The world’s leading technology brands, Facebook and Microsoft, recently bashed Apple for its restrictive App Store policies, which they claim prevents them from launching their gaming services on Apple devices.

Microsoft also disclosed that it will no longer be launching a limited testing version of the app on iOS. The gaming platform Microsoft had created for Apple devices can only support one game, which Microsoft said was due to Apple’s App Store policies.

READ MORE: Apple, Facebook record impressive earning results in spite of COVID-19 disruptions

Microsoft’s concern

Microsoft revealed that such policies set by Apple will make it unable to launch its game streaming service commercially on iOS due to these limitations.

“Unfortunately, we do not have a path to bring our vision of cloud gaming with Xbox Game Pass Ultimate to gamers on iOS via the Apple App Store,” a Microsoft spokesperson said in a statement Friday.

“Apple stands alone as the only general-purpose platform to deny consumers from cloud gaming and game subscription services like Xbox Game Pass. And it consistently treats gaming apps differently, applying more lenient rules to non-gaming apps even when they include interactive content.”

READ ALSO: Facebook rivals TikTok with launch of video-sharing product inside instagram

Facebook’s concern

The social media giant finally struggled to launch an Apple version of its gaming app on Friday, but it disclosed that it was compelled to make a concession to bring it on Apple’s App Store and had to remove the ability to play games instantly.

“Unfortunately, we had to remove gameplay functionality entirely in order to get Apple’s approval on the standalone Facebook Gaming app – meaning iOS users have an inferior experience to those using Android,” Facebook’s Chief Operating Officer Sheryl Sandberg said in a statement Friday.

“We’re staying focused on building communities for the more than 380 million people who play games on Facebook every month — whether Apple allows it in a standalone app or not.”

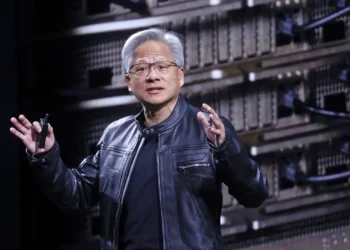

Microsoft and Facebook seem not to be the only ones facing challenges in bringing cloud gaming services on iOS devices. Google’s Stadia and Nvidia’s GeForce had also experienced difficulties in launching iOS versions of their apps due to the App Store’s guidelines.

READ MORE: Apple unveils a new credit card, Apple Card

Will Apple cave in?

“There is quite a lot of pressure building from different entities, and they are attempting to build consumer awareness of the issues involved as a way to convince Apple to change its policies,” Piers Harding-Rolls, research director of games at Ampere Analysis, told CNBC.

“Is it inevitable that Apple will cave in? Not necessarily. Apple is plowing its own path with privacy and how it wants to manage its ecosystem.”