The Nigerian Stock Exchange (NSE) data on domestic and foreign investor participation for December 2019 has revealed that foreign investor participation in the local bourse remained poor.

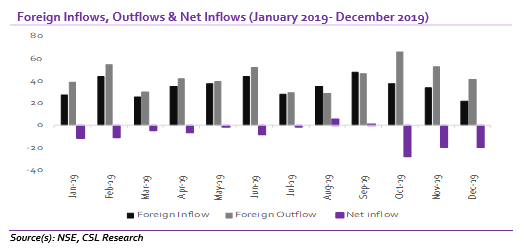

Specifically, foreign inflows declined 35% m/m to N21.69 billion (US$60.3 million) in December while outflows declined at a slower pace, down 22% m/m to N41.45 billion (US$115.1 million). Consequently, net outflows were little unchanged in December (N19.76 billion) compared to November (N19.58 billion).

Overall, in 2019, foreign inflows into the stock market fell 27% y/y to N419.13 billion (US$1.16 billion) while net outflows widened to N104.29 billion (US$289.7m) compared to N66.21 billion (US$183.9 million) in 2018, reflecting the fact that foreign investors remained net sellers for the second consecutive year.

The negative returns from the market for the past two years has been mainly due to reduced foreign participation affirming the fact that foreign investors remain the key drivers of the stock market. This year, however, our optimism on the market is based on expectation of local institutional participation.

Following CBN’s announcement barring non-banking corporates as well as individuals from accessing the OMO market, increased liquidity in the secondary debt market, as well as auctions, has since sent yields crashing. There has been a sharp decline in Nigerian Treasury Bills rate at the primary market auction over a three-month period from 12.94% before the announcement was made to 5.1% at the last auction.

We believe key institutional investors with trillions of debt assets maturing in 2020 will be searching for alternative investment opportunities given negative real returns on debt and money market instruments. Thus, we expect some of these funds to filter into the equities market.

[READ MORE: Transportation: Lagos bans okadas and tricycles…including Gokada & Oride)

That said, asides global risk, a major risk facing Nigerian capital markets in 2020 stem from recent policies of the CBN and their possible negative impact on banking sector profits. Oil price risk and in effect currency risk stand out as an extraneous factor that could deteriorate, hence, a sharp fall in the oil price would have negative implications.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.