PricewaterhouseCoopers, a global tax and consulting firm has estimated that migrant remittances to Nigeria could grow to US$34.8 billion by 2023.

According to the report released by the firm, the total remittance flow to Nigeria will grow by almost double from US$18.37 billion in 2019 to US$34.89 billion in 2023.

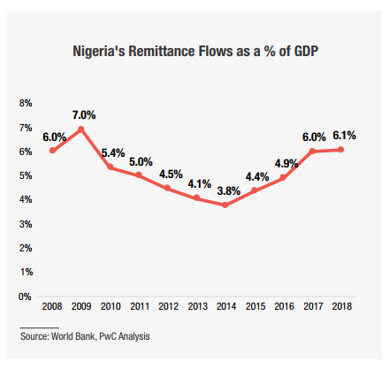

The breakdown: According to the report, the Sub-Saharan Africa (SSA) region received a small share of the global remittances in 2018, with Nigeria accounting for over a third of the regional inflows. Despite representing a small percentage of global flows, official remittances to SSA grew by 10% ($46 billion) in 2018.

[READ MORE: Presco’s half-year revenue dips by 9.5%]

- According to the International Monetary Fund (IMF), remittances sent to SSA through informal channels, at 45 to 65% of formal flows, are significantly higher than what was obtainable in other regions.

- India, China, Mexico, the Philippines and Egypt are among the largest remittance recipients globally, collectively accounting for approximately 36% of total inflows.

- Egypt and Nigeria account for the largest inflows of remittances in Africa in 2018.

- In 2017, Nigeria led the Continent in terms of remittance receipts but dropped to second place behind Egypt in 2018.

- The two main reasons behind this growth are global economic growth, especially in high-income OECD countries and a rise in oil prices, which boosted economic activities in oil-producing countries worldwide.

Why remittances: Basically, remittances represent household income from foreign economies arising mainly from the temporary or permanent movement of people to those economies. Remittances could be in the form of cash or noncash items that flow through formal channels such as electronic wire, or through informal channels, such as money or goods carried across borders.

Generally, the officially recorded remittances are much lower than the actual remittances that take place through unofficial channels.

[READ MORE: Nigeria ranks 7th country with highest number of internet users in the world]

Remittances play a great role in economies. The report further shows that remittances help poorer recipients meet basic needs, fund cash and non-cash investments, finance education, foster new businesses, service debt and essentially, drive economic growth.

How Nigeria can harness remittances: According to PwC’s report in order to ensure that remittances are being utilized in ways that are beneficial to the economy, Nigeria must create platforms that increase the accessibility of crucial information for Nigerians in Diaspora.

- Overall, remittance flows are anticipated to keep expanding. It is therefore imperative that countries in the region, especially Nigeria, take advantage of this trend in the course of strategic economic decision-making.

- In summary, PwC believes that a coherent policy framework is required to harness remittances into generating capital for productive investments for the growth and development of small and micro-enterprises, which will in turn, create employment.

- In addition, remittances can be deployed toward philanthropic activities which can serve as solutions to specific deficiencies in the local infrastructure such as schools, hospitals and roads.

[READ MORE: CBN’s Godwin Emefiele, foreign investors meet amidst weak naira]