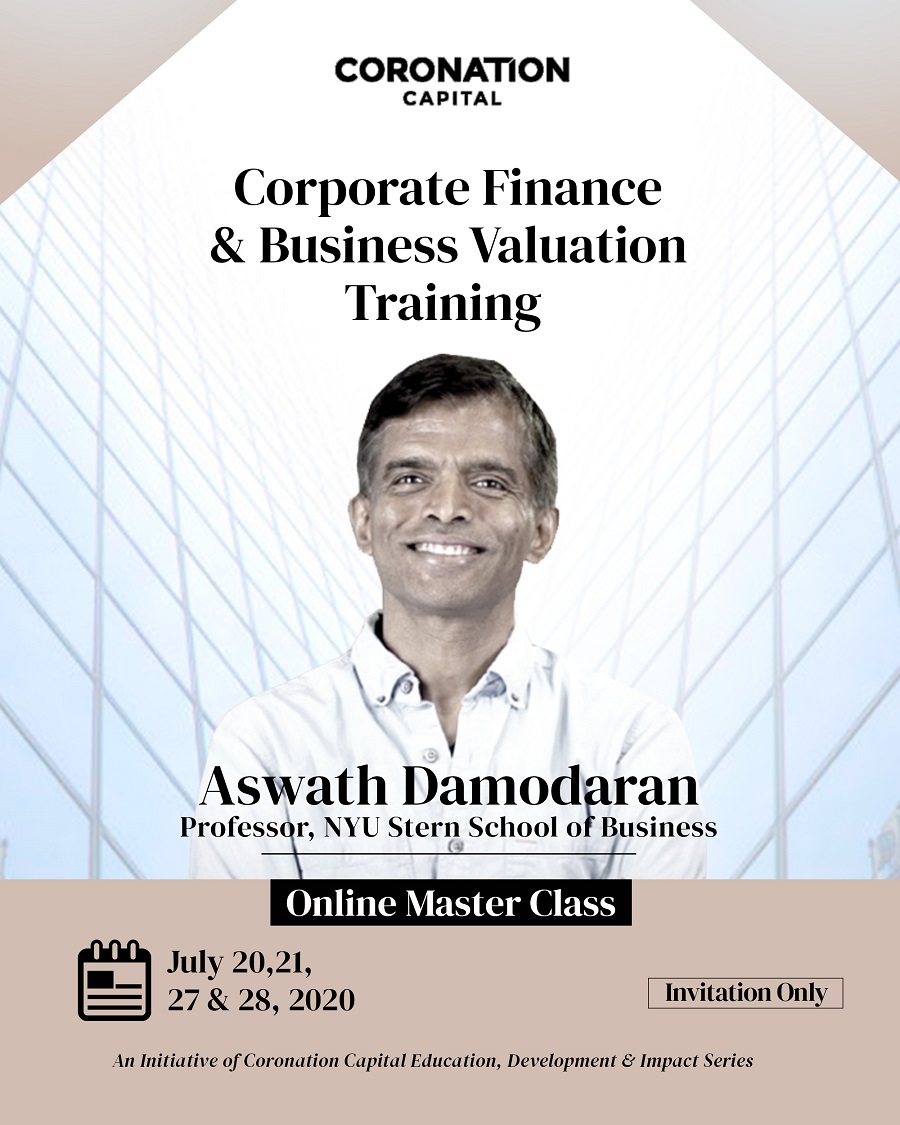

Leading Private Equity Firm in Nigeria, Coronation Capital, is set to host the 2nd edition of its Corporate Finance and Business Valuation online training (“Valuation Master Class”). Scheduled for the 2oth, 21st, 27th and 28th of July, 2020, the four-day event is designed to provide participants with a deeper understanding of corporate finance, valuation methodology and financial statement analysis with a key focus on appraising the business impact of financial decisions on the organizational performance.

The Master Class will be headlined by the globally renowned Professor Aswath Damodaran: a Professor of Finance at New York University’s (“NYU”) Stern School of Business. Over the years, he has been referred to as Wall Street’s “Dean of Valuation” and is widely respected as one of the foremost experts on corporate valuation. Damodaran has published several books and articles on equity valuation and corporate finance and has been featured in the Journal of Finance, the Journal of Financial Economics, and the Review of Financial Studies. Professor Damodaran has been voted ‘Professor of the Year’ by Stern’s graduating MBA class five times and has been awarded NYU’s Excellence in Teaching and Distinguished Teaching award; Coronation is delighted to bring him to Nigeria for a second time.

The Valuation Master Class, is a thought leadership and capacity building initiative of Coronation Capital. Lecture sessions will be hosted virtually and will also feature an engaging one-on-one fire side chat with Professor Damodaran on various topics including his views on the current global business environment and the Nigerian economy – opportunities for growth and investment. The Finance guru will train employees of Coronation Capital as well as related companies in the Coronation ecosystem which covers insurance, investment banking, asset management, technology and venture capital. Given that there is limited space, participation will be extended, by invitation only, to finance practitioners in the media and public sector as well as Coronation counterparties.

Dowmload the Nairametrics News App

Commenting on the event, John Opubor, Managing Partner of Coronation Capital said, “The world has entered uncharted territory. History teaches that a return to fundamentals espoused by Professor Aswath Damodaran is crucial to thriving in times like this”. He further stated that, “Participants will, over four-days, benefit from a deep dive into corporate finance and valuation and how investments are impacted during these unprecedented times”.

Coronation Capital is a private equity fund manager with a culture built on promoting innovation, good corporate citizenship and delivering strong returns to our investors. Coronation Capital aims to build well-positioned, well-run, cash-generative, and sustainable businesses that become significant employers and sources of growth in West Africa and across the continent. A core pillar of good corporate citizenship for Coronation Capital is utilizing education and development to positively transform our immediate environment.

EDITOR’S NOTE: This is a sponsored content.