The word ‘valuation’ has been mistaken by several experts and audiences around the world as the process of pricing an asset. While some believe it is an opportunity for bargaining or negotiation between parties involved, lessons from the just concluded 2nd edition of the Coronation Capital Masterclass, which was tagged Corporate Finance and Business Valuation, suggests otherwise and the expert trainer provided a simplified process for carrying out company valuation.

The facilitator of the Masterclass, Professor Aswath Damodaran of New York University Sterns Business School took his time to provide practical guidance on the entire valuation process to the participants. According to him, “Valuation is not a science or an art, it is a craft that provides a bridge between values and numbers. Valuing an asset is not the same as pricing that asset. Valuation is driven by Cash-flows from existing assets, the growth in those cash flows and quality of the growth (which represents the risk in the process).

The Second edition of the Coronation Capital Masterclass which discussed “Corporate Finance and Business Valuation” with Professor Aswath Damodaran of the New York University Sterns Business School, unlike the first edition was hosted virtually due to the impact of the novel coronavirus on the globe which includes sustained travel restrictions.

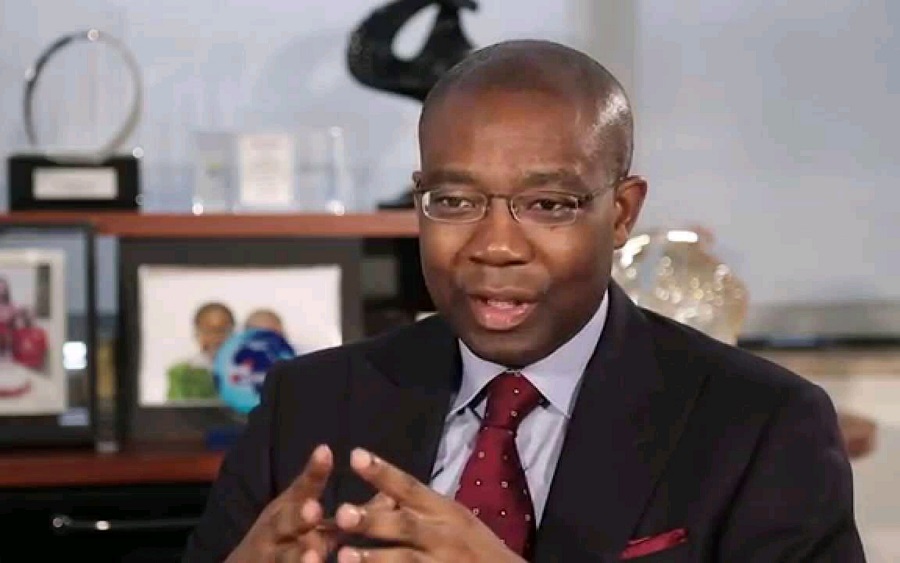

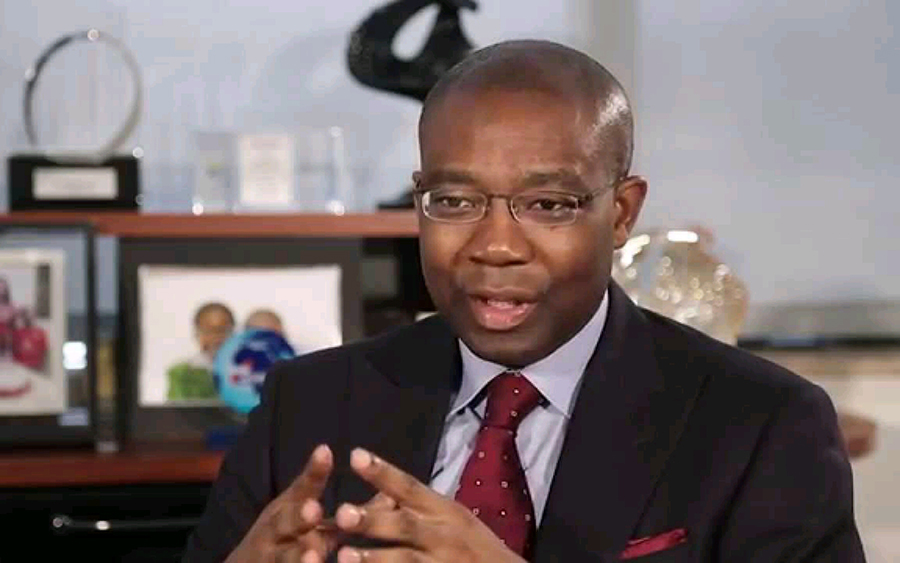

Giving his opening remarks the Chairman of Coronation Capital Mr. Aigboje Aig-Imoukhuede said the masterclass was an attestation to the value placed by the Coronation Capital and its ecosystem on valuation of assets and its culture of continuous learning and development. He described himself as a student of Professor Aswath Damodaran and believed it was a privilege to learn from the scholar.

Here are 10 key takeaways from the NYU Finance Professor’s classes during the Coronation Capital Masterclass session.

- Valuation Is not a Science or Art, but a Craft

- Valuing an Asset is not the same as Pricing an Asset

- A Good Valuation is the expression of a Possible, Plausible and Probable story in numbers

- When developing stories from numbers, ensure to connect all drivers of value to valuation and keep the feedback loop open

- All Valuations are biased. The only question is how much and in which direction is the bias

- There is no precise valuation and “You don’t have to be right to make money, you just have to be less wrong than everybody else”

- As companies get larger, it gets more difficult to sustain value-adding growth

- The payoff to Valuation is greatest when it is least precise

- Simpler valuation models do much better than complex ones

- Always question but respect markets. The market is always right

“Valuation is a process that needs to developed, through understanding what the #company does, and ensuring the story is possible, probable, and plausible, it should not sound too abstract”. – @AswathDamodaran

Every Valuation starts with a narrative. In developing that narrative, the critical assessment of the following is crucial in providing a strong base of understanding about the business.

- The company (products, management & history)

- Present and future competition

- Macro environment in which it operates.