The Global System for Mobile Communications Association (GSMCA) has warned the Senate and Nigerians against the implementation of the proposed 9% Communication Service Tax on voice calls, SMS, data usage and Pay per View TV stations.

GSMCA, a trade body that represents interests of mobile network operators worldwide, argued if implemented, the tax, which has been abandoned for two years before it was revisited by the Senate, would boost the nation’s poverty rate.

What it means: It imposes and collect communication services tax (CST or levy) on charges payable by consumers of electronic communication services in Nigeria (excluding private electronic communication services) at the rate of 9%.

GSMCA argued that the proposed tax would threatens economic growth and would further deepen poverty in the country where about 30 million more people have been projected to fall into the poverty bracket in the next 10 years.

Tax will affect poor households: Based on a research on the impact of taxation on mobile communication services, the association said the tax would have a negative impact on poor households in the country. It would discourage the use of communication services in remote or rural areas due to the impact it will have on cost of voice calls, SMS and data usage.

The body advised that the country should not roll out fiscal policy that discourages the use of broadband services.

[READ MORE: Why Nigeria’s Data woes may not end soon]

According to GSMA, if Nigeria does not implement the proposed tax, its economy would experience unprecedented growth, as the International Telecommunications Union stated that a 10% increase in mobile penetration in a sample of African countries yields a 2.5% increase in GDP per capita.

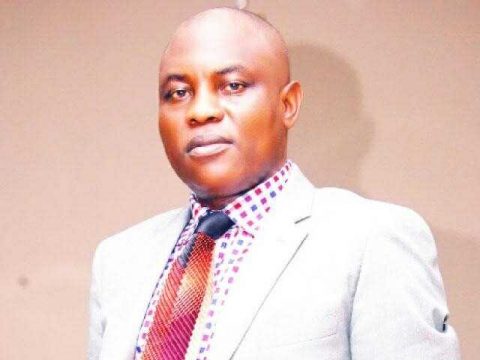

Is the government shooting itself in the foot? Speaking on the proposed tax, GSMA’s Head of Sub-Saharan Africa, Akinwale Goodluck, said, “The government’s long-term digital ambitions will be severely compromised if these tax proposals go ahead.

“The potential of mobile broadband is clear from the rapid development of the digital economy in Nigeria. The mobile ecosystem already contributes over $21billion to the Nigerian economy and around 16% of total government tax revenue. The focus should be on boosting mobile penetration, and investment in networks to strengthen the economy, rather than undermining this through potentially punitive taxes.”

Affordability issue already existing: Goodluck said the adoption of communication services was low in the country where fixed-line penetration was at less than 1%, so implementing such tax would hamper much-needed penetration.

“Based on GSMA analysis of the total cost of mobile ownership, a 1GB basket in Nigeria cost around 7% of average income in 2018.

“The affordability barrier is particularly evident for lower-income citizens in Nigeria for whom access to a 1GB basket would cost around 24 per cent of income. The new tax, even if only partly reflected in prices, will exacerbate an already significant affordability barrier and hamper the uptake and usage of services, especially for lower-income citizens.”

[READ ALSO: NCC gets deadline to resolve data bundle depletion issues]

Telecommunications companies in Nigeria have also condemned the re-introduction of the tax by the 9th National Assembly, stating that the decision would only place more burden on Nigerians. The Association Licensed Telecommunications Operators of Nigeria (ALTON) said the tax would affect the standard of living of Nigerians.

According to the association, the purchasing power of Naira is low, imposing tax on essential services like calls, texts and data will further drag it down.

The Nigerian Senate had proposed the 9% CST in a bid to boost the revenue of the Federal Government.

The Finance Minister, Zainab Ahmed, stated that Nigeria had revenue problem. Hence, President Buhari’s administration and the National Assembly have been drafting potential revenue sources.