According to figures from the World Health Organisation (WHO), the Coronavirus Pandemic (formally known as COVID-19) ravaging the world has infected 2,164,111 people and resulted in 146,198 deaths across 210 countries and territories as at 18th April 2020.

It has led to the shut down of many businesses as governments around the world have implemented varying degrees of lockdown directive in a bid to slow the spread of the deadly virus and ultimately flatten the curve. Schools were abruptly closed; high streets are deserted and even churches and other religious gatherings have been suspended in most affected countries. In other words, life, as we used to know, has been put on hold!

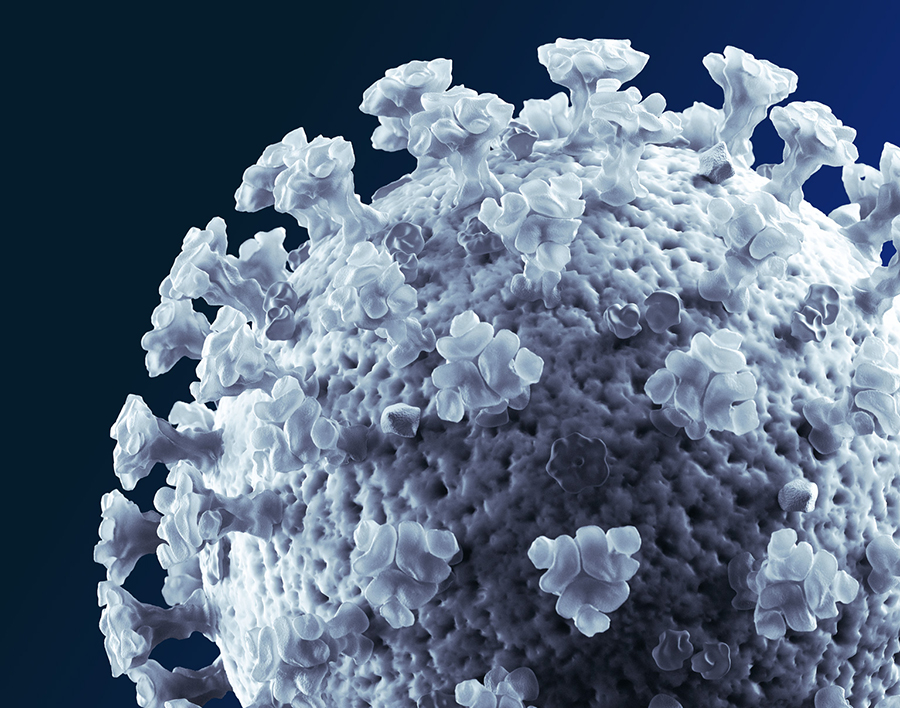

Despite ongoing frantic efforts at finding a cure for this invisible enemy, it is difficult to miss the pervasive sense of anxiety and trepidation that has engulfed the world because of COVID-19. Aside from the obvious threat to human life, the economic toll this would inflict on the world has been a source of concern to many.

For instance, the International Monetary Fund (IMF) already forecasts a 3% dip in the global economy mainly due to COVID-19. The challenge for most world leaders is in striking the right balance between saving people’s lives and their means of livelihood.

READ MORE: New report reveals how companies are adjusting to COVID-19 pandemic

Given this grim scenario, it is understandable if nothing good is readily identifiable in this global pandemic situation. Nevertheless, it is my firm opinion that every crisis usually carries with it an equal dose of opportunity, if we dare to look closely. The rest of this article will be dedicated to highlighting some of these opportunities and making recommendations on what businesses can do to make the best out of an ugly situation.

UPSIDES OF COVID-19

- Opportunity to Test Business Continuity Plans: For most companies that have expended enormous resources in crafting their Business Continuity Plans (BCP), COVID- 19 presents just the perfect circumstances to ascertain the worth of these documents. Outside COVID-19, it might have been difficult to simulate another scenario with the same level of reach and impact thereby limiting the drawn-conclusions. According to the Business Continuity Institute, 70.9% of surveyed companies have activated their BCP since the outset of COVID-19. While of this lot, only about 57% have exercised these plans in the last 12 months – implying that the remaining 43% plans are not up-to-date. Even for businesses with no prior BCP, the current situation demonstrates just how important it is to plan for how a business will conduct its affairs in unlikely but probable times.

(READ MORE: COVID-19 relief: Group of Techpreneurs use BVN to disburse funds to Nigerians)

- Forced Re-evaluation of Business Models: Necessity is the mother of invention. Due to restrictions brought on normal business practices by COVID-19, many businesses are being forced to dig in and find ingenious ways of serving their customers and staying afloat. Some businesses have found new markets to serve while others have discovered alternate delivery channels to get goods & services to customers. All of these are happening with utilization of lesser resources than the pre-COVID-19 days.

- Faster Adoption of Digital Channels: At the beginning of the year, the percentage of United Kingdom’s (UK) retail shopping done online was about 21%. This figure was projected to rise to 53% in ten years’ time according to a report published by The Guardian (UK). However, since the emphasis on the need for social distancing and the eventual lockdown, UK retail footfall has reduced by 85% while retail shops have witnessed a surge in the number of orders coming in online. This phenomenon is expected to draw more people into the digital ecosystem as they experience the convenience and ease of online shopping. Ultimately, the length of time necessary for majority of UK retail shopping to happen online is projected to reduce. The same trend can be expected of Nigeria even if at a slower rate than the UK due to higher illiteracy levels, poor internet connectivity and epileptic power supply.

- Access to Cheap Funds: The Central Bank of Nigeria (CBN) is offering a combined stimulus package of about N3.5trillion targeted at households, businesses, manufacturers and healthcare providers. From this fund, N50billion is particularly targeted at households and Small & Medium Enterprises (SMEs) to cushion the negative effects of COVID-19. In addition, the CBN is offering one-year moratorium on all CBN intervention facilities while also reducing interest rates on these facilities from 9% to 5%. Although the immediate objective of these interventions is to ameliorate any negative consequence of this pandemic, they nonetheless provide access to cheaper funds to these businesses which may come in handy for post-COVID-19 operations.

- Stronger Case for Health Sector Investment: COVID-19 has proven to be no respecter of race, colour or economic status. It is plundering the rich and poor alike on both personal and national scale. Here in Nigeria, it has infected both men in power and out of power. The difference this time around is that the rich and powerful cannot seek better healthcare services abroad – we are all constrained to the level of care available in Nigerian hospitals! This development has accentuated the plight of the Nigerian health sector in a manner never seen. For example, of the N3.5trillion CBN stimulus package, N100billion is specifically targeted at pharmaceutical companies to build/expand capacities. Also, as part of the CBN’s short-term post-COVID-19 priorities, it plans to get banks and private equity firms to finance homegrown healthcare services to reverse the nation’s high medical tourism.

(READ MORE: How to access the N50 billion CBN Covid-19 intervention fund for SMEs)

RECOMMENDATIONS

In the light of the above bright spots directly attributable to COVID-19, I have enumerated three key recommendations to enable businesses consolidate their positions during COVID-19 and emerge stronger for life after the pandemic:

- Robust and Updated BCP: As we have seen, having a BCP is not enough. The document must be robust to cover multiple scenarios and kept current through regular exercises. As companies with BCP implement same during this period, they must continually assess their results to ensure same are consistent with where they planned to go. Where this is not the case, appropriate changes should be made to the BCP. Whilst it is a clear sign of executive short-sightedness for companies that entered this COVID-19 war without a BCP, I strongly believe that this situation can still be remedied. However, such companies will now be reacting to this pandemic instead of responding to it and they must be ready to accept a higher margin of error and inefficiencies. For clarity, having a robust and updated BCP will not save any company from all possible losses that may emanate from a situation like COVID-19. It will only ensure such losses are guided and minimized as best as possible. In the words of Niccolò Machiavelli, in times of peace, prepare for war. This is the summary of a BCP.

READ MORE: Dangote gets African leaders’ support on health sector plan

- Embrace the New Normal: As earlier mentioned, COVID-19 has disrupted lifestyles, businesses and nations. For businesses that have found new markets or new ways to deliver goods and services to their customers, efforts should be made to consolidate on these discoveries post-COVID-19. They should resist the urge to return to the status quo and exploit this opportunity to possibly run leaner structures and improve efficiencies. However, businesses that are considered non-essential in this COVID-19 era (partly due to where they appear on the Maslow’s scale), should take this feedback in good faith and pursue strategies that increase their capacities to serve their customers remotely (e.g. digitization). Where this is not possible, such businesses may consider diversifying their interests into unrelated industries. Also, more organisations have had to adopt some form of flexiwork styles (such as work from home, shift work etc.) to cope with COVID-19 realities. These work styles should be explored and adopted as applicable, post-COVID- 19.

- Continuous Investment in Health Sector: In March 2018, Bill Gates succinctly pointed out the need for Nigeria to scale up investment in human capital development if the country wishes to realize her full potentials. While we did not need Mr. Gates to point this naked truth out to us, the fact remains that the country’s Education and Health Sectors are still grossly under-funded and require urgent overhauling. This COVID-19 saga has presented another opportunity for the issues bedevilling our health sector to be brought to the front- burner. The CBN must ensure it follows through on its post-COVID-19 short-term priority of getting local banks and private equity firms to fund the development of homegrown healthcare solutions via attractive incentives. Also, the Government, through its fiscal policies, must lead the way in this cause by having more skin in the game beyond the paltry 5% budgetary allocations to health.

(READ MORE: Stanbic IBTC gives update on its business continuity approach amid COVID-19 lockdowns )

Although the COVID-19 situation is still unfolding, one thing is sure – the world will never return to how we used to know it! Discerning companies, aside from doing all they can to keep their employees alive, will be keeping their eyes on the horizon for opportunities that can be exploited to turn this tide in their favour before the next wave comes along.

Article was written by Tunde Adeyemi, a versatile banker with over twelve years’ experience in the Nigerian banking industry. He can be reached via email at manovas2002@yahoo.com and on Twitter @manovas5.

Insightful arlticle. You guys should keep it up