It’s two days straight and the crazy Western Texas Intermediate (WTI) crude oil price remains below zero for the first time ever. Prices fell not just below zero but to negative $40 per barrel. There is a major reason for this price drops.

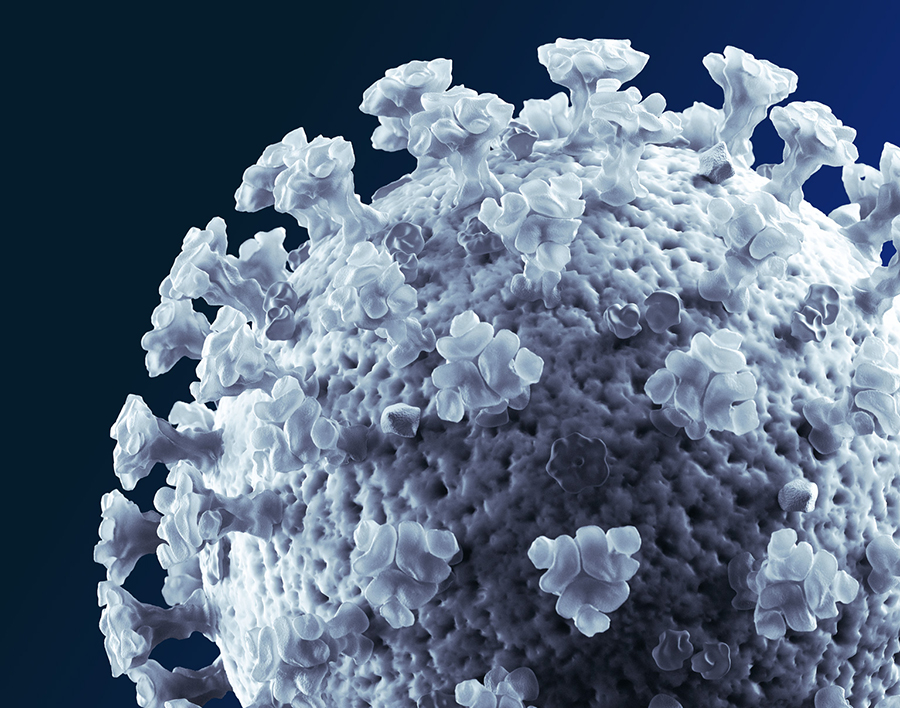

Why negative: Since the world went into a COVID-19 induced lockdown, demand for crude oil fell drastically. Crude oil derives its value when it is refined and sold. However, with movement restricted and most factories shut down, there is little to no demand for refined crude oil.

Very limited vehicular movement means people don’t have any need to fuel their cars or bikes. Demand from major factories has also plummeted as customers have no need to place orders for non-essential items. Thus, refineries are left with piles of unrefined crude that they have no immediate use for shutting out any need for immediate use of crude.

READ MORE: Nigeria is in a weak financial position to absorb recession shocks —Bismark Rewane

The result is that crude oil traders find themselves with shiploads of undelivered crude which they need to store somewhere. To, however, store the crude in tank farms, they now have to pay higher. Several reports tracked by Nairametrics point to oil traders effectively paying buyers to take the crude off their hands as it is probably cheaper than paying to keep them inexpensive storage facilities.

Silver lining: The price fall could, therefore, be a temporary issue and could reverse once the lockdown eases in countries across the world. For example, the WTI crude oil price to be delivered in June trades at about $11 on Tuesday (it fell to about $6.5 in intraday trading before rising again) compared to the zero price (which is widely reported) for May contracts.

READ ALSO: Nigeria’s Bonny Light hits $12, yet nobody is buying

But Is Nigeria affected? Nigeria’s flagship bonny light remained stable trading at just about $20 on Tuesday but fell to $14.75 compounding Nigeria’s revenue woes.