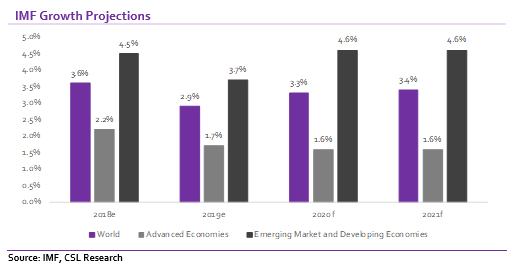

On Monday, the International Monetary Fund (IMF) released its Global Economic Outlook where the fund announced it expects global growth to slow in 2020 to 2.9% (World Bank – 2.5%) from an estimated 3.6% in 2019. The fund’s growth projection for Nigeria at 2.5% for 2020 and 2021 is 0.4ppts higher than the World Bank’s projection for Nigeria.

We recall that World Bank released its World Economic Outlook (WEO) on January 8 where it projected Nigeria’s economy will expand 2.1% in 2020 through to 2022. Noteworthy to mention, Nigeria’s GDP growth is still expected to trail SSA forecast which IMF projects will grow at 3.5% and the World Bank at 2.9%.

The World Bank appears to be less optimistic compared to the IMF about growth prospects in Nigeria as well as across the globe. In its WEO, the World Bank posited that the country’s macroeconomic framework is characterized by multiple exchange rates, foreign exchange restrictions as well as persistent high inflation while also noting that the growing uncertainty over the direction of the policies of the federal government will weaken growth further.

In our view, the policy thrust and implementation framework of the federal government remains unclear while fiscal challenges faced by the government would continue to constrain government spending on infrastructure.

In our view, restoring the economy to the path of sustainable growth that will translate into improved job creation, better living standards, reduction in unemployment/poverty rates and growth in per capita income requires the implementation of tough and not so politically friendly structural reforms.

[READ ALSO: Fintech: Growth frontier of the next decade)

In addition, we think policies geared towards improving the business environment as well as the ease of doing business will boost the productivity of SMEs and stimulate private sector participation.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.