World Bank has projected that the remittances to Nigeria, Egypt, Senegal and other Low and Middle-income Countries (LMICs) would drop sharply by 19.7% to $445 billion in 2020 due to the economic crisis induced by the COVID-19 pandemic and lockdown.

The World Bank Group defined LMICs as low-income economies ($1,005 or less GNI per capita) or as lower-middle-income economies ($1,006 to $3,955 GNI per capita).

The decline, according to the statement issued by the global lender and seen by Nairametrics, would be the sharpest decline in recent history and it is largely due to a fall in the wages and employment of migrant workers that are more vulnerable to loss of employment and wages during an economic crisis in a host country.

READ MORE: Reasons Reps call for taxation, remittances police

What it means: The remittances to LMICs would fall to $445 billion, representing a loss of a crucial financing lifeline for many vulnerable households. According to the World Bank, studies show that remittances alleviate poverty in lower- and middle-income countries, improve nutritional outcomes, are associated with higher spending on education, and reduce child labour in disadvantaged households.

A fall in remittances affects families’ ability to spend on these areas as more of their finances will be directed to solve food shortages and immediate livelihoods needs.

READ ALSO: Fending off Recession in Nigeria: Experts Offer some Advice to Presidency

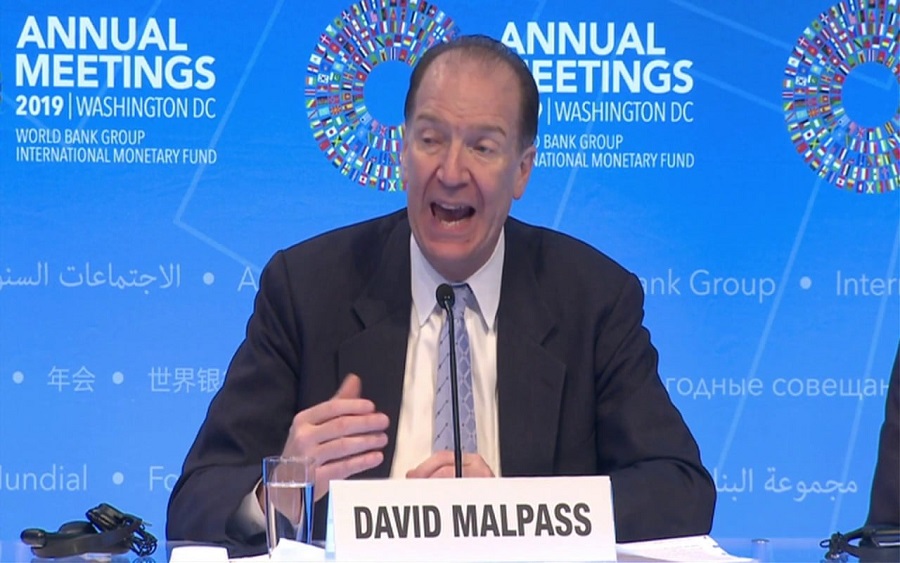

President, World Bank Group, David Malpass, said:

“Remittances are a vital source of income for developing countries. The ongoing economic recession caused by COVID-19 is taking a severe toll on the ability to send money home and makes it all the more vital that we shorten the time to recovery for advanced economies.

“Remittances help families afford food, healthcare, and basic needs. As the World Bank Group implements fast, broad action to support countries, we are working to keep remittance channels open and safeguard the poorest communities’ access to these most basic needs.”

READ ALSO: Nigeria’s diaspora remittance to hit $34 billion by 2023 – PwC

Meanwhile. the World Bank is assisting member states in monitoring the flow of remittances through various channels, the costs and convenience of sending money, and regulations to protect financial integrity that affects remittance flows. It is also working with the G20 countries and the global community to reduce remittance costs and improve financial inclusion for the poor.