For the first time in world history, about 90% of the world’s citizens have been restricted from travelling, either to return home or to destinations of choice. Without a doubt, the most affected in travel & tourism is the aviation industry.

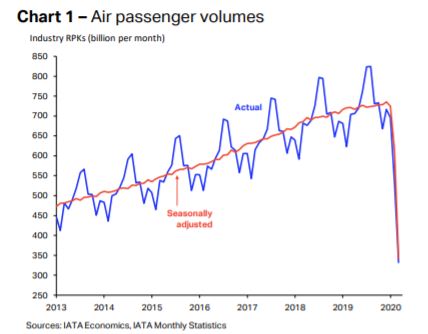

An estimated 25 million aviation jobs and 100 million travel and tourism jobs across the globe are at risk. That is not all; the growth recorded in the industry in the last seven years would potentially be lost across the world.

Coming back home, in Nigeria, most of the local airlines have either forced their workers to embark on unpaid leave, slashed salaries or dismissed their workforce. This is how Coronavirus (COVID-19) has brought the global and Nigerian aviation to a standstill.

READ ALSO: Use appropriate aircrafts or stop operations, FG to Turkish airline

But will Nigeria ever fly again?

Experts at the Institute of Directors’ webinar titled “Impact of COVID-19 on Aviation Sector: The Way forward” which was covered by Nairametrics, emphasized that Nigeria would fly again, but things would not be the same. According to them, the pandemic would birth “a new normal” in the aviation industry.

At the webinar, which was moderated by the immediate past President, National Association of Nigerian Travel Agents (NANTA), the experts that were selected across the industry agreed that the new normal would be challenging but must be adhered if the industry must survive the outbreak.

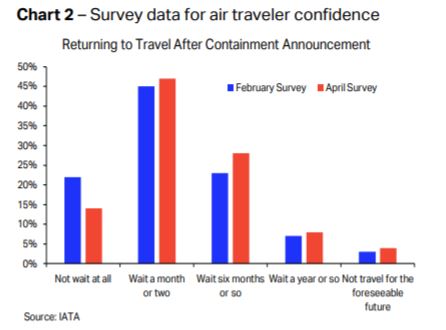

Even if borders reopened, Managing Director, Aero Contractor Airline, Captain Aso Sanusi, explained that travellers must trust that boarding a plane was safe and that they would be able to enter the destination country.

The most immediate and perhaps most visible change the industry will witness is social distancing or touchless travel.

“Shortly before the total lockdown, we had implemented the social distancing policy and that took a lot of time. We witnessed a lot of delays because we had to ensure passengers keep safe distances at the point check-in in order to curb the spread of the virus. But physical distance policy in the aircraft will not be possible. That will not happen.”

“Passengers will have to be fit to travel, as the Yellow cards will be substituted for COVID-19 card. Passengers must arrive earlier than they used to at the airport and definitely expect more delay. The old normal turn around for local will increase from 30 minutes to over 1 hour (new normal) because aircraft will be sanitized every time the plane land.”

READ MORE: These are the sad reasons Nigerian airlines struggle and fail

According to him, there would also be panic at the airport or in an aircraft if certain things happened. For instance, if anyone sneezed, others would panic. “We will have to work hard to psychologically educate the passengers that the aircraft is the safest place to be,” he added.

Country Manager, Nigeria & West Africa, Qatar Airways, Kennedy Chirchir, also agreed that the new normal of the industry would mean a total paradigm shift.

To him, the development would affect airline preparations, check-in preparations together with how agencies interacted with customers and airlines.

He said, “We are moving to the digital space where physical interaction would be reduced drastically. Most of the operations will be on a digital platform. There will be more requirements in terms of the turnaround of aircraft. Before now, it takes about 1 hour for aircraft to turnaround but now it may take as long as 2 or 3 hours because there would be stricter checks. These will happen but will not stop people from travelling.”

READ MORE: Jumia is optimistic of COVID-19 boost, despite poor Q1 2020 earnings report

On the part of travel agencies, Managing Director, BTM Travels Limited, Lola Adefope, explained that the adoption of technology would be emphasized. Before this, she insisted that it was important for operators and regulatory authorities to ensure that right policies and processes were in place to drive the technology, else the nation would be placing the cart before the horse.

“What we need to do is to implement a proper education process and platform. That is to ensure people understand the risk of travel and the safety measures in place with the technology to support the process. The technology will push notifications to people directly.

“We are going to see a move to much smaller groups when it comes to actual leisure travel. Leisure travel won’t develop at the international scene immediately but we have to develop domestic tourism. We must put in place policies and processes before we open our borders for intercontinental or international tourism,” she said.

According to the BTM boss, the nation would witness a change from long distance travels, as air travellers would do more research to know about where they were going before embarking on trips, and more emphasis would be on careful travel. “The new products that will be sold in the new normal are health, safety and compliance and not comfort and leisure that was the focus in pre-COVID-19,” she added.

READ ALSO: US to stop issuing visa for Birth Tourism

Executive Chairman, Phillips Consulting, Foluso Phillips, expected the new normal to birth new digital skills that would grow the aviation industry. He said the development would lead to job losses, because some people’s services would no longer be required with the advent of technology.

According to him, it is obvious that the Federal and State Governments are saddled with bigger responsibilities of public safety, decay in education sector and Nigerians should expect them to be fully involved in implementing the desired turnaround needed in the sector. He said,

“We need to privatise airports and have extremely sophisticated airports. There is no magic silver bullet, we have to try and engage the people and restore their confidence in the sector. These are the real things we must face.

READ ALSO: Aviation sector to contribute over N1.2 trillion to Nigeria’s GDP by 2020

“Let us lessen the burdens of the government. That for me is the new norm. How can we bring confidence to people? People should be able to say, ‘I want to go on vacation, as I now have confidence in the system.’”

Meanwhile, IoD organized the webinar to offer a guide that would cause the aviation sector to rebound. Bankole said, “It is important to debate and discuss these current realities and emerging trends that will shape the future world of travel. With the need for social distancing and stringent health measures that have been put in place by all responsible Governments, the cost of operations, if and when the airlines operate again, may be daunting.”

Please where are refrences