Two days ago, Flutterwave, an African focused fintech company disclosed that it secured US$35 million through its Series B funding round. The company also disclosed it is now teaming up with Worldpay and Visa for facilitating payments across Africa.

According to the CEO of the firm, Olugbenga Agboola, the partnership will enable any Worldpay merchant in Europe or the U.S. to accept any African payment. He also disclosed that Flutterwave processed close to US$2 billion in payments and 25 million transactions across over 33 African countries where it currently operates since it was established in 2006.

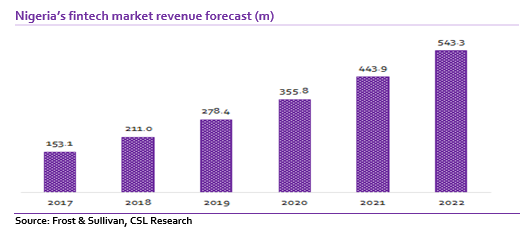

We recall that in 2019, Visa, a renowned American multinational financial services corporation bought a 20% stake in leading Nigerian payments provider Interswitch Ltd, raising its valuation to US$1 billion. In our view, the growing attraction of investors to the fintech industry is reflective of the positive industry dynamics, favourable country demographics amid increased regulatory support towards deepening financial inclusion.

Despite the relatively large number of players in the industry amid the growing number of payment channels available to Nigerian consumers, we believe the digital payments industry remains significantly under-tapped. Our view is underpinned by the relative dominance of cash payment in settlement of transactions.

According to the Enterprise Development Centre (EDC) of the Pan African University, cash payment accounted for 95.3% of transaction volumes at the end of 2018. This compares less favourably with SSA’s 88.5% cash payments. Additionally, we think increasing mobile and internet penetration will continue to support growth in the volume of online payments.

[READ MORE: Economy: IMF & World Bank differ on Nigeria’s growth outlook)

Fintechs in Nigeria have raised over US$500 million since 2014, either through equity or grants. While equity funding is led by international investors targeting a few early- and growth-stage fintechs, grant funding is driven by local investors and state governments focusing on proof-of-concept and early-stage fintechs.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.