Pan African Financial institution, United Bank for Africa (UBA) Plc has again given its loyal customers reason to cheer as it rewarded 100 loyal customers with N100,000 each in the UBA Bumper account draw.

The draw, which took place at the UBA Head office on Tuesday, was held via the Facebook platform in strict compliance with social distancing rules as directed by the Federal and Lagos State Government where 100 more customers emerged winners through a transparent draw.

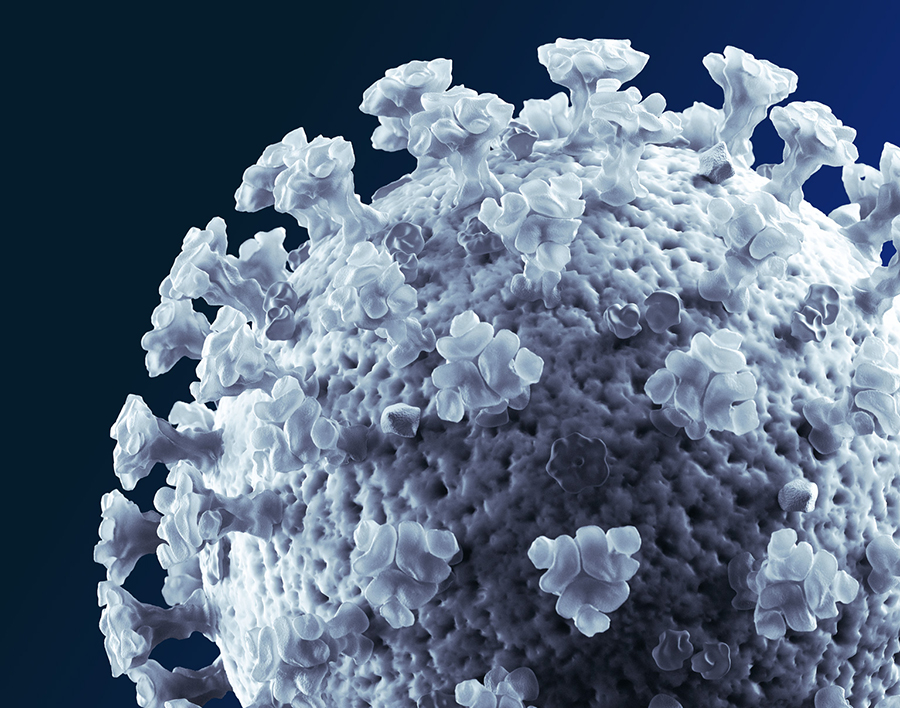

When contacted, the customers who emerged winners of the draw agreed that the total reward of N10m is timely and would be very useful in assisting them especially in the face of the Coronavirus Pandemic currently ravaging the world with attendant effect on incomes of individuals.

UBA’s Group Head, Consumer and Retail Banking, Jude Anele, spoke about the bank’s excitement to be able to put smiles on the faces of as much as 100 customers at this critical time when livelihoods and lives are being threatened by the Covid-19 pandemic.

“These are difficult times indeed with little to cheer about because people are going through trying times. However, for us in UBA, we want our customers to know that we are in these together, that is why we have taken it upon ourselves to reward those that have kept our business going with their loyalty. With this reward, we want to encourage them to stay happy and safe even as they continue to aim for their dream regardless of the present challenges,” Anele said

Anele noted that the bumper draw is also in line with the bank’s mission of creating superior value for its stakeholders while encouraging saving cultures among Nigerians, adding that “We have in recent times deepened our focus on the most important aspect of our business – the customers we serve. Hence, our huge investment in technology to make banking easier and seamless across all our product channels and that is why we most recently introduced new offerings such as this Bumper Account, with our customer in mind as it is expected to deliver improved value to them.

Explaining the modalities for the draw, Anele said that all new and existing customers need do to qualify for the draw is to ensure that they have a minimum deposit of N5,000 in their UBA Bumper Account. “Current UBA customers are to dial *919*20*1# to migrate to the UBA Bumper Account whilst potential customers should dial *919*20# if interested in opening a UBA Bumper Account,” he added.

In the first draw which was held live during the official launch in Lagos, a total of 100 customers emerged winners as the Bumper to Bumper Crooner, Wande Coal serenaded guests with his famous hit songs to the delight of all present.

The Group Head Marketing & Customer Experience, Michelle Nwoga, explained that the Bumper account was created specifically with the customer in mind, adding that UBA truly puts its customers first and will stop at nothing to ensure they have the right solutions to support their needs. “We are committed to delivering exceptional service and will always seek to excite our customers at every interaction. We back our words with action and that is why a total of 100 customers emerged winners at the last draw which also took place here,” she said.

She added that a monthly shopping allowance of N100,000 for a year is also up for grabs. “No fewer than 5 account holders will get a whopping N2 million each across all participating regions every quarter. This account is open to both existing and new customers of the bank who save a minimum of N5,000,” Nwoga added.

Mafulul Emmanuel King, one of the winners who was called on the phone, could not hide his joy when he was announced as one of the winners. “I am still very amazed. I never knew I could get lucky and win. All my life, I have never won anything like this, and I am very happy that I won this time. What a time to get lucky than now when this Corona Pandemic has affected my business severely. You cant imagine how relieved and delighted I am. God bless you guys, thank you so much UBA,” he said.

Another winner, Bello Aishat, who could not also believe it when her name was contacted screamed for joy, saying “you don’t know what this means to me at this very difficult time! This bank keeps touching and supporting lives. The same way they supported both the federal and state governments and some African countries with a whooping N5billion. I am convinced UBA truly cares and I am proud to bank with UBA. Thank you so much, you have touched me beyond words at a trying time,” she concluded.

Please stop send me any nonsense news about UBA bank. The worse bank in Nigeria.

The best bank ever. Uba best