Investing in stocks has always been touch-and-go for Nigerians, both at home and in diaspora. A typical tale of the-more-you-look, the-less-you-see, many Nigerians have experiences – both real and imagined – of how they have lost some money in the stock market.

Amidst all of these, startups offering an opportunity to invest in foreign or local stocks have the problem of trust to deal with, before they can successfully break into the market.

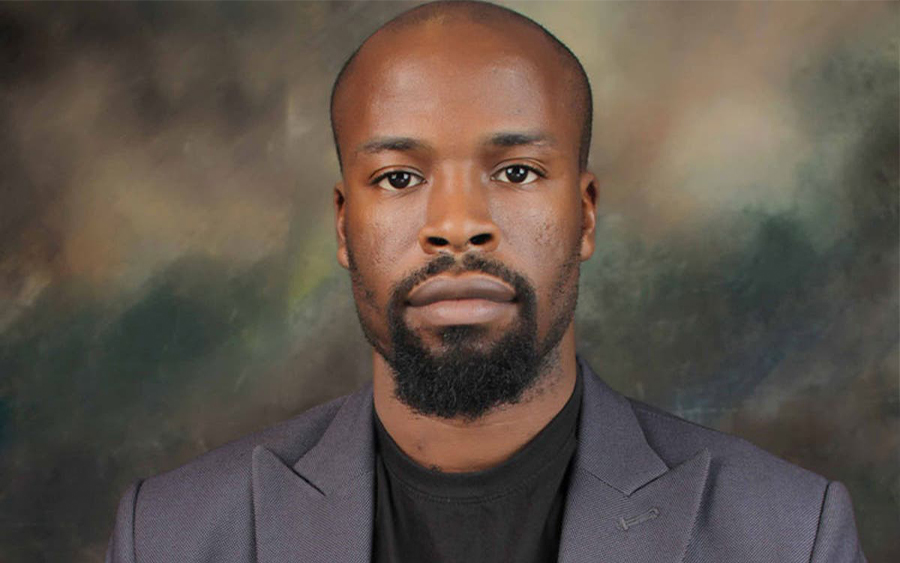

Co-founder and Chief Executive Officer of Chaka, Tosin Osibodu, said this was a major challenge for Chaka when it launched in 2019.

Tosin was a guest on Nairametrics’ Business Half Hour radio programme where he explained that with Chaka, investing in foreign stocks have become a more knowledgeable and transparent process that enables investors to make informed choices.

Chaka, as Tosin describes it, is a gateway that allows Nigerians to easily invest in local and foreign stocks, and also allows those in diaspora to invest in local stocks.

According to Nairametrics’ investment analyst, Olumide Adesina, Chaka “makes it easier for many Nigerians to access world brands like Coca-Cola, Pepsi, Twitter, Facebook, Amazon, General Electric, and provides top-class access to stocks listed.”

With Chaka, global stocks such as Apple, Alibaba, Google, Manchester United, the S&P 500 index and several others listed on NASDAQ, the New York Stock Exchange, and the Nigerian Stock Exchange, and top brands from over 40 countries are only a tap away for investors.

Averting the sour experiences

Sour experiences in investing are usually a result of poor knowledge of the market, and little or no access to market insights. As Tosin explained:

“The market is not bad everywhere at the same time. The secret is knowing the right market to invest at any time, and having the right information.”

Information about market fundamentals, insights and knowledge of the right portfolio at any time will guide an investor towards taking the right buy-hold-or sell decisions, and the Chaka weekly webinars offer this.

Apart from the regular insights, investors can also rest easy knowing that they have the backing of financial regulators such as SEC, NSE, CSCS in Nigeria and SEC, FINRA, SIPC, IRS in the U.S. This is no mean feat for investment start-ups and Tosin admitted that getting the approval of these regulators formed a large part of the initial challenges.

Building automated trading systems to create wealth

During the years spent schooling as a systems engineer in the US, Tosin observed the ease of investing in the stock market, a direct contrast to what was obtainable in Nigeria. Though a systems engineer by training, he was passionate about solving the problem, and reducing access barriers to local and global markets.

Back in Nigeria, he teamed up with his life-long friend and cousin, Bolanle Osibodu to set up Chaka.ng. With a core financial expert and a systems engineer, the company was all set to get rolling.

The goal was simply to reduce barriers to trading stocks across borders, and help Nigerians cash into the emerging mine that was the stock market.

With the Chaka solution, investors can register, get verified, buy and sell stocks the same day. The no-minimum investment rule also makes it open to beginner investors, allowing them to buy as much as they can afford.

For instance, even though the share unit of a company is worth $500, an investor may invest $100 and free up funds to build a well-rounded portfolio. According to Tosin, “if you are above 18 years and interested in investing, we don’t believe that you should be restricted by funds”.

It also has other unique features like the Naira or Dollar conversion on a per-asset-basis so that you can see how a Naira investment would perform in dollar assets or vice-versa. Its low transaction charges and wire transfer fees makes it even more affordable for Nigerian investors, especially since there are no hidden charges.

Collaborations

There are other companies who serve as digital brokers to Nigerian investors. But rather than see them as competitors, Tosin and his colleagues regard these startups as potential collaborators.

“Anyone that does what we do and shares same vision is a potential collaborator,” Tosin said.

One of the ways of collaborating is by providing execution services, white-label services and market automation technologies for corporate and institutional clients, so that these companies integrate Chaka into their operations to provide solutions for clients such as KYC verification, and user-onboarding.

Chaka partners with Citi investment capital in Nigeria and a global broker in the US, through which its offers are regulated by the relevant bodies. The aim of all collaborations is not just for profit but to improve client trust, increase foreign direct investment, and improve the investment income of Nigerians.

“Our focus is to create an amazing customer experience, because the more you can service customers in the way they want to be serviced, the better it is in the long term. This is seen in our lower commission rates, seamless onboarding process, best prices. We are focused on giving the buyer the most transparent offer,” he explained.

With a team of technologists and financial professionals working around the clock, Chaka remains on course to continually improve investment offers, and provide better decision-making tools to customers.

Hi Ruth,

Chaka is doing very well and their app is user friendly, only concern is that attempts to verify their claims to being registered and regulated by FINRA, SIPC and IRS can’t be verified.