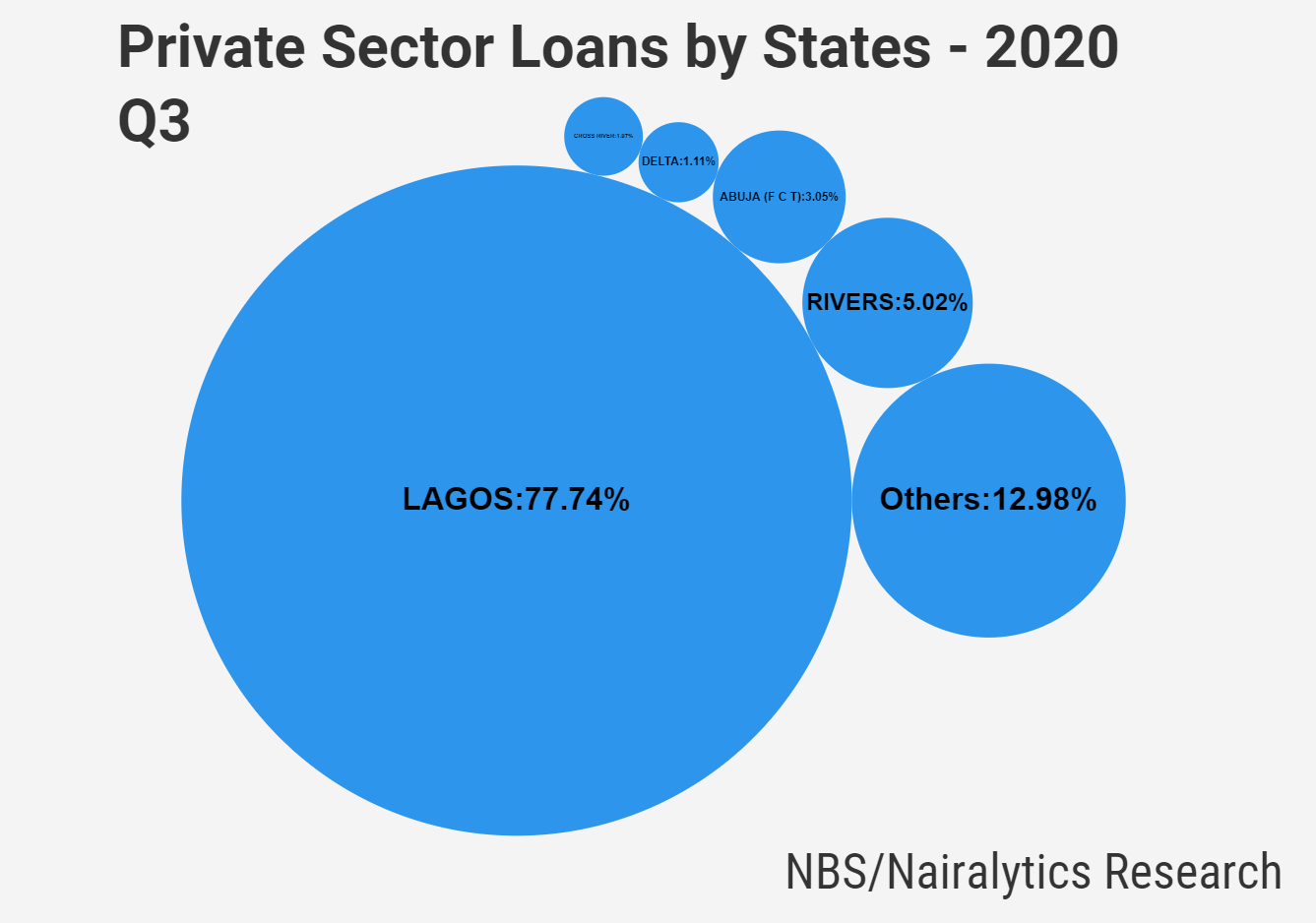

The latest data from the National Bureau of Statistics reveals Lagos state borrowers obtained 77.7% of all banking sector loans by value given to states across the country.

Lagos State is the commercial capital in the country and has dominated economic activities in the country since independence.

READ: VAT collection surges on increased VAT rate

According to the data about N15.1 trillion out of N19.4 trillion of the loans went to Lagos State in the third quarter of 2020 a 13.86% rise from the same period in 2019. Total loans given to beneficiaries in Lagos State was N13.9 trillion at the end of 2019.

READ: Effects of the recession on families and how to cope

READ: FCMB Group posts N48.3 billion revenue in Q3 2020

What the data says

About 32 states in the country got less than 1% of the loans and a combined 12.01% of the loans buttressing just how concentrated Lagos is when it comes to banking.

- Among the states with the least loans were Yobe, Jigawa, and Ebonyi States with 0.1%, 0.13%, and 0.13% respectively.

- Combined, businesses in 32 states borrowed N2.3 trillion compared to Lagos State alone with N13.9 trillion.

- River State was next to Lagos with just 5% of the loan or N977 billion.

READ: Dapo Abiodun presents N339 billion budget to Ogun State Assembly

What this means: Lagos State remains the economic powerhouse of the country driving much of economic activities in the country. Apart from being the location for most head offices in the country it also maintains the most workforce employing about 11% of the total of 35.5 million employed people in the country.

- The central bank has made credit to the private sector the center point of its monetary policy. It has also focussed on its developmental responsibilities, particularly as it relates to Agriculture.

- However, most of the states where farming is practiced received the least loans suggesting Nigerian banks are wary about lending outside of the commercial capital of Lagos.

- For most small businesses outside of Lagos or the bigger cities in the country, the chances of obtaining a loan are slim and nearly non-existent.

READ: #EndSARS: Access Bank announces N50 billion interest-free facility for businesses

READ: Application and payment for C of O, building plans to be done online from Q1 2021

Please stop misleading us with your headlines, Loans were given to businesses domiciled in Lagos

It is so because even if you fulfil all documentation, the bank keeps delaying till you are fed up and decide not to collect. The interest rate is also a factor where most banks issue rates & compounding. I wanted to know more about the agric loan issued banks via the CBN, my bank refused information and the public aren’t aware of all these…..

A lot needs to be done by the commercial banks in terms of advocacy and information dissemination. That way people will be aware.

can we have the deposits from the states as well please.