Network Providers have reacted to the recently proposed 9% tax on Communications Services by the Senate. The new communication tax was initially initiated by the 8th National Assembly led by Bukola Saraki four years ago.

The telecommunications companies condemned the re-introduction of the tax by the 9th National Assembly, stating that the decision would only place more burden on Nigerians. The telcos spoke through two associations – Association of Telecommunications Companies of Nigeria (ATCON) and the Association Licensed Telecommunications Operators of Nigeria (ALTON).

[READ MORE: Senate to investigate 7 oil companies over refusal to remit $21 billion]

Nairametrics had previously reported that the Senate was seeking a legislative action to impose a 9% tax on Communication Services. The tax would cover electronic communication services like Voice Calls, SMS, MMS, and Data usage both from Telecommunication Services Providers and Internet Service. The tax was also extended to Pay per View TV Stations.

While reacting to the communications tax by the lawmakers, ALTON said it would affect the standard of living of Nigerians. According to the association, the purchasing power of Naira is low, imposing tax on essential services like calls, texts and data will further drag it down.

Speaking on behalf of ATCON, Olusola Teniola, said the 8th National Assembly had shelved the plans to tax these communication services in 2016 because they understood the impact of the Information and Computer Technology (ICT) sector. He said a meeting between the Senators and members of ATCON led to the suspension of the 9% tax because they knew the contribution of ICT to job creations.

Teniola also advised the lawmakers to broaden the tax base to enable more businesses to have tax commitment.

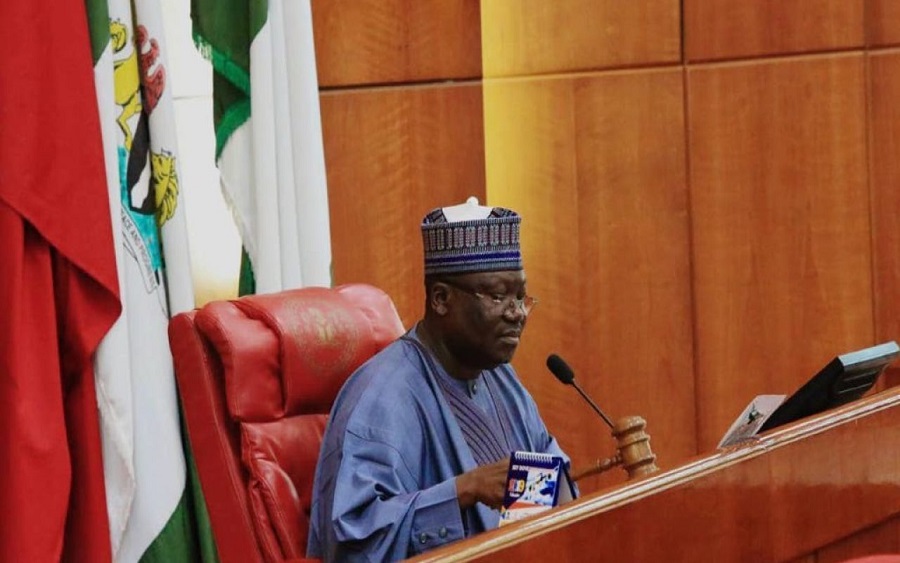

Senate’s defence: Senator Ali Ndume, who introduced the Communication Service Tax to the senate during one of its plenary session, said the tax was a way of distributing wealth in such a way that it would not affect the ordinary people.

[READ ALSO: Senate increases 2020 budget to N10.729 trillion, approves N1.5 trillion borrowing]

What the 9% tax means: The communication service tax, for instance, implies that for every N100 airtime you buy, you only have access to N91. The higher you buy, the more tax you pay. This will apply to products differently.

If approved, the tax is payable whether the person making the supply is permitted and authorized to provide electronic communications services or not.