FBN Holdings Plc has announced the completion of its divestment from FBN Insurance Ltd. According to a public disclosure that was sent to the Nigerian Stock Exchange, FBN Holdings’ previously-held 65% stake in FBN Insurance was completely sold to Sanlam Emerging Markets (Proprietary) Ltd. The effective divestment date was June 1st, 2020.

Following the divestment, Sanlam Emerging Markets (Proprietary) Ltd will now take over full ownership of the insurance company and its subsidiary — FBN General Insurance Ltd. No mention was made about how much the transaction was valued at.

(ALSO READ: Debt crisis looms in emerging markets)

In the meantime, both FBN Holdings and Sanlam Emerging Markets Ltd have “activated the Shareholders Agreement which provided pre-emptive rights to Sanlam,” the statement said.

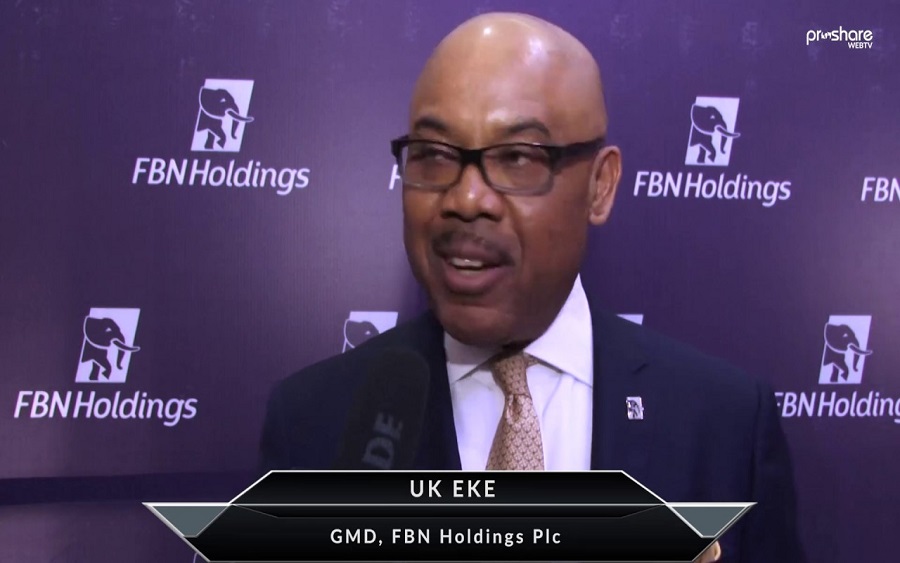

In a separate statement that was made available to Nairametrics, FBN Holdings’ CEO, U.K Eke (MFR), was quoted to have said:

“The divestment is in line with the Group’s medium to long term strategic objectives. This will ultimately improve our shareholders’ wellbeing and deliver greater value to all the stakeholders.”

Heinie Werth, the CEO of Sanlam Emerging Markets (Proprietary) Limited, also commented. He said:

“Over the years we have enjoyed a mutually beneficial partnership with FBNH, and we will continue to cooperate with them in the future. Sanlam exercised its pre-emptive right to acquire the remaining shareholding of FBNI and in line with our partnership philosophy that underpins our business model, we will introduce local shareholding at an appropriate time in the future. This transaction is evidence of our belief and confidence in the value and future of the business, as well as the skilled management team and staff. Moreover, we are committed to Nigeria and view it as a key market on the continent.”

(Download the Nairametrics News App)

Recall that FBN Holdings Plc first hinted at the deal in April this year when it announced that talks were ongoing with Sanlam Emerging Markets and regulators.

iam fbn holding shareholder member since2017_but I didn’t any benefit.