Fitch, an international credit rating organisation, has released its end of year report on the Nigerian economy.

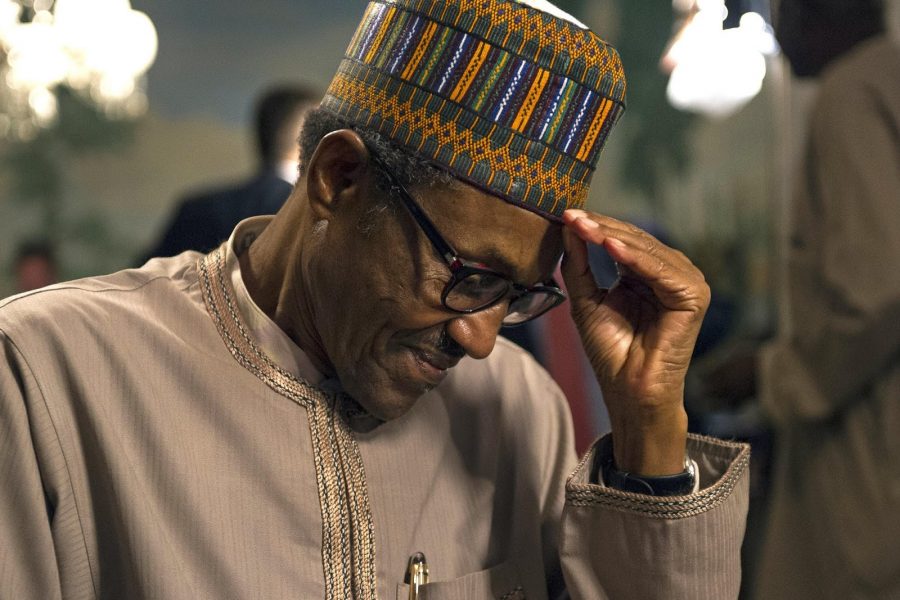

In the latest report , the firm lowered the nation’s economic outlook from stable to negative, attributing its rating to wrong policies implemented by President Muhammadu Buhari.

Why Fitch downgraded Nigeria’s economic outlook

Nairametrics had provided details of the Fitch report, highlighting major drivers considered by the American rating firm to project a difficult economic outlook for the country.

Here are some major highlights

- The economic policies implemented so far in Nigeria under the current administration of President Buhari have made the economy become more vulnerable, as the value of Naira remained weak.

- Any devaluation of Naira would cause big problems to Nigeria’s macroeconomic environment, and as a result, drag down the economy.

- The Central Bank of Nigeria’s (CBN) array of policies are unconventional and costly for the economy.

- Fitch questioned the CBN policy of attracting portfolio investments in its short-term Open Market Operations (OMO) bills by offering high yields to foreign investors at low cost while restricting operations.

- To Fitch, the restriction imposed on operations in the OMO market by the CBN will lower OMO market liquidity due to a narrower range of participants, and this will dampen net portfolio inflows.

- Government’s borrowing will be on the rise as Nigeria’s low non-oil fiscal revenues linger.

- Similar, the firm believes inflation will spike in Nigeria in 2020 due to recent policy measures which include the upcoming raise of the VAT rate, 66.7% hike of the minimum wage, as well as the recent closure of land borders to foreign trade and tightening restrictions on FX financing for a wide range of imports.

- Fitch projects average GDP growth of 2.4% in 2019-2021, well below the ‘B’ median of 3.4% and the five-year average demographic growth rate of 2.7%.

[READ MORE: FG may shift deadline to deactivate bank accounts without tax verification]

How it affects your 2020

The Fitch outlook for the Nigerian economy has come against the backdrop of predictions by various institutions that the year 2020 will pose a great challenge to businesses in the country.

- Fitch projection shows that Nigeria’s economy will continue to slow down until 2021, hovering around 2.4%. This represents a big blow to investors’ sentiments, as investments in the economy may drop further and that may affect you.

- Fitch expects the CBN policy to limit operations in the OMO market to dampen net portfolio inflows. What this means is that, as net portfolio inflows drop, the country’s reserves will continue to decline and this poses a big threat to Naira devaluation in 2020. It also means the Naira you hold would loose its value i.e you can only buy little with much money.

- Going by the Fitch prediction, devaluation may be imminent in 2020 and any such move means businesses are in for major setbacks in 2020. That may affect your business too.

- Fitch added that President Buhari is likely to increase borrowing as revenue crisis will worsen in 2020. This means a large chunk of the country’s revenue will go into debt servicing, as the country’s debt stock is expected a new high. This affects you as it may affect the pace some infrastructure decay would be addressed in 2020, as government may channel more fund to debt.

- Nigeria’s inflation is expected to continue to rise in 2020. This means purchasing power is expected to drop in the economy, as several unconventional policies being implemented by the government will continue to drive prices high in the economy.

- Lastly, Fitch expected rise in political uncertainty. According to the Firm, emerging rivalries within the ruling APC party is expected to spark by early dissensions over the 2023 succession to President Buhari. This means uncertainty in Nigeria’s political atmosphere could hamper policy-making.