The long-awaited new Petroleum Industry Bill (PIB), which was just submitted by President Muhammadu Buhari to the National Assembly, has taken steps to amend changes to deep water royalties made last year.

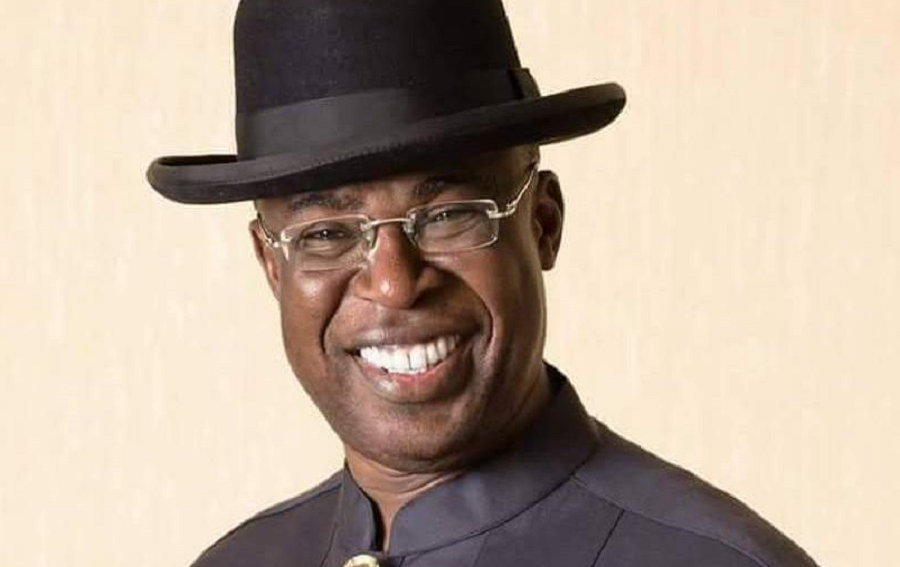

This is as the Minister of State for Petroleum Resources, Timipre Sylva, has clarified that the new PIB seeks to commercialize the Nigerian National Petroleum Corporation (NNPC) rather than scrap it.

According to Reuters, while confirming the receipt of the Petroleum Industry Bill (PIB) from the President, the Senate President, Ahmed Lawan, said that it would be officially presented on the floor of the 2 chambers of the National Assembly on Tuesday and would get quick consideration.

READ: Senate urges FG to diversify from crude oil to natural gas production

In addition to the earlier reported creation of a new company, Nigerian National Petroleum Company Limited, to take over the assets and liabilities of NNPC and the establishment of some new regulatory bodies, a section of the bill proposes an amendment to controversial changes to deep offshore royalties made late last year. This involves reducing the royalty that oil companies pay the Federal Government for offshore fields producing less than 15,000 barrels per day from 10% to 7.5%.

It would change a price-based royalty too so that it kicked in when oil prices climbed above $50 per barrel, rather than the initial $35.

It would also codify in law that companies cannot deduct gas flaring penalties from taxes, a practice that was the subject of a court case.

READ: FG projects $2 billion annual revenue from Escravos Gas project

Sylva made the disclosure during an interaction with journalists at the National Assembly complex after an interactive session with the leadership of the assembly.

Sylva said, “We have heard so much noise about NNPC being scrapped but that is not being envisaged by the bill at all. NNPC will not be scrapped but commercialized in line with deregulation move being made across all the streams in the sector comprising of upstream, downstream and midstream. We have said that NNPC will be commercialized.

“But if you are talking about transforming the industry, the only new thing that we are introducing is the development of the midstream, that is the pipeline sector. So we have provided robustly for the growth of the midstream sector. Through commercialization, the required competitiveness in the sector will be achieved.”

READ: NNPC signs gas development and commercialization deal with SEEPCO

Sylva also pointed out that the host communities would have the best deal from the bill.

Nairametrics had earlier reported the scrapping of the Petroleum Product Pricing Regulatory Agency (PPPRA) and the Petroleum Equalization Fund (PEF) in the proposed new bill, in addition to the creation of a new entity, NNPC Ltd.

The Federal Government is expected to pay cash for shares of the company, which would operate as a commercial entity without access to state funds.

READ: Board room squabble tears HealthPlus apart

The changes could make it easier for the struggling company to raise funds. However, the bill does not require the government to sell shares in the company and, unlike previous reform proposals, does not set a deadline for privatization to be completed.

This is another good decision from the President but what about the turnaround maintenance fund on the refinery, are they going to recoup it since the refinery is not working because Nigeria cannot continue to maintain and fuel a dead vehicle.