Berger Paints Nigeria Plc has recorded N3.59 billion in revenue for the financial year ended December 31, 2019, 6% up from the N3.3 billion recorded in 2018.

Gross profit for the year also grew by 12% to N1.66 billion from N1.48 billion in 2018, while the profit for the year grew by 40% from N320 million to N448.7 million.

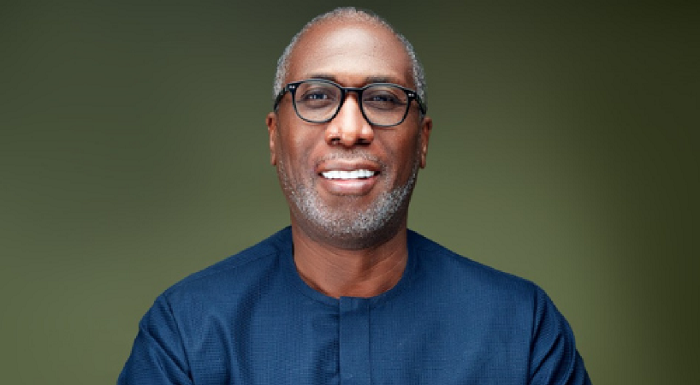

The Chairman, Mr. Abi Ayida, announced this to shareholders during the 60th Annual General Meeting (AGM), which was held virtually on Wednesday.

In addition, the company’s operating profits rose by 196% between 2017 and 2019, with an upward trend seen in all key performance indicators during the period.

READ MORE: IMF signals further economic contraction, warns of unprecedented crisis

Ayida attributed the results to internal efficiency and a re-refocusing on the production of its primary products, corporate foresight and innovativeness and huge investment in an automated factory.

This, according to Ayida, was not without its challenges.

“The board and management faced an increasingly hostile business-operating environment in 2019. However, due to your company’s growth strategy, we’re able to deliver an impressive performance. A review of financial results shows improved performance across all financial indices.

“The moderate growth in revenue was intended as deferred scale achievement to maintain our focus on operational efficiency. We believe the numbers justify this approach. Indeed, operating profit improved by 196% between 2017 and end of 2019,” Ayida said.

READ MORE: World Bank approves $750 million loan to Nigeria for power sector

In spite of the impressive results however, the management decided to declare a modest dividend of 25k per share, to make funds available for guarding against global market uncertainties.

“The lockdown has brought significant level of uncertainties to the global business environment. We have analysed COVID-19 and determined to brace up; our first approach is preservation of capital. This informed our decision to declare a modest dividend of 25k per share for the review period. Our position is that it is better to err on the side of prudence,” Ayida explained.

NAN reports that Shareholders commended the company’s performance in the tough operating environment, while also raising issues to be addressed.

Explore the advanced financial calculators on Nairametrics

One of the requests made by shareholders was for the company to increase the dividend of 25k per share in subsequent years while mapping out a long-term strategy to cope with the impacts of COVID-19.

One of the shareholders, Mr. Egunde Moses, also advised the company to address the issue of unclaimed dividend and impacts of adulterated products on the business of paint manufacturers.