Nigeria’s unattractive mortgage system has been a key theme in its residential market for decades. With a housing deficit running into tens of millions, homeownership rate at 25% and a mortgage financing requirement conservatively estimated between 15-20 trillion naira, there is a great deal of work to be done.

Housing is typically capital intensive in Nigeria due to the high cost of construction, surging land prices and excessive financing costs. The high capital requirement of housing has made long-term financing critical in driving affordability; particularly for lower and middle-income groups.

Interest rates for mortgage products from commercial institutions are typically between 15%-25% per annum for a tenor up to 20 years. A model mortgage transaction would assume an interest rate of 20% on a ₦50million mortgage over 15 years. Using the loan amortization calculator by Aso Savings, the borrower would have made total payments amounting to 3x the principal at ₦158,066,685.

Paying 3x the principal on a mortgage transaction appears like daylight robbery. However, it is critical to note that the time value of money would play a major role as we expect ₦158 million today to have lost a significant percentage of its value over 15 years. Nevertheless, I reckon the question on your mind would be…

READ: National Housing Fund: FG inaugurates scheme’s first estate in Lagos

Why is mortgage in Nigeria this expensive?

The simple answer is interest rates are outrageous and here’s why;

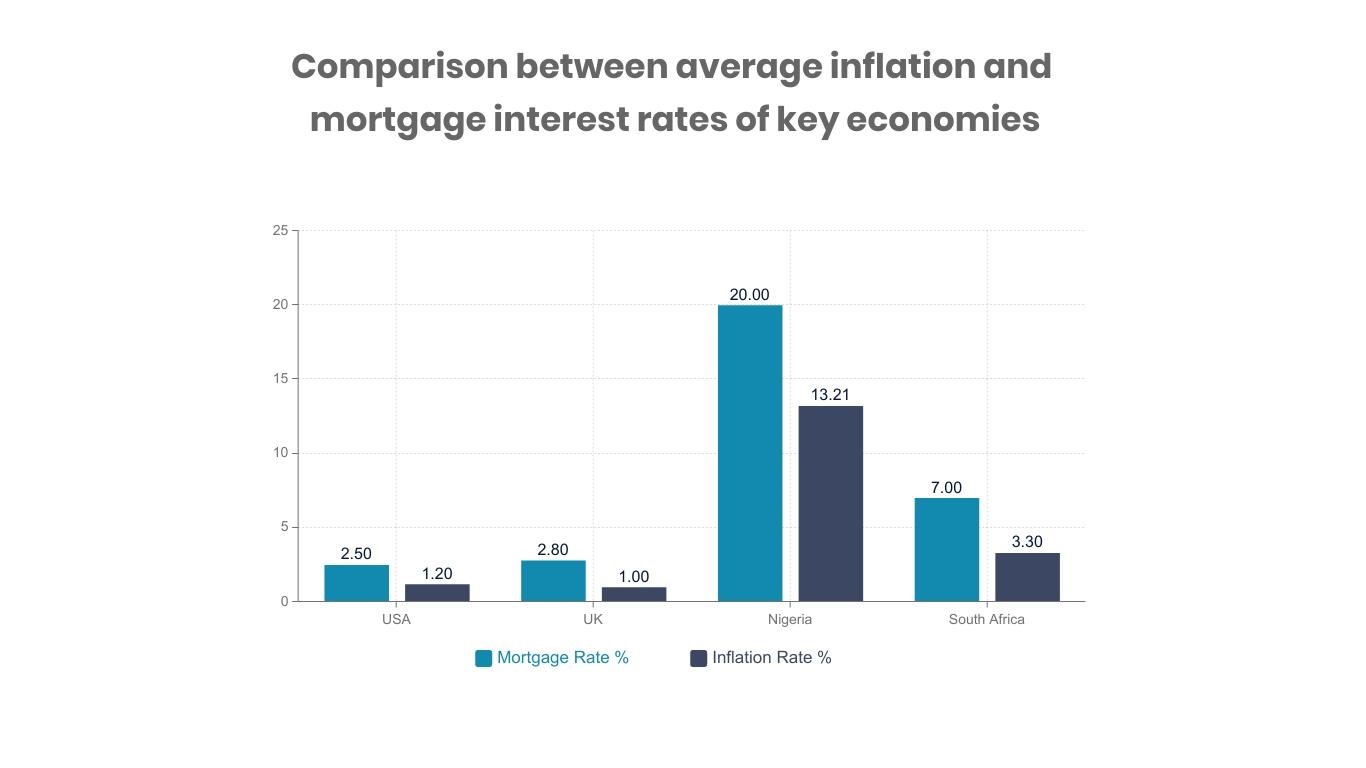

There is a direct relationship between inflation and interest rates on mortgages. When inflation rates are high, the naira loses its purchasing power and mortgage lenders tend to increase interest rates above inflation to compensate for loss in purchasing power. Observe how Nigeria’s mortgage sits in comparison with other key economies:

Nigeria’s average mortgage rate is close to 9x that of the United Kingdom (UK) and United States of America (USA). The high mortgage rates in Nigeria discourages prospective borrowers since they have to pay so much to repay their interest and principal. Therefore, potential homeowners rather opt for personal savings, subsidized public sector housing and other sources of funding.

READ: Federal Mortgage Bank disburses additional 8,700 homes, N112 billion in three years

What is being done in making Nigeria’s mortgage market work efficiently?

Private Sector Led:

Some mortgage banks including Cooperative Mortgage Bank have gotten creative in reducing their interest rates by taking the burden of building residential properties and placing those properties on mortgages at single-digit interest rates of about 9% per annum. Mortgage banks have also executed partnerships with cooperatives to design a system where their members can make convenient monthly contributions to the mortgage bank to qualify them for affordable and quality homes over time.

The Future Africa-backed startup; Bongalow serves as a mortgage marketplace for well-curated properties, connecting banks and property developers with people that require financing to purchase homes. You can start a mortgage application on Bongalow by providing information on your income, desired property, credit profile among others. Bongalow then recommends the best mortgage rates and solutions based on the criteria of its lending partners.

READ: Thinking Of Getting A Mortgage In Nigeria? 10 Important Things You Must Know

Public Sector Led:

The government-owned institution; Federal Mortgage Bank of Nigeria (FMBN) lends mortgage at 6% to National Housing Fund (NHF) contributors over a maximum tenor of 30 years. While mortgages from the government may appear more affordable, NHF contributors can only access up to ₦15million from the fund through an accredited and licensed Primary Mortgage Bank.

The government is also encouraging financial institutions to participate in mortgages through the World Bank-backed institution; Nigerian Mortgage Refinance Company (NMRC). The NMRC issues long-term bonds in the capital market to provide refinancing facilities to eligible loan portfolios of financial institutions extending mortgages. This is done to increase the maturity structure of mortgage loans & reduce mortgage rates.

READ: NMRC signs N3bn mortgage agreement with Kaduna govt

What then?

Real Estate as an asset class would need more reforms to drive mortgage participation. Aside from the issues in titling and discouraging bureaucracies in land documentation, the non-existence of an effective foreclosure law serves as a major disincentive to mortgage financiers.

A foreclosure law basically helps the lender repossess and sell the property in the case of default by the borrower. The National Assembly has not been keen on expediting the foreclosure law and only a few states have passed the law. Without the foreclosure law, cases of repossession of properties after default by borrowers spend a long period of time in court.

Fundamentals of Nigeria’s macroeconomy may be harsh on its mortgage market, however, there are a few positives. It has taken too long for inflation and mortgage rates to function effectively and I believe the public and private sector would need to intervene through the introduction of more specific policies and creative financing facilities to drive affordability.