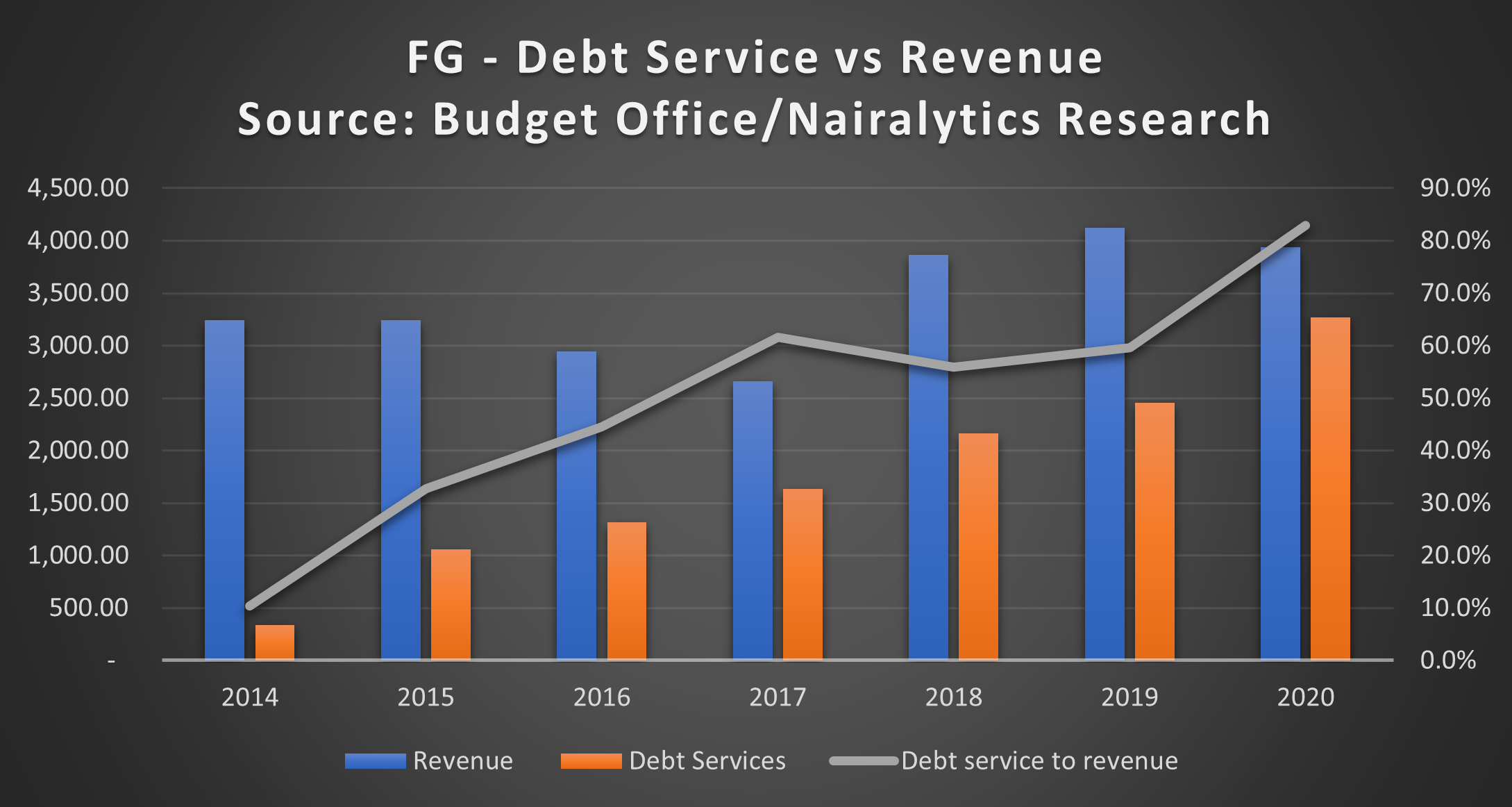

The Federal Government of Nigeria achieved a debt service to revenue ratio of 83% in 2020. This is according to the information contained in the budget implementation report of the government for the year ended December 2020.

According to the data seen by Nairametrics, total revenue earned in 2020 was N3.93 trillion representing a 27% drop from the target revenues of N5.365 trillion. However, debt service for the year was a sum of N3.26 trillion or 82.9% of revenue.

READ: FG posts 27% revenue shortfall in 2020 as budget deficit hit N6.1 trillion

Nigeria’s debt service cost of N3.26 trillion has now dwarfed the N1.7 trillion spent on capital expenditure of N1.7 trillion incurred in 2020. This is also the highest debt service paid by the Federal Government since we started tracking this data in 2009.

The total public debt (External and Domestic) balance carried by Nigeria as of September 2020 stood at N32.22 trillion ($84.57 billion). Included in the total debt is a domestic debt of about N15.8 trillion.

READ: Nigeria’s high recurrent costs, low revenue and escalating debt numbers

READ: Customs revenue rises by N200 billion to hit N1.5 trillion in 2020

What this means: Nigeria’s debt to GDP ratio is estimated at about 22%, one of the lowest in the world and much below what is obtainable in most emerging markets.

- However, the challenge has always been the debt service to revenue ratio, a metric that reveals whether the government is generating enough revenues to pay down its debts as they mature.

- Since the first recession experienced in 2016, Nigeria has struggled with a higher debt service to revenue ratio as revenues slid in direct correlation with the fall in oil prices.

- Nigeria’s government spent about N2.45 trillion in debt service in 2019 out of total revenue of N4.1 trillion or 59.6% debt service to revenue ratio.

- At 83%, 2020 ranks as the highest debt service to revenue ratio we have incurred. Before now it was 2017 with 61.6%.

READ: PayVIS: New Lagos State platform to use traffic cameras to fine traffic offenders

Breakdown of what debts were serviced

The following amount was spent on debt service during the year

- To service domestic debt, the government spent N1.755 trillion in 2020 as against a budget of N1.87 trillion.

- For foreign debts, a sum of N553 billion was spent against a target budget of N805.47 billion. The drop here is likely a result of lower interest rates on foreign borrowing as well as very limited borrowing from the foreign debt market during the year.

- The government only contributed N4.58 billion into its sinking fund instead of the budgeted N272.9 billion.

- The sinking fund is required to set aside funds that will be used to pay down on other loans such as bonds when they mature in the future.

- Finally, a sum of N912.57 trillion was spent on servicing CBN’s loans, granted via its Ways and Means provisions.

- Nairametrics reported last week that a total sum of N2.8 trillion was extended by the CBN to the FG as Ways and Means.

READ: World Bank hopes to cut down debts of poor countries rather than delay payments

What happens next: In 2021, the government projects a debt service of N3.1 trillion against revenue of N6.6 trillion or debt service to revenue ratio of 46.9%.

- The government plans to spend N4.3 trillion on capital expenditure during the year.