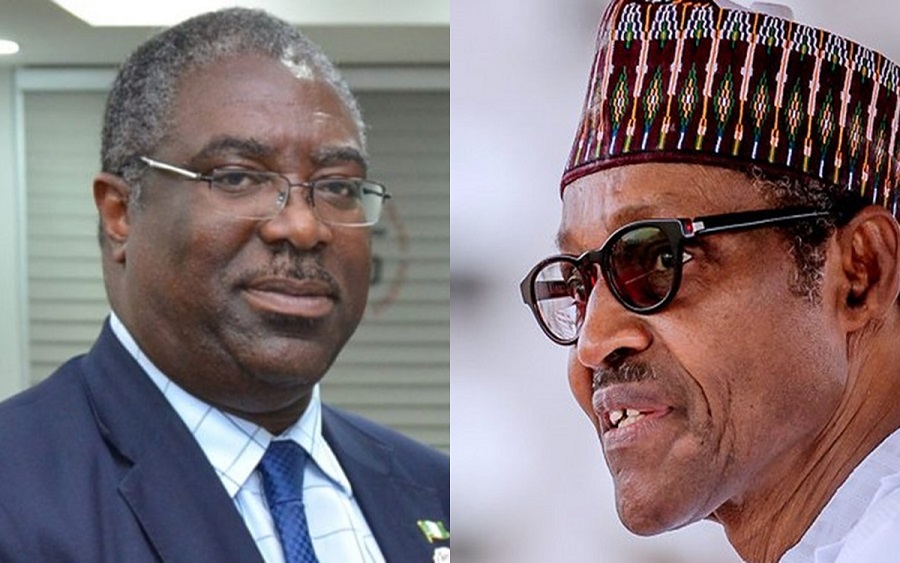

The reason the immediate past Chairman of Federal Inland Revenue Service, Babatunde Fowler, failed to retain its seat at the agency could be attributed to the findings of the National Audit Report.

The report stated that the agency, under Fowler, failed to collect taxes worth about N41 billion in Lagos as it has not been able to meet up with its target over the past four consecutive years.

The taxes, which are yet to be collected from companies, government agencies, and local government councils, are valued at N40.8 billion.

[READ ALSO: How proposed Communication Service Tax affects you (Opens in a new browser tab)]

In the report for the year ended December 2017, the Auditor-General of the Federation (AuGF), Anthony Ayine, said the observation was made during the review of records filed by Companies at Federal Inland Revenue Service Micro and Small Tax Offices (MSTO), Medium Tax Offices (MTO), Large Tax Offices (LTO) and Government Business Tax Offices (GBTO) within the South–west Zone comprising of Lagos, Ogun, Osun, and Oyo states.

He said the uncollected taxes, which range from Company Income Tax, Value Added Tax, withholding tax, education tax, to Capital Gains Tax, may prevent the federal government from meeting its projected revenue.

Highlights:

- 545 companies had not remitted their Company Income Tax (CIT) to the FIRS valued at a total of N26 billion.

- Companies, Federal and State MDAs, Local Government Councils and State Government within the South–west Zone were yet to remit about N8 billion being their Value Added Tax.

- Withholding tax from companies, government agencies and local government councils valued at about N5 billion were also yet to be remitted to the FIRS.

- About 318 companies were said not to have remitted their Education, tax which is 2% on profits of Companies valued at N697 million.

- Two companies are yet to remit N99 million, being their Capital Gain Tax of 10% from the disposal of these companies’ assets. All these unreconciled taxes were said to have been communicated to the FIRS chairman.

- Out of 28,237 duly registered Companies, 11,221 failed to submit their annual returns to various tax offices. These contradict the provision of the Company Income Tax Act, which requires a company to render an account of its operations within six months of its accounting year-end.

- This number of companies who failed to render its returns represents 39% of duly registered companies with the FIRS.

Ayine said, “This issue was communicated to the Chairman, FIRS in my letter reference No. OAuGF/RESAD/FIRS/2017/VOL.II/5 of 1st August 2018 and no response has been received as at the time of forwarding this report.”

Findings revealed that Fowler failed to meet his collection target in 2015, 2016, 2017, 2018. For instance, in 2015, it set N4.7 trillion target but was only able to make N3.7 trillion in the actual collection. In 2016, 2017 and 2018, the target collections were N4.2 trillion, N4.8 trillion and N6.7 trillion but the actual collections were N3.3 trillion, N4 trillion and N5.3 trillion, respectively

Meanwhile, Nairametrics had reported about the memo, purportedly written from the office of the Chief of Staff to the President Abba Kyari to the Chairman of the FIRS, Babatunde Fowler circulated around social media on Sunday.

The Leak: The letter queried the FIRS head whose tenure is up about why he consistently failed to hit budget and why his tax receipts over the last four years were lower than that of the previous administration.

The chief of staff queried Fowler demanding a variance analysis him explaining the reason for the variances between the budgeted and actual revenues.

Why it matters: The Executive Chairman Tunde Fowler whose tenure has reportedly ended was expected to return for a second term. However, this letter suggests he may not get it as the vultures are circling in.

- The query is also somewhat rudimentary as the reason for lower taxes over the last 5 years is obviously due to the recession.

- The economy suffered through a recession in 2016 and has remained stuck in a GDP Growth rate of under 2%.

- Suffice to add that various government policies on forex, an increase in import duty has also significantly hurt trade making it even more difficult to increase tax revenues.

- Fowler also stated earlier in the year that the FIRS collected about N5.3 trillion in taxes in 2018 with non-oil taxes making up about 47% the highest in recent years.