The coronavirus disease (COVID-19), which originated in China, has spread to several countries and territories. Many economies around the globe have witnessed reduced economic activities in the first quarter of the year.

Industrial facilities have been shut down in some affected countries, and the global supply chain has been disrupted. Brent crude prices have fallen below $22 per barrel – the lowest since 2003 – due to the escalating global economic impact of the COVID-19 pandemic and the price war between Saudi Arabia and Russia.

Nigeria, the most populous country in Africa, is awakening to a new economic and social reality as a result of the COVID-19 crisis. The country of over 192 million people, recorded its first case on February 28, 2020. Since then, it has recorded about 4,151 cases and 128 COVID-19 related deaths.

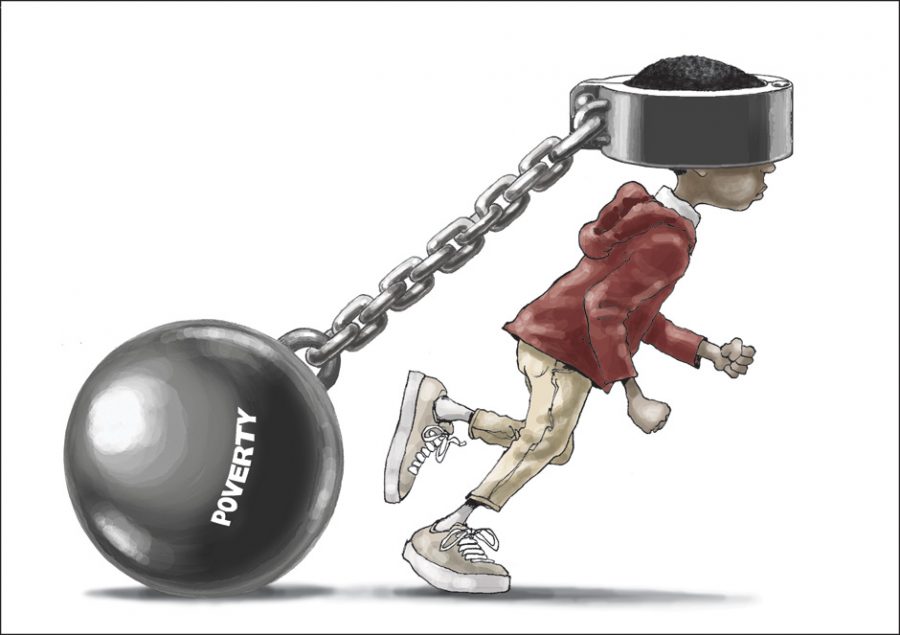

While the virus infects people regardless of wealth and social status, the poor will be most affected. In 2019, Nigeria surpassed India in terms of the number of people living in abject poverty. With a recession looming as a result of the pandemic, that number will only grow if proper measures are not enacted.

Living in typically high-density houses, with reduced access to sanitation, and a lack of savings to facilitate self-isolation, Nigeria’s poor are at greater risk of contracting the disease. More so, due to the high cost of health care, greater economic fragility, and higher mortality rates, we are bound to see many more Nigerians fall below the poverty line before this is over.

(READ MORE: Sahara Group donates medical equipment to support fight against COVID-19)

About two months ago, the Lagos State government banned the use of tricycles and bikes. The immediate and most significant impact was the sudden rise in unemployment. The ban affected about 14,000 bike-hailing employees and about 50,000 tricycles and informal motorcycle riders.1 A further strain on incomes resulting from the COVID-19 pandemic will devastate workers.

Nigeria’s response to the pandemic

The CBN is providing N50 billion to firms affected by the virus and is increasing credit to the health sector. In addition, the Bankers Committee pledged to provide N3.5 trillion in support to pharmaceutical companies, assist essential health companies in purchasing raw materials, and encouraging local production of drugs. Whilst these stimulants are necessary to spur economic growth, structural policy changes are required to achieve macro-economic stability and long-term sustainable growth.

The average size of the stimulus package as a percentage of GDP in advanced economies is 12%. The US, for instance, is 11%, while in SSA the average stimulus is 0.4% of GDP. Therefore, a stimulus package of 0.34% of GDP in Nigeria is totally insignificant and unlikely to boost the already fragile economy.

To reduce unemployment and poverty, which are inevitably linked to this pandemic, it is imperative that policymakers provide relief packages tailored particularly to Nigeria’s vulnerable citizens. Nigeria needs to ease the financial burden ensuing from the lockdown, and cushion the aftermath of the pandemic.

(READ MORE: Fidelity Bank debuts ‘SME Forum Online)

Countries’ responses to the pandemic

The US, now the epicenter of the virus, reversed its initial indifference, approved strict external travel prohibitions and some states enacted strict internal restrictions. The President approved a coronavirus relief bill of $2 trillion, which was designed to bolster unemployment benefits for individuals, increase money for states, deliver a huge bailout fund for businesses and send one-off payment of up to $1,200 to every American with an annual income of $75,000 or less.2 This had a direct impact on each citizen including low-income earners and casual workers.

In other countries such as China, the government has instructed that salary payments should be made to workers who are unable to work due to quarantine or illness. Ireland, Singapore, and South Korea have made sick leave available for the self-employed, while in the UK, statutory sick pay will be provided for diagnosed or self-isolating individuals, coupled with a three-month payment holiday for anyone struggling with mortgage or rental payments.3

Taking a look at the relief packages in advanced countries: they are well-tailored to citizens, will have an immediate and positive impact on the standard of living of its citizenry, and they will reduce the knock-on effects on incomes.

The way forward

It is no news that the COVID-19 pandemic will disrupt the global and Nigerian economy in 2020. However, Nigeria can cushion the impact of the virus by introducing measures to protect companies and their workers, most especially the vulnerable citizens, from the impact of the quarantine measures. Such measures could include:

- Unemployment benefits

- Employment retention

- Social assistance benefits

- Financial support and tax relief

While these measures will not single-handedly contain the pandemic, it will encourage the citizenry to stay at home, reduce the spread, and also help reduce the level of unemployment, day-light robbery, and poverty ensuing from the pandemic.

Article was written by Miss Tobiloba Ogunpolu. Ogunpolu is a Senior Economic Analyst with a renowned investment firm