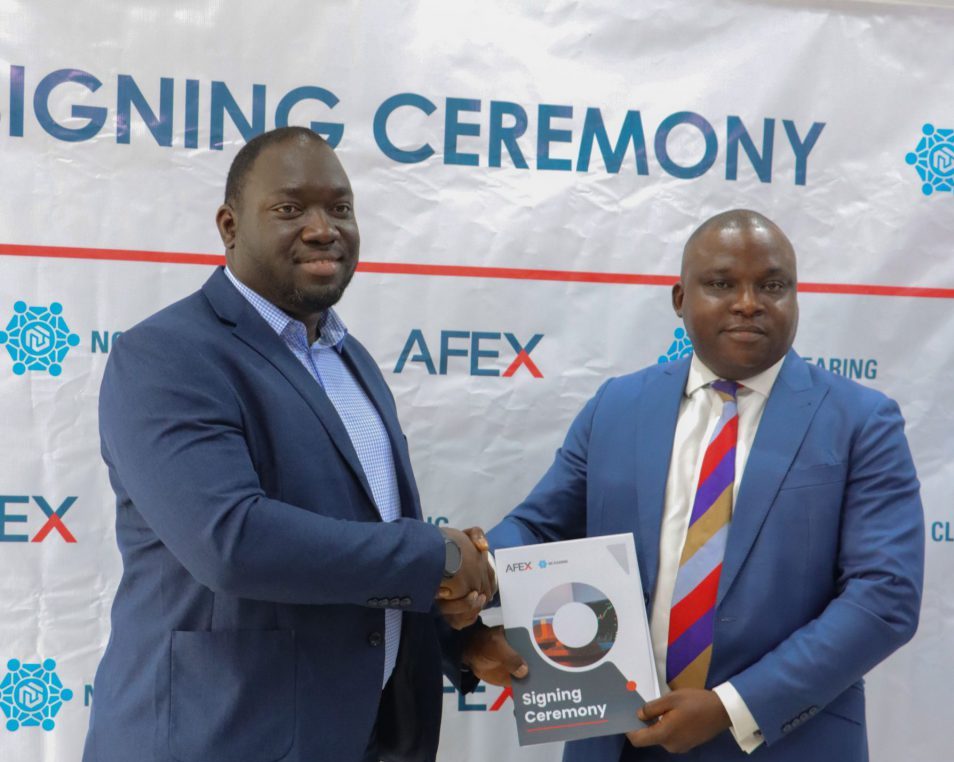

READ: AFEX partners FMDQ, Dubai Commodities Exchange to deepen markets opportunities

Ayodeji Balogun, CEO, AFEX, stated, “The AFEX financing deal will help eradicate the high cost of procurement incurred by processors by deploying a discounted value of a warehouse receipt distributed among five leading players in the Food and Beverage, Trading Poultry and Animal Feed segments in Nigeria.

“The receiving companies are top 10 players in their respective segments. They have now been enabled access to a tool for managing price volatility, enabling up to 30% direct savings on prices.

“With our vision to reach a cumulative total of over $5 Billion in investment to the agriculture sector over the next five years, this financing deal is right on track to achieve this goal.’’

He added that as AFEX move towards building a derivatives market in Africa, “we want to be able to reduce exposure to price risk for stakeholders, by enabling them to hedge their positions and trade in commodity derivatives.”

READ: CBN to increase loans to agricultural sector to 10% of total bank credit

Why it matters

- The warehouse receipts, which can then be transferred from commodities to a financial asset and listed under the borrower’s portfolio on the AFEX trading platform, will create a sustainable funding structure and address underfunding in the Nigerian agricultural sector.

- With the warehouse receipt system linked to financiers, the system allows financiers value and marks the commodities’ price to market on a real-time basis.

What you should know

- AFEX’s mission is to provide low-risk working capital facility for stakeholders in the Agro sector, in a way that is transparent and has a very high viable investment return.

- As a licensed commodities exchange and warehouse receipt system operator, it deploys a warehouse receipt system and collateral management infrastructure to increase market confidence for both lenders and borrower.