The Founder and Chief Executive officer of the popularly traded business intelligence firm, Michael Saylor, recently disclosed billionaires, who could turn the price of Bitcoin up at least three folds. His bias was based on the aurora these billionaires bring notably in the global financial world.

In his most recent Youtube interview, he started his narrative by explaining deeply the effect such billionaires would have on the flagship crypto market,

READ: Germany’s biggest bank says more people now prefer Bitcoin over gold

“It’s important that 100 million people embrace Bitcoin but there are 10 people that can triple the price of Bitcoin. This is not like Facebook, nobody ever brought a billion friends to Facebook. This is like when a person with $10 billion decides that they want to adopt this network and they put $2 or $3 billion on the network, that’s going to be more monetary energy that flowed into the network than the first 10 million people put into the network. It’s ten million to one gain.”

He went on by revealing the names of such billionaires, amid their stronghold seen on global finance.

READ: Most profitable asset in a decade, Bitcoin up over 26,600,000%

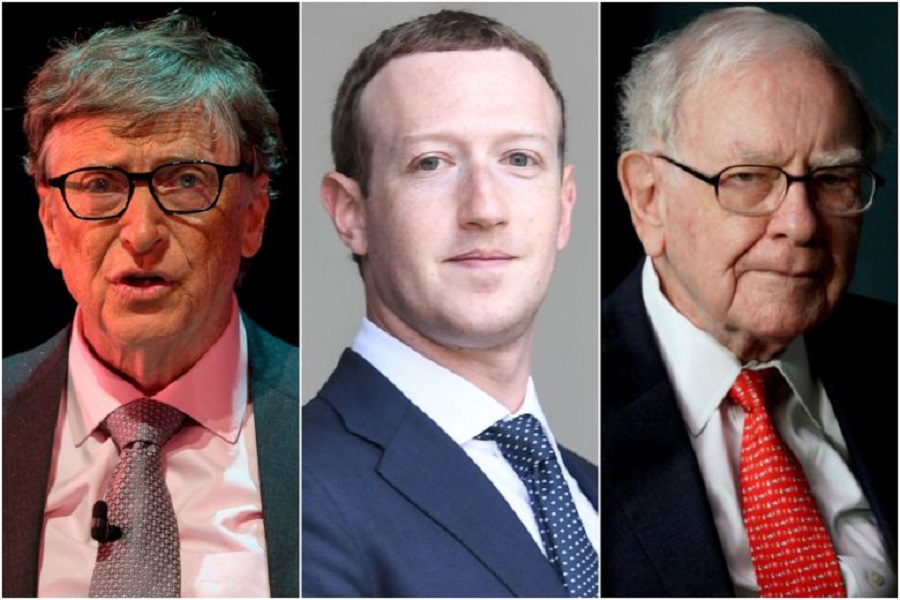

“Here’s the other thing. When a person with $10 billion puts $10 billion on the network, they’ve got a friend with $10 billion. Warren Buffett (Berkshire Hathaway CEO) plays bridge with Bill Gates (Microsoft founder) and then they talk with Mark Zuckerberg (Facebook CEO and founder).

“So when this hits that social network, it’s like a billion to two billion to four billion to eight billion and those four decisions, those four blocks have more impact on the network than the first 10 million blocks.”

READ: Crypto; Tron’s founder offers $1 million bounty in finding BTC Twitter hackers

What you should know

Sequel to these macro, Nairametrics some days ago revealed key insights coming from DeVere Group discovering that 73% of poll participants (millionaires) are now already invested or are preparing to invest in digital assets, such as Ethereum, Bitcoin, and XRP, before the end of 2022, showing a significant amount of interest by the world’s top earners.

READ: Apple market capitalization nears $2 trillion, as Apple’s CEO becomes a billionaire

- The findings come as the price of Bitcoin rallied close to $18,000, almost close to the $19,763 all-time record reached in December 2017.

- Most of the high net worth individuals polled by the financial firm got triggered into planning to buy cryptos by the latest institutional buying.

- Those classified as millionaires in the study include ‘High Net Worth’ having more than £1m (or equivalent) in investable assets.